Last fall's contentious United Auto Workers' strike changed Ford Motor Co.'s relationship with the union to the point where it will “think carefully” about where it builds future vehicles, Ford's top executive said Thursday.

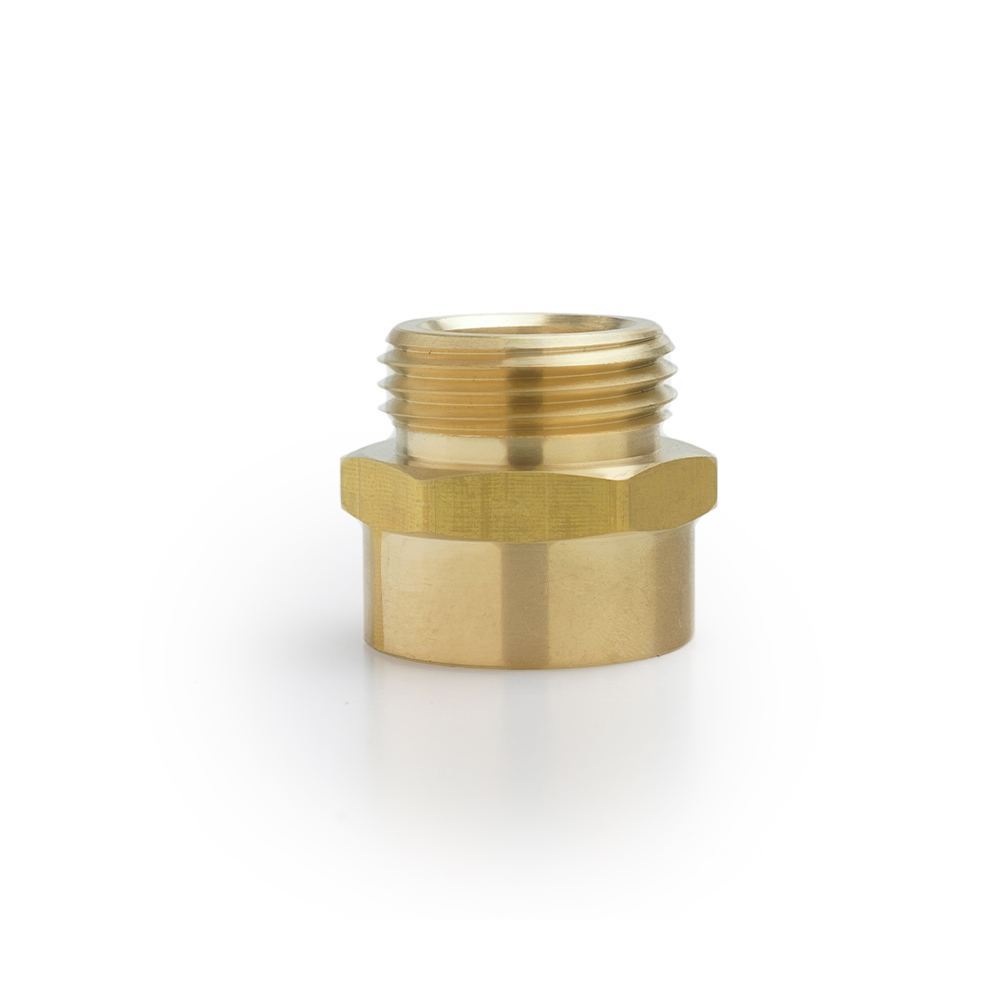

CEO Jim Farley told the Wolfe Research Global Auto Conference in New York that the company always took pride in its relationship with the UAW, having avoided strikes since the 1970s. Female Pipe

But last year, Ford’s highly profitable factory in Louisville, Kentucky, was the first truck plant that the UAW shut down with a strike. Farley said as the company looks at the transition from internal combustion to electric vehicles, “we have to think carefully about our (manufacturing) footprint."

Ford, Farley said, decided to build all of its highly profitable big pickup trucks in the U.S., and by far has the most union members — 57,000 — of any Detroit automaker. This came at a higher cost than competitors, who went through bankruptcy and built truck plants in Mexico, he said. But Ford thought it was the “right kind of cost,” Farley said.

“Our reliance on the UAW turned out to be we were the first truck plant to be shut down,” Farley told the conference. “Really our relationship has changed. It's been a watershed moment for the company. Does this have business impact? Yes.”

In response to Farley's comments, union President Shawn Fain said in a statement Thursday that Ford should stay focused on building the best auto industry, not on a race to lower wages.

“Maybe Ford doesn’t need to move factories to find the cheapest labor on Earth," he said. "Maybe it needs to recommit to American workers and find a CEO who’s interested in the future of this country’s auto industry,” Fain said.

The statements by Farley and Fain suggest the relationship between the union and company has changed. The rhetoric, especially Fain's response, build on previous public poundings between the two, including when Executive Chairman Bill Ford in October appealed to the union to end the work stoppage. Fain responded by saying, “if Ford wants to be the all-American auto company, they can pay all-American wages and benefits.”

Marick Masters, a Wayne State University business professor, said "this tit-for-tat kind of comment isn't necessarily useful. I don't think it furthers anything ... there are many ways for an executive to state that they have lots of options and have to consider a lot of things going forward in terms of making decisions. And they don't have to stick a needle in the back of the UAW or do anything like that."

Asked about Farley's comments, White House press secretary Karine Jean-Pierre said President Joe Biden believes in making goods and creating jobs in the U.S.

“We're going to do everything we can to make sure that continues,” she said.

Biden, she said, also believes that workers have the right to collective bargaining to get better wages and benefits like the UAW did. “That is something that the president is always going to speak for and is going to stand up for” she said. "You hear him say this all the time, unions build the middle class, and he believes that.”

Last year, the UAW achieved robust wage and other gains after a six-week strike at selected plants run by Ford, General Motors Co. and Jeep maker Stellantis NV. Top-scale factory workers won 27% raises over a contract that runs through April 2028, taking their top wage to around $42 per hour. In total, Ford has said the new UAW contract is expected to cost $8.8 billion over the agreement's four-and-half years.

High manufacturing costs are among the reasons Ford has a $7 billion annual cost disadvantage to competitors, Farley has said. He told the conference on Thursday that Ford is making progress on cutting those costs with cultural and structural changes at the company.

Ford expects to take out $2 billion worth of costs this year, and Farley said he thinks cuts in manufacturing costs will “fully offset” the cost of the UAW contract. Ford has said the contract would add $900 to the cost of a vehicle by the time it reaches full effect.

Ford has shifted its electric vehicle strategy to concentrate on smaller, lower-priced EVs and electric work vehicles such as pickup trucks and full-size vans, Farley said. Any EