Founded in 1993, The Motley Fool is a financial services company dedicated to making the world smarter, happier, and richer. The Motley Fool reaches millions of people every month through our premium investing solutions, free guidance and market analysis on Fool.com, top-rated podcasts, and non-profit The Motley Fool Foundation.

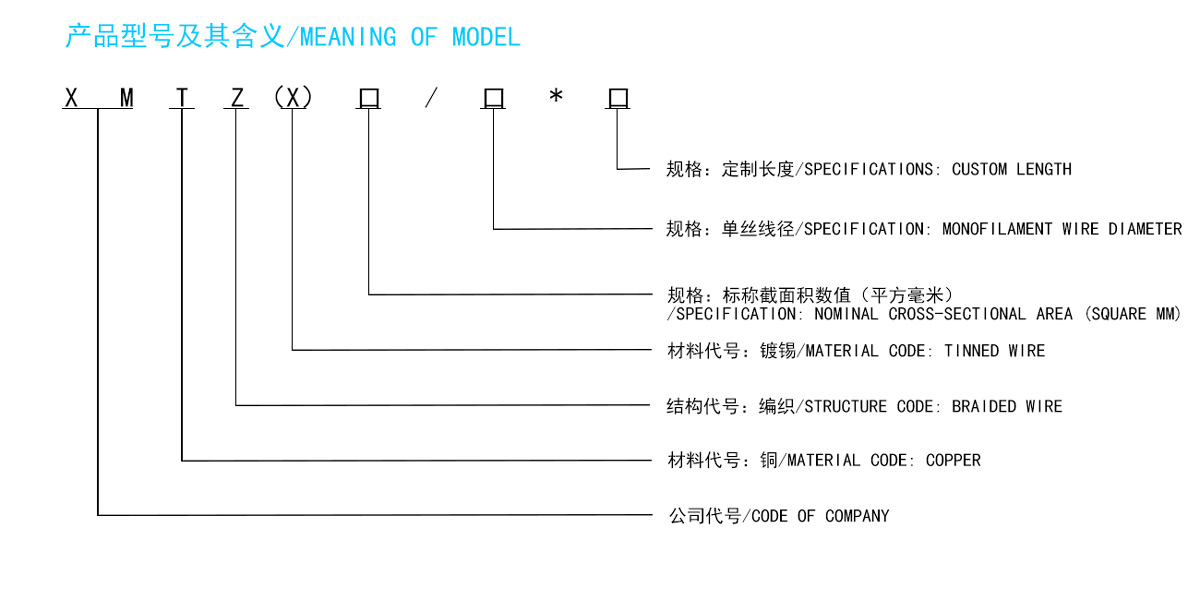

Founded in 1993, The Motley Fool is a financial services company dedicated to making the world smarter, happier, and richer. The Motley Fool reaches millions of people every month through our premium investing solutions, free guidance and market analysis on Fool.com, top-rated podcasts, and non-profit The Motley Fool Foundation. Tinned Grounding Strap

You're reading a free article with opinions that may differ from The Motley Fool's Premium Investing Services. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources, and more. Learn More

The company isn't turning it around fast enough for investors.

Auto parts retailer Advance Auto Parts (AAP -8.79% ) is (hopefully) in the middle of a turnaround. But it's apparent that the turnaround isn't done yet.

The company just reported financial results for its fiscal first quarter, which ended on April 20, and they were below investor expectations. Consequently, Advance Auto Parts stock was down 6% as of 11 a.m. ET on Wednesday.

In August 2023, Advance Auto Parts hired Shane O'Kelly from HD Supply to be its new president and CEO. He inherited a business with lower profit margins than its peers and consequently began reshaping the leadership team and restructuring the business for better performance.

In the first quarter, net sales were down less than 1% year over year to $3.4 billion. The company's operating margin was down to 2.5% compared with a 2.9% margin in the prior-year period. These are just a couple of metrics reminding investors that things haven't turned around yet, and it's why the stock is down today.

I'm a shareholder, so I might be biased, but I think that investors are overreacting today. Advance Auto Parts is making the right long-term moves. Many of its profitability problems started when it acquired Carquest in 2013, which essentially gave the company two supply chains, and that is inefficient. O'Kelly is consolidating it into one, which should yield better margins.

Moreover, the company is getting closer to selling its smaller Worldpac brand, which could give it a helpful infusion of cash.

Even with its ongoing troubles, Advance Auto Parts expects to generate full-year free cash flow of $250 million. That's not bad for a company with a market capitalization of just $3.8 billion, as of this writing. If the company is indeed on the right path, I believe the stock can provide strong gains from here for patient shareholders.

Jon Quast has positions in Advance Auto Parts. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.

Making the world smarter, happier, and richer.

© 1995 - 2024 The Motley Fool. All rights reserved.

Stamping Processing Market data powered by Xignite and Polygon.io.