Posted by Jennifer Read | Jan 10, 2024 | Design, EMSNOW Mexico, Feature, Mexico-feature, Supply Chain

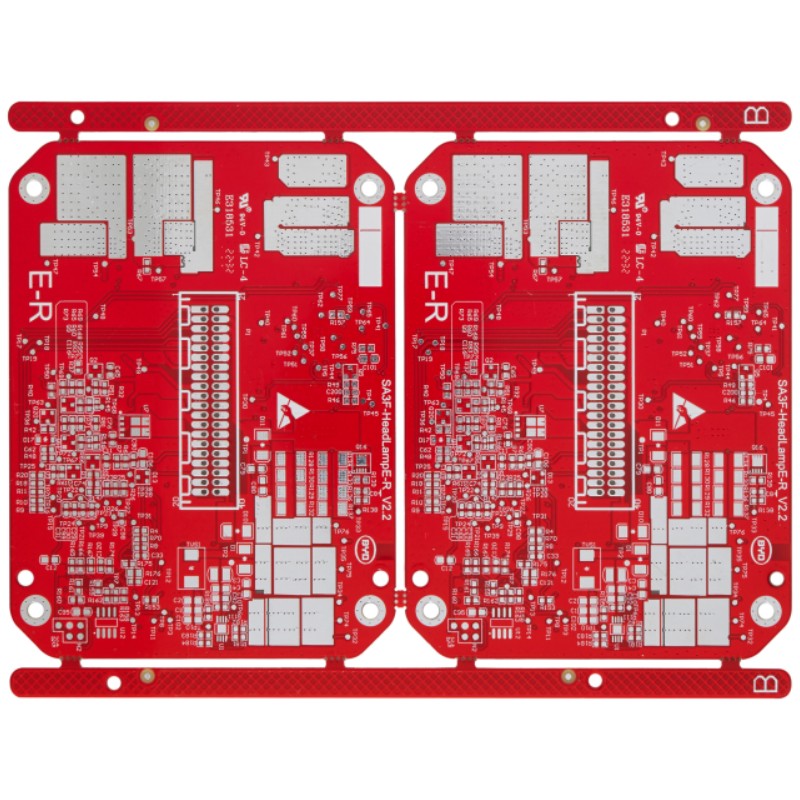

In the dynamic world of electronics manufacturing, trends and shifts in production locations are not uncommon. However, one recent trend has caught the attention of industry observers: a significant migration of electronics manufacturing from China to Mexico. This shift is being observed across a range of electronics manufacturers, including Original Equipment Manufacturers (OEMs), contract manufacturers, and electronics manufacturing services companies. These companies serve a diverse clientele, from large OEMs to small and medium-sized businesses (SMBs) and even smaller PCB design firms. Impdance Controlled Pcb

This blog post aims to delve into the reasons behind this shift and its implications for supply chain professionals and electronics engineers. We will explore the factors driving manufacturers to consider Mexico as a viable alternative to China, the opportunities this presents, and the challenges that lie ahead. By understanding these broader trends, we can better navigate the evolving electronics manufacturing environment and leverage the opportunities it presents.

As the global electronics manufacturing landscape continues to evolve, a significant shift is underway. Many electronics manufacturers, including Original Equipment Manufacturers (OEMs), contract manufacturers, and electronics manufacturing services companies, are increasingly moving their manufacturing capacity from China to Mexico. This shift is driven by a confluence of factors that are reshaping the global supply chain dynamics.

One of the primary reasons for this shift is economic. Over the past decade, China’s economic landscape has changed dramatically. The country’s rapid economic growth has led to increased labor costs, making manufacturing in China more expensive than it used to be. This is particularly true in the electronics manufacturing sector, where skilled labor is a necessity. As a result, manufacturers are looking for more cost-effective locations for their operations.

Mexico, on the other hand, offers a competitive alternative. The country has a robust manufacturing sector, with a long history of electronics manufacturing. Labor costs in Mexico are significantly lower than in China, and the country has a large, skilled workforce. Additionally, Mexico’s proximity to the United States provides a logistical advantage for manufacturers serving the North American market.

