Money market accounts are similar to savings accounts, but offer some checking features as well.

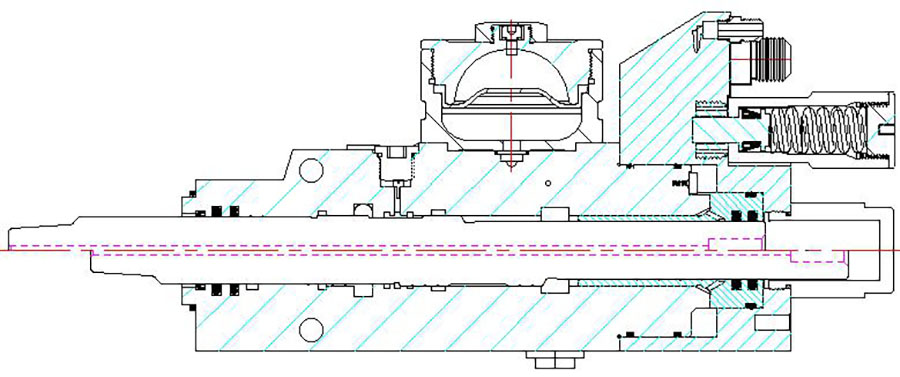

Skip the searching and find your next bank in minutes with BankMatch℠. Mini Pile Drivers

Home equity is the portion of your home you’ve paid off. You can use it to borrow for other financial goals.

Find an expert who knows the market. Compare trusted real estate agents all in one place.

Home insurance doesn't have to be a hassle. Choose the best home insurance company for you.

Life insurance doesn’t have to be complicated. Find peace of mind and choose the right policy for you.

Answer a few quick questions and we’ll show you your top credit card options.

See what the experts say

Read in-depth credit card reviews to find out which cards have the best perks and more.

Start making moves toward your money goals and compare your debt management options.

Boost your business with rewards, perks and more. Compare cards in one place to find the one for you.

Figure out funding for your next car or refinance with confidence. Check out today’s auto loan rates.

Drive with peace of mind when you compare insurance carriers and find the policy that’s right for you.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity, this post may contain references to products from our partners. Here's an explanation for how we make money .

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most — the different types of lending options, the best rates, the best lenders, how to pay off debt and more — so you can feel confident when investing your money.

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Bankrate’s editorial team writes on behalf of YOU — the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

The price of vehicle ownership adds up. When the time comes to purchase your next car, you must consider the true cost of vehicle ownership — trips to the mechanic included. Though services range in cost, AAA found that drivers put an average of $10,728 toward their new cars in 2022 — not including the purchase price. This is a $1,062 increase from the previous year.

As gas prices rise, it is important to prepare for vehicle costs when budgeting for which car is right for you.

Routine vehicle maintenance keeps your car running the way it should and, by extension, keeps you and your passengers safe. Maintenance costs vary by vehicle type, age and location, but there are some basics that almost every car needs.

Typically, your vehicle will need a visit to the mechanic for overall upkeep every 5,000 or so miles. But check your owner’s manual for specifics on your car’s needs.

While mechanics are there to help you, they are also aiming to make money. So while most maintenance does require professional help, consider what you can handle at home to save money.

You will almost certainly have to replace some parts on your vehicle, either due to general wear-and-tear or larger issues.

No matter the reason, the replacement’s price tag depends on the part that needs replacing. Mechanics may not have the exact extra batteries, transmission or brakes your vehicle requires on hand, and delivery takes time. Outside of that, two common factors that influence cost are vehicle type — luxury vehicles carrying higher costs for parts — and the market cost. Consumers are also directly impacted by an increase in cost from inflation and the availability of vehicle parts.

If you’re comfortable working with vehicles, you could save money by replacing your air filter yourself.

Surprise costs are bound to come up in vehicle ownership. This could be an unexpected spill that stains the interior of your car or something more serious like a fender bender. Either way, it is important to have extra money saved in case unexpected repairs pop up.

AAA found that nearly one in three drivers cannot afford a bill for an unexpected repair. While these costs are mostly out of your control, you can save future stress by budgeting for that worst-case scenario.

It is also wise to shop around and find a repair shop with a good reputation and fair prices. Contact your insurance company and see what is covered before spending money on a repair. Here’s an outline of common repairs that may come up and the costs that are associated with them.

The out-the-door price of a higher-end vehicle is higher than that of a standard car — and its maintenance will carry a higher cost, too. Your warranty may even require you to handle maintenance at a specific dealership, even for simple things like oil changes and mileage inspections. The dealer experience tends to be more expensive but does carry the comfort of mechanics that specialize in your car’s make and model.

While it may seem obvious that mid- and high-end vehicles require high-end upkeep, this is not always the case. Take Dodge, for example. Although it is a mid-tier option, the five-year maintenance cost nears what Mercedes drivers must pay.

Consider the value that comes with a vehicle, which can come down to how many times you will have to take it to the body shop. But even regular costs — like gas — can be more expensive if you have to opt for premium fuel. Research the average annual costs of vehicle brands to estimate how much a car will cost you over the course of ownership.

Consumer Reports 2022 Annual Auto Survey

Although the brand of the vehicle clearly influences the cost of maintaining it, the type of vehicle is also a large determining factor. Broken down below is the average cost of ownership per mile of driving.

AAA found this cost by calculating the cost of depreciation, financing, fuel, insurance, licensing, registration, taxes, maintenance, repairs and tires across five years of ownership and 75,000 miles. The lowest cost for vehicle maintenance goes to small sedans, while the half-ton pickup is the most expensive to maintain.

As these prices show, vehicle maintenance is based on many factors, and there is no perfect recipe for finding an inexpensive car. But an electric vehicle or smaller vehicle tends to cost less. Electric vehicles are becoming more available across the market and can be a great option for drivers looking for lower maintenance costs.

Maintenance is unavoidable in vehicle ownership. But by understanding average costs, you can accurately budget for routine maintenance and surprise repairs. Research mechanics and consult your owner’s manual to confirm you are meeting your specific vehicle’s needs.

What is the SBA weekly lending report and how does it work?

How much will an equipment loan cost?

How much will a business line of credit cost?

How much would you pay to get a job?

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Bankrate, LLC NMLS ID# 1427381 | NMLS Consumer Access BR Tech Services, Inc. NMLS ID #1743443 | NMLS Consumer Access

Pile Driver Screw © 2024 Bankrate, LLC. A Red Ventures company. All Rights Reserved.