By subscribing, you agree to our Terms of Use and Policies You may unsubscribe at any time.

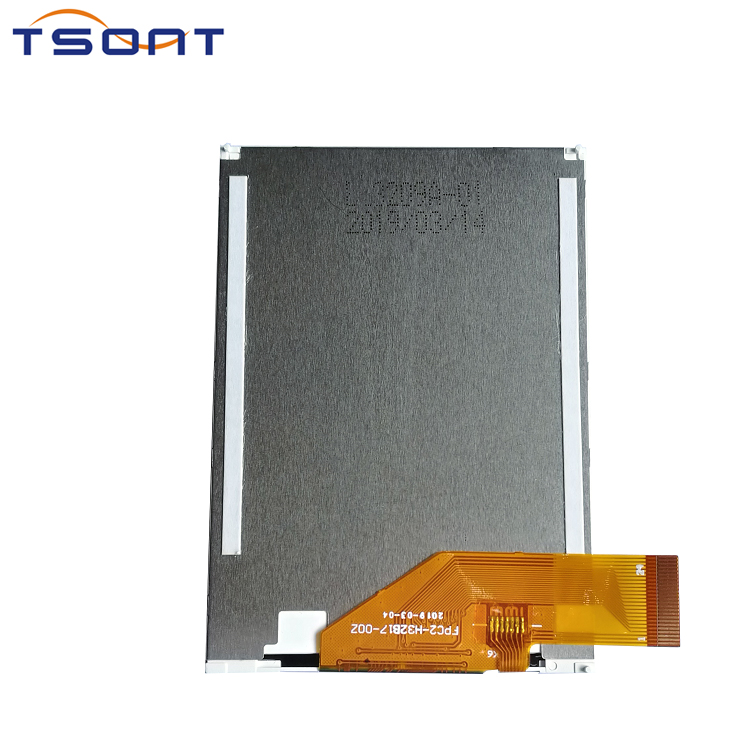

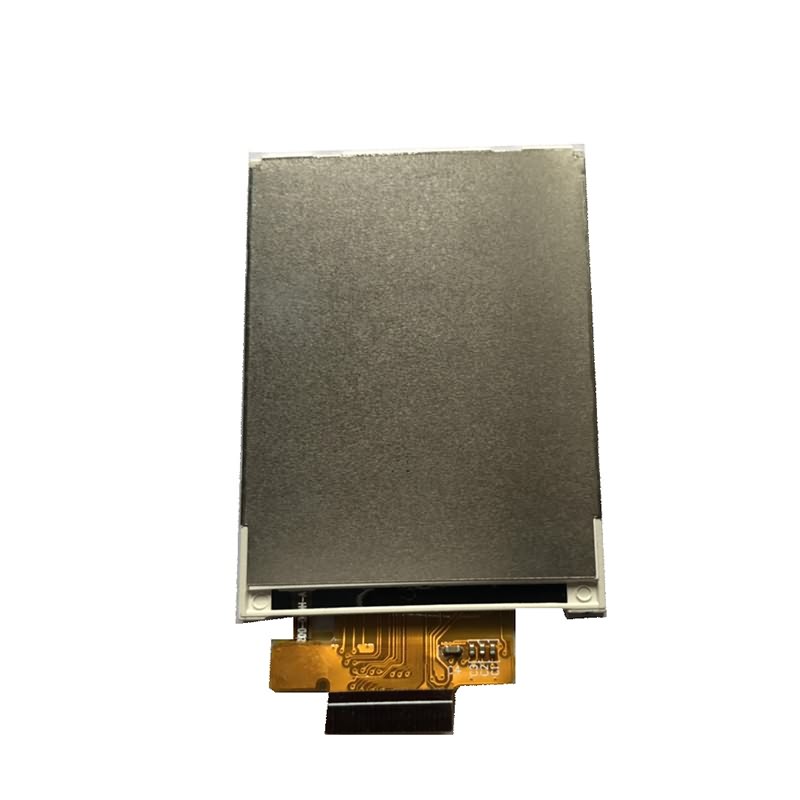

The recent coronavirus emergency in China, which is expanding at a global level, also represents a crisis in the electronics supply chain industry now and in the near future at least. 2.4 Inch Lcd Suppliers China

The recent escalating coronavirus crisis is impacting production at display panel factories located in the semi-quarantined city of Wuhan, China. This means the production is going to experience a significant near-term reduction in the scheduled global supply of panels used in liquid crystal display televisions (LCDs) and other electronics products.

According to IHS Markit technology research, now a part of Informa Tech, the five factories in the city producing liquid crystal displays (LCDs) and organic light-emitting diode (OLED) panels will experience near-term slowdowns in production compared to expected levels.

"With the situation evolving quickly, IHS Markit technology research is still assessing the magnitude of the supply shortfall on multiple display types and markets. However, leading Chinese panel makers stated they believe that total capacity utilization for all LCD fabs in the country could fall by at least 10 percent and perhaps by more than 20 percent during the month of February," the research firm reports.

With China expected to own 55 percent of global display manufacturing capacity in 2020, the immediate impact of the production reduction has been a worldwide decrease in availability and an increase in pricing for LCD-TV panels. This has resulted in turmoil throughout the display supply chain as suppliers and purchasers alike scramble to adjust to swiftly changing market conditions.

David Hsieh, Senior Director, Displays, at IHS Markit technology research, “display facilities in Wuhan currently are dealing with the very real impacts of the coronavirus outbreak. These factories are facing shortages of both labor and key components as a result of mandates designed to limit the contagion’s spread. In the face of these challenges, top display suppliers in China have informed our experts that a near-term production decline is unavoidable.”

As a consequence of this, the leading Chinese suppliers of LCD panels for TVs, notebook PCs, and PC monitors now are planning to raise panel prices more aggressively. The price for an open-cell LCD-TV panel was originally expected to rise by $1 or $2 per month in February. However, industry reports state that the actual increase may be $3 to $5 for the month.

The five display factories in Wuhan are:

China Star Optoelectronics Technology’s T3 low-temperature polysilicon (LTPS) LCD fab

CSOT’s T4 Gen 6 OLED fab

Tianma’s TM8 Gen 4.5 LTPS LCD fab

Tianma’s TM17 Gen 6 OLED fab

BOE’s B17 Gen 10.5 LCD fab

Beyond the immediate production impact at these facilities, the coronavirus is also likely to trigger delays in the ramp-up of manufacturing at new display fabs during the first half of 2020, according to IHS Markit. This will reduce overall panel availability during the next few months. The research firm says this could also result in further panel supply tightness as TV display buyers hasten the pace of their panel purchases to build stockpiles for future shortfalls.

According to IHS Markit, while major panel makers are rightly concerned about the coronavirus’ impact on consumer sales, demand for their products from TV makers has actually increased. "TV makers are pulling in their panel demand and sometimes double-booking orders to shore up their inventories. The panel maker indicated that the demand surge for orders delivered in February is as large as 10 percent above the previous demand forecast."

In order to reduce travel and cut down on public gatherings with the ultimate goal of containing the spread of the coronavirus, the Chinese government decided to extend the Lunar New Year holiday by three days until Sunday, February 2. This also contributed to labor shortage encountered by fabs in Wuhan.

However, even after workers return, many will have to undergo testing procedures to check for contagion. As it is expected, this will have a continued negative impact on the overall productivity.

Moreover, China’s LCD panel suppliers may face an even more dire issue related to the coronavirus outbreak: An acute shortage of essential LCD modules.

According to IHS Markit's research, LCD panel makers outsource much of the production of such modules. However, production at several key third-party module suppliers has now ceased, impacting panel production severely throughout the country. Key module supplier SkyTech is sharply reducing production until mid-February.

Panel makers maintain their own captive LCD module factories. However, the firm says that these operations are also facing production bottlenecks amid the coronavirus crisis.

Also, the module shortage potentially could expand the impact of the contagion beyond China, with a knock-on effect on production at display manufacturers worldwide and making things more complicated for global electronics manufacturers.

Previously, there were rising concerns about the availability of LCD panels from Korean firms and television brands had started to revise their sourcing strategy to make greater use of Chinese suppliers.

TV Display and OEM Intelligence Service reported in January that Korean LCD TV panel makers were undergoing fab restructuring and shutdowns in 2020. This would result in changes to the supply chain that would force TV makers to seek alternative supply bases that were both reliable and competitive enough to ensure they could meet their increased shipment targets in 2020. This, too, has now shifted.

Current supply dynamics and changes have led the brands to rethink their purchasing plans for 2020 as well as for the near future. We will start seeing and learning about the first changes perhaps in the upcoming MWC2020 in Barcelona later this month.

Latest Updates on Wuhan's Deadly Coronavirus

Wuhan Rushing to Build New Coronavirus Hospital in Record Six Days

Coronavirus Test That Works in Under Minutes 15 Developed in China

Coronavirus: China to Ban Trade in Wild Animals and Tighten Grip on Wet Markets

2.4 Inch Lcd Supplier China 5 Million People Already Left Coronavirus-Infected Wuhan before Imposed Travel Restrictions