Trade agreements and tariffs also play a significant role in this shift. The ongoing trade tensions between the United States and China have led to increased tariffs on Chinese goods, including electronics. This has made manufacturing in China less attractive for companies that export their products to the U.S.

Mexico, on the other hand, is a part of the United States-Mexico-Canada Agreement (USMCA), which provides duty-free access to the North American market. This makes Mexico an attractive location for manufacturers looking to avoid tariffs and reduce their overall manufacturing costs.

The COVID-19 pandemic has underscored the importance of supply chain resilience. The disruption caused by the pandemic has highlighted the risks of relying too heavily on a single country for manufacturing. As a result, many companies are looking to diversify their supply chains to reduce risk.

Moving manufacturing to Mexico allows companies to diversify their supply chains and reduce their dependence on China. This not only reduces risk but also increases supply chain resilience, allowing companies to better respond to future disruptions.

Government policies and incentives also play a role in this shift. The Mexican government has implemented a range of policies and incentives to attract foreign investment in the manufacturing sector. These include tax incentives, infrastructure development, and initiatives to improve the business environment. In contrast, China’s government policies have increasingly favored domestic companies, making it more challenging for foreign companies to operate in the country.

In conclusion, the shift in electronics manufacturing from China to Mexico is driven by a combination of economic factors, trade agreements and tariffs, supply chain resilience, and government policies and incentives. As these trends continue, we can expect to see more electronics manufacturers moving their operations to Mexico in the coming years.

As we delve deeper into the reasons behind the shift in electronics manufacturing from China to Mexico, it becomes clear that government policies and supply chain resilience play a significant role.

Mexico’s government has been proactive in attracting foreign investment, particularly in the manufacturing sector. The government has implemented policies that make it easier for foreign companies to set up operations in Mexico, such as simplifying the process for obtaining permits and reducing the bureaucratic red tape that can often slow down the process of establishing a new business.

In contrast, China’s government policies have been a source of uncertainty for many electronics manufacturers. In recent years, China has enacted numerous policies including quotas for mining and export, and a two-tier pricing system, under which rare earth elements (REE) cost less in China than in the rest of the world. These policies have led to concerns about decreases in REE availability outside China, with the price increase of export-destined REE products by up to +600% in 2011.

Furthermore, lawsuits against the REE export policies by China were filed at the World Trade Organization (WTO) by the EU, Japan, and the U.S. In response, China removed the application of export duties and export quotas to REEs, and the restriction on trading rights of enterprises exporting REEs. However, it remains uncertain how subsequent new Chinese industrial policy measures, including new export licenses and the ad-valorem tax, will affect the market over the long term.

Another key factor driving the shift in electronics manufacturing to Mexico is the increased focus on supply chain resilience. The COVID-19 pandemic has highlighted the risks of relying too heavily on a single country for manufacturing. Companies are now looking to diversify their supply chains to reduce the risk of disruption.

Mexico’s proximity to the U.S. market offers significant advantages in terms of supply chain resilience. Companies manufacturing in Mexico can quickly and easily ship products to the U.S., reducing the time and cost associated with long-distance shipping from Asia. This proximity also allows for greater flexibility in responding to changes in demand, as companies can more quickly ramp up or scale back production as needed.

Moreover, Mexico has a robust infrastructure and a well-established network of suppliers, making it an attractive location for electronics manufacturing. The country has a strong industrial base, with a wide range of industries including automotive, aerospace, and electronics, which can provide a reliable source of components and materials for electronics manufacturers.

In contrast, the concentration of electronics manufacturing in China has led to concerns about supply chain vulnerability. The heavy reliance on China for critical components and materials has exposed companies to significant risks, including the potential for supply chain disruptions due to political or economic instability, trade disputes, or other unforeseen events.

The shift of electronics manufacturing from China to Mexico has significant implications for supply chain professionals and electronics engineers. This section will delve into these implications, providing insights into the challenges and opportunities that this shift presents.

For supply chain professionals, the shift to Mexico presents both challenges and opportunities. On the one hand, the proximity of Mexico to the United States simplifies logistics and reduces lead times, making supply chains more responsive and resilient. This is particularly beneficial in the electronics industry, where product life cycles are short and the ability to quickly bring products to market is crucial.

On the other hand, the shift to Mexico requires supply chain professionals to navigate a different set of regulations, customs procedures, and business practices. Mexico’s regulatory environment is different from China’s, and understanding these differences is critical for ensuring compliance and avoiding costly delays or fines.

Moreover, the shift to Mexico may require supply chain professionals to reconfigure their networks of suppliers and logistics providers. While some companies may be able to leverage existing relationships with suppliers and logistics providers in Mexico, others may need to establish new relationships. This can be a complex and time-consuming process, requiring careful due diligence and negotiation.

Supply chain professionals will also need to consider the potential impact of the shift to Mexico on their companies’ sustainability efforts. Mexico has different environmental regulations and standards than China, and companies may need to adjust their practices to ensure compliance. Additionally, the shift to Mexico may affect companies’ carbon footprints, given the differences in transportation distances and modes.

For electronics engineers, the shift to Mexico presents opportunities for closer collaboration with manufacturing operations. The proximity of Mexico to the United States makes it easier for engineers to visit manufacturing sites, observe production processes, and work directly with manufacturing teams. This can lead to better communication, faster problem-solving, and more opportunities for innovation.

At the same time, the shift to Mexico may require electronics engineers to adapt to different manufacturing practices and standards. Mexico has a strong tradition of craftsmanship and a different approach to manufacturing than China, which may affect aspects of product design and production.

Furthermore, electronics engineers will need to consider the potential impact of the shift to Mexico on the quality and reliability of their products. While Mexico has a growing electronics manufacturing industry, its capabilities and expertise may differ from those of China. Engineers will need to work closely with their manufacturing counterparts in Mexico to ensure that their designs are feasible to produce and that the resulting products meet their quality and performance specifications.

Finally, electronics engineers will need to consider the potential impact of the shift to Mexico on their companies’ sustainability efforts. As with supply chain professionals, engineers will need to consider the environmental implications of their designs and production processes in the context of Mexico’s regulations and standards.

The electronics manufacturing industry in Mexico, like any other, faces a set of challenges. However, with the right strategies and approaches, these challenges can be effectively managed and even turned into opportunities for growth and innovation.

One of the key challenges in electronics manufacturing in Mexico is the need for continuous technological advancement. The industry is characterized by rapid technological change, and manufacturers must constantly innovate to stay competitive. Samsung Electronics, for instance, spends about 8% of its annual revenues on research and development, more than most of its competitors, to maintain its technological edge.

Another challenge is the fluctuation in customer preferences. The electronics industry has seen shifts from boom boxes to Walkmans, and now to digital music players like MP3 players. To navigate this challenge, companies like Samsung conduct constant research and development not only of products but also of markets. They also monitor existing customers to catch changes in customer preferences.

The possibility of a worldwide recession is another challenge that electronics manufacturers in Mexico, and indeed all over the world, must grapple with. A worldwide recession would mean greater consciousness of value in the mass consumer electronics business and erosion of margins for producers.

To mitigate these and other risks, Samsung employs a variety of strategies. These include keeping inventories low, maintaining flexible capacity, having redundant suppliers for a bulk of its non-core components, and using information technology to keep its supply chain responsive and informed.

There are compelling reasons for electronics manufacturers to consider moving their operations from China to Mexico, and there are compelling reasons to source these services from Mexico. These include cost advantages, proximity to North American markets, favorable trade agreements, favorable geography, and a skilled labor force.

In my opinion, the migration of electronics manufacturing to Mexico will become a larger trend in the global supply chain. Understanding this trend is crucial for supply chain professionals and electronics engineers as they navigate the evolving landscape of the industry. By staying informed and adaptable, they can seize the opportunities this shift presents and contribute to the future of electronics manufacturing.

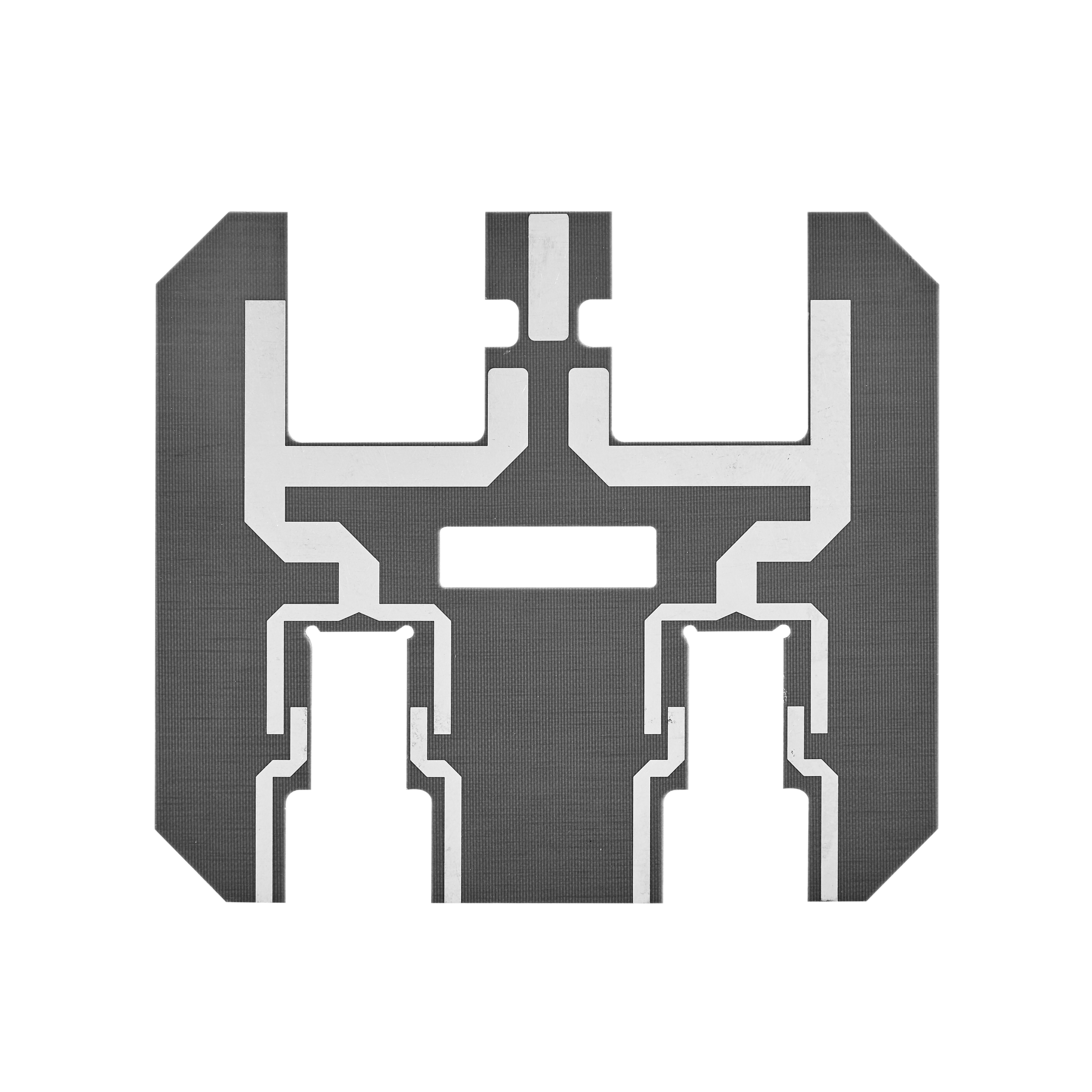

Whether you’re designing high-speed PCBs for mil-aero embedded systems or a complex RF product, you should work with a design and development firm that can ensure your product will be reliable and manufacturable at scale. NWES helps aerospace OEMs, defense primes, and private companies in multiple industries design modern PCBs and create cutting-edge embedded technology, including power systems for high reliability applications and precision control systems. We’ve also partnered directly with EDA companies and advanced ITAR-compliant PCB manufacturers, and we’ll make sure your next high speed digital system is fully manufacturable at scale. Contact NWES for a consultation.

Quick Turn Prototype Pcb © 2024 EMSNow.com, Global Source for the Electronics Manufacturing Services Industry |