KUALA LUMPUR (Jan 12): Practice note 17 (PN17) company Scomi Energy Services Bhd on Friday said it is not proceeding with a plan to acquire the assets of a marine vessel operator, and instead announced new proposals to regularise its financial condition which includes a diversification into the construction business and the entry of a new major shareholder

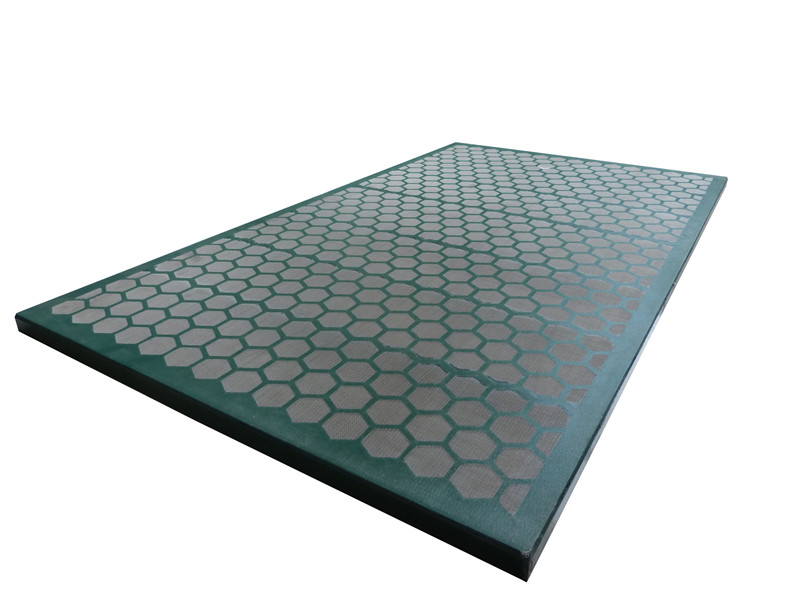

The group has proposed a share consolidation, which will see a reduction of its issued share capital from RM445.535 million to RM35,000 by cancelling RM445.5 million of its share capital, followed by a consolidation of every 20 existing shares into one consolidated share. Composite frame screen

Scomi Energy proposed to follow that up with a private placement of 35.125 million new shares, representing 60% of its enlarged issued shares at 22 sen per placement share, to Datuk Seri Dr Subramaniam Pillai Sankaran Pillai, the founder and group executive director of Dhaya Maju Infrastructure (Asia) Sdn Bhd (DMIA), under an agreement executed between Scomi and him on Friday.

It will then accept a RM140.03 million contract from DMIA for the construction and maintenance of the proposed upgrading of the Keretapi Tanah Melayu Bhd station and facilities under the Klang Valley Electrified Double Track Phase 2 project, through the group’s wholly-owned unit Richfield Construction (M) Sdn Bhd.

"This contract is facilitated through a subcontracting chain vide the letter of award dated July 29, 2022 (main contract) from the Ministry of Transport to Dhaya Maju LTAT Sdn Bhd. Following this, DMLTAT subcontracts the project to DMIA, which in turn subcontracts it to Richfield Construction," said Scomi Energy in a filing with Bursa Malaysia.

The troubled oil and gas services group went on to propose a change of its name to Richfield (M) Bhd, and the diversification of its principal activities to include the construction business.

In a separate filing, Scomi Energy said that the Heads of Agreement (HOA) it signed with Duta Marine Sdn Bhd in August last year "has been automatically terminated due to the definitive agreement not being signed within the exclusivity period".

The two parties had intended to enter into a deal "for purposes of setting out a broad framework for further discussions leading up to the signing of the definitive agreement" which includes two alternatives.

Under the first alternative, Duta Marine was to dispose of certain assets, including one or more of its subsidiaries, to Scomi Energy in exchange for shares and/or cash. Duta Marine's assets include a 51% stake in Duta Pacific Offshore Sdn Bhd, which owns ships and provides marine vessel chartering services.

The second alternative would have seen the two parties entering into any other arrangements "as may be mutually agreed”.

The troubled group fell into PN17 status in January 2020 when its shareholders’ equity on a consolidated basis fell below 50% of its issued share capital.

Shares of Scomi Energy have been suspended since July last year after it failed to submit its regularisation plan on time to Bursa Securities. It last traded at 0.5 sen per share.

Read also: Scomi Energy in talks to acquire marine assets from Duta Marine

MI-Swaco Mongoose Screen Replacement Screen Copyright © 1999-2023 The Edge Communications Sdn. Bhd. 199301012242 (266980-X). All rights reserved