The polyethylene wax market is driven by the increasing demand for these applications across various industries. The packaging industry, in particular, is witnessing substantial growth due to the rising need for efficient and sustainable packaging solutions.

The SNS Insider report estimates the Polyethylene Wax Market size at USD 1.97 billion in 2023, with a projected CAGR of 4.3% to reach USD 2.76 billion by 2031. Polyethylene Wax Process

The global polyethylene wax market is experiencing growth driven by rising demand from industries such as plastics, rubber, paints, and coatings. The increasing adoption of polyethylene wax across various sectors, including its use as a lubricant, releasing agent, shining agent, binding agent, and dispersant, further propels market expansion. Additionally, the chemical industry's growing demand for polyethylene wax, attributed to its superior physiochemical properties and ease of modification, supports market growth. The anticipated rise in demand for efficient organic compounds in plastic processing, biocompatible materials, hot melt adhesives, and other sectors is expected to drive further growth in the global polyethylene wax market.

Get a Report Sample of Polyethylene Wax Market www.snsinsider.com/sample-request/4077

Some of the Key Players Included are:

The major key players are Clariant, BASF SE, Baker Hughes, SCG Chemicals, Mitsui Chemicals, Honeywell International Inc., Trecora Chemical, Zellag, Marcus Oil & Chemicals Pvt. Ltd., Oxidized Polyethylene Innovations, and other key players are mentioned in the final report.

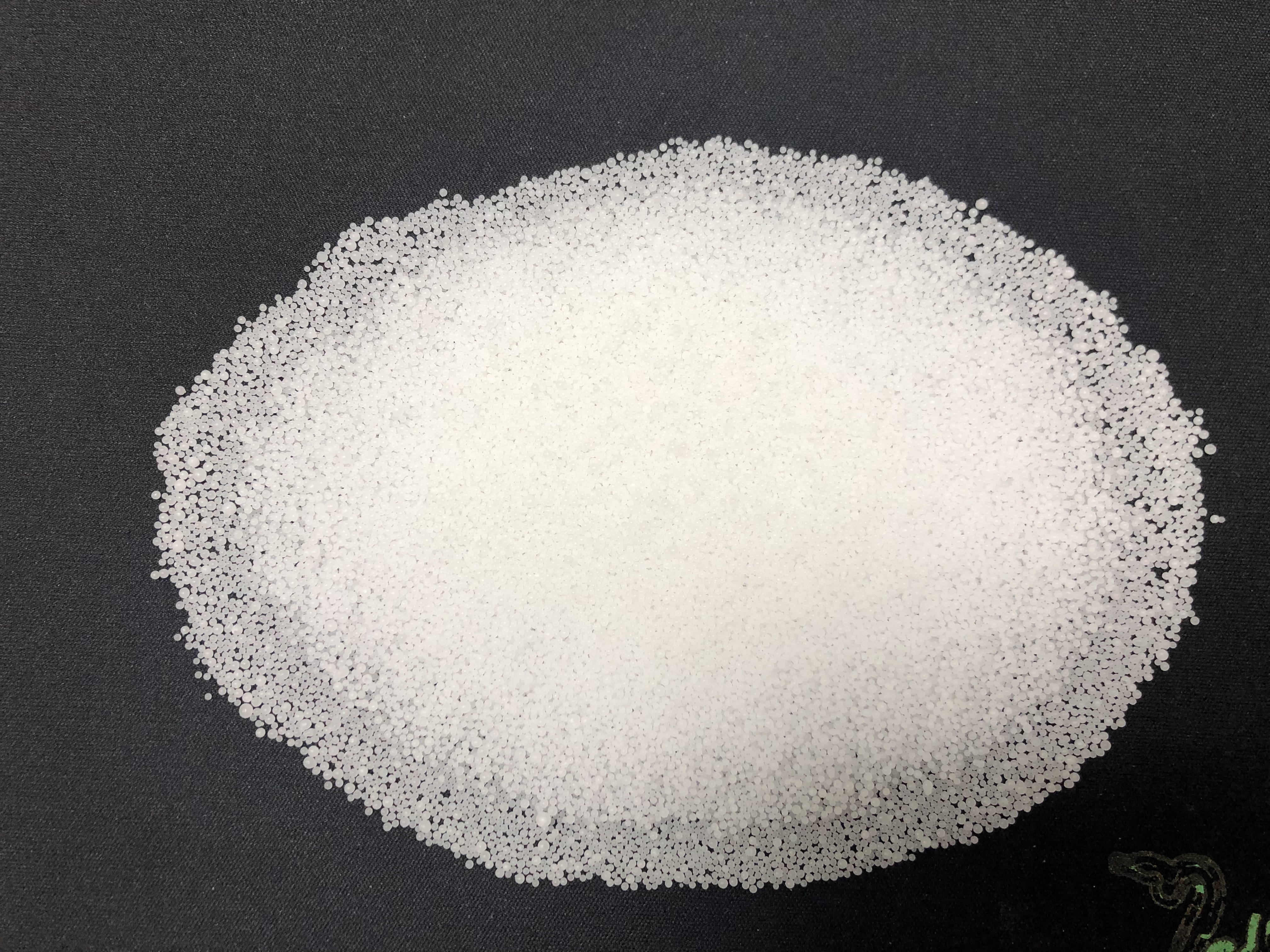

Based on product the market is segmented into low-density polymerized pe wax, high-density polymerized pe wax, micronized pe wax, oxidized pe wax and others. The oxidized PE wax segment dominated, accounting for over 40% of revenue, driven by its increasing application across industries such as coatings, plastics, inks, rubber, footwear, leather, lubricants, and masterbatches. The Asia Pacific market for oxidized PE wax is projected to experience substantial growth due to rapid industrialization and increased R&D activities. PE wax has gained traction in the coating industry, finding use in water-based wax emulsions, nonionic emulsions, and PVC processing across various sectors including textiles, adhesives, packaging, automotive, and paper coating.

Moreover, high-density polymerized PE wax emerged as the second-largest segment, projected to maintain significant market share. Known for its high density and tensile strength, high-density polymerized PE wax is widely used across diverse applications, ensuring high market penetration and stable growth.

Major players in the Polyethylene Wax market are heavily investing in R&D to expand their product lines, driving further market growth. Additionally, strategic initiatives such as new product launches, contractual agreements, mergers and acquisitions, increased investments, and collaborations are being pursued to enhance global presence. To thrive in an increasingly competitive market, competitors must offer cost-effective products. Local manufacturing to reduce operating costs is a key tactic employed by manufacturers in the Polyethylene Wax industry to benefit customers and expand market reach. Moreover, the Low-Profile Additives market has recently provided significant advantages to various industries, particularly in medicine.

Make Enquiry About Polyethylene Wax Market Report www.snsinsider.com/enquiry/4077

December 2023: Innospec Inc. acquired QGP Química Geral (QGP), a top special chemical company in Brazil, to expand its customer base in South America.

June 2023: BASF established a plant at the Zhanjiang Verbund site in China with a capacity of 500,000 metric tons annually to meet the growing demand for PE wax in China.

March 2022: Sasol completed the sale of its Germany-based subsidiary, Sasol Wax GmbH, to AWAX s.p.a., strengthening Sasol's operations in Germany, the U.K., and Austria under the name Hywax GmbH.

Impact of Russia-Ukraine War on Polyethylene Wax Market

The Russia-Ukraine conflict has significantly affected the polyethylene wax market, primarily disrupted the supply chain and caused uncertainties in raw material availability. As Ukraine is a major ethylene producer, essential for polyethylene wax production, disruptions in production and transportation have led to shortages and price fluctuations. Moreover, geopolitical tensions have impacted trade policies and currency exchange rates, adding further complexity to the market dynamics for polyethylene wax. These challenges have posed significant obstacles for manufacturers and consumers, impacting the stability and growth of the global polyethylene wax market.

During the forecast period, Asia Pacific is expected to dominate the global landscape, holding approximately 46% share in 2023. The region's growth is driven by increased manufacturing activities and infrastructure development in countries like China, India, Japan, South Korea, and Southeast Asia, leading to market expansion for polyethylene wax. Furthermore, population growth and urbanization are increasing the demand for lubricants, paints, and coatings, further fueling market growth in the region.

In North America, the polyethylene wax market size is projected to rise steadily due to growth in industries such as automotive, construction, and chemicals, particularly in the U.S. and Canada. These countries are key consumers of polymers and lubricants, contributing to market expansion.

Micronized Wax For Coating Latest Version of Polyethylene Wax Market Report 2024-2031 www.snsinsider.com/checkout/4077