The US and Europe aim to keep their lead against China on semiconductors. They also need to stay ahead with Printed Circuit Boards.

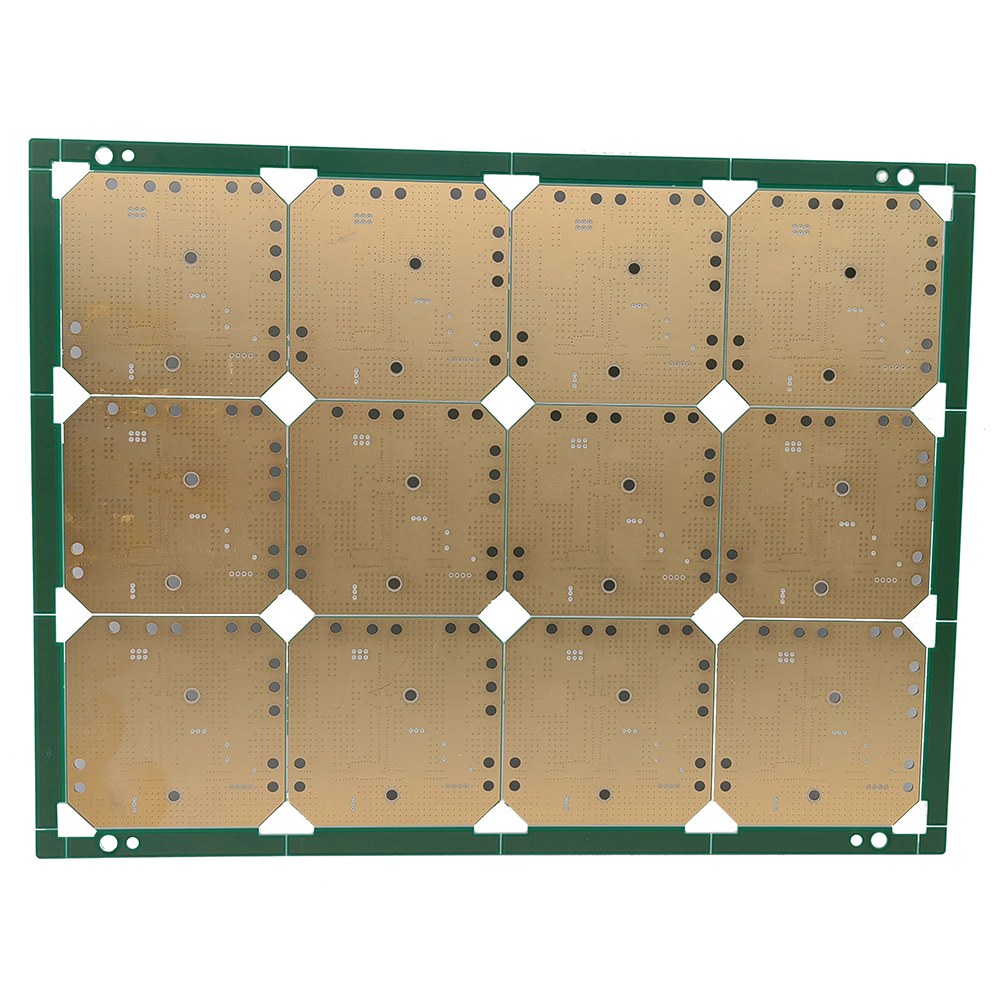

Chips do not function by themselves. They need to be connected and surrounded by electronic components, sensors, and a power source. Printed Circuit Boards accomplish this critical task. From iPhones to F16 fighters, from data centers to dishwashers, all are based on Printed Circuit Boards (PCBs). If chips are a product’s brain, the PCB is the skeleton. Pcb Prototype Board

Both European and US policymakers are spending billions in public funds to boost their own domestic semiconductor production. They are aligned on the security risks of an unstable supply chain. To succeed, they must make sure to appreciate the importance of PCBs.

Over the last couple of decades, the US and its allies have increasingly relied on low-cost Southeast Asian production of PCBs. Thailand and Malaysia are the major players. Although the US share of global PCB production has plunged to 4% from 30% about 25 years ago, with China’s share rising to 54%, the US retains a technological lead. American production accounts for 27% of global PCB revenue, compared to 47% for the whole of Asia Pacific. The US produces far fewer units but earns high margins making the most sophisticated PCBs.

Europe’s PCB industry is losing both volume and market share. In 2015 Europe counted 247 PCB manufacturers. By 2021, this number has fallen to 171. Europe’s global revenue market share dropped to 19% in 2022 – third behind Asia Pacific and the US.

Unlike giant brand-name chip makers such as Intel and Nvidia, PCB producers are little known. The biggest in the US is Texas-based Flex Ltd, followed by Wisconsin’s TTM Technologies. Flex has 2,000 employees. Intel employs 131,900. The European industry is strong in specialist sectors such as medical, defense, and automotive, which together account for a little more than 25% of production.

PCB manufacturers argue that foreign subsidies make it hard for them to compete. China supports its PCB industry as part of its Made in China 2025 strategy, with subsidies going to key sectors such as medical and electrical transmission equipment. Countries such as Thailand offer “investment incentives” to attract Taiwanese PCB manufacturers keen to move production out of China. After giving billions to chip companies, the PCB industry is pushing for its own government incentives.

Politicians are listening — to a point. In March, US President Joseph Biden and Canadian Prime Minister Justin Trudeau announced $52 million of support for PCB production. Compared to the subsidies earmarked for chips, this sum looks minuscule. The US alone is spending $53 billion on its Chips Act. The EU is moving forward with €43 billion of chips support.

While $52 million may look small, PCB makers appreciate that the money is being disbursed with speed. President Biden made use of the Defense Production Act, designed and first invoked in the Korean War, to protect national security by averting a shortfall of critical technology. The $52 million comes from the Defense Department and will be used for research and development.

Politically, too, the move is important. It labels PCBs as a critical technology, expanding the meaning of the term. Critical tech is no longer limited to military items such as F16 fighter jets and Abrams tanks. It extends to key dual-purpose products that require PCBs: data centers, telecoms, healthcare, banking infrastructure, and much, much more.

Importantly, too, this aid is not protectionist. American PCB producers rely on tooling and materials from Europe. It’s crucial that the US and Europe avoid a subsidy war. Government aid for the PCB industry on both sides of the Atlantic should be complementary, as it is turning out to be for semiconductor policy with the US and EU Chips Acts.

The key going forward is to distinguish between true critical technology and products which can and should be made overseas. We don’t need to manufacture PCBs for dishwashers and garage door openers — these are not vital for innovation or infrastructure. But electric vehicle chargers should be made at home. Almost every EV charger now is filled with PCBs that come from Asia.

What comes next? The US PCB industry is fighting for a standalone bill with a $3 billion investment and a 25% tax credit to purchasers buying American-made components. This would be a good investment. It would build supply chain resilience, improve national security, encourage the training of top-flight engineers, and bring high-value jobs back to the US.

Chips are crucial to the future digital world and Western security. Policymakers are right to focus on sustaining their semiconductor industries. They also need to consider other related technologies, starting with PCBs.

HDI PCB Board Christopher Cytera CEng MIET is a Non-resident senior fellow with the Digital Innovation Initiative at the Center for European Policy Analysis and a technology business executive with over 30 years of experience in semiconductors, electronics, communications, video, and imaging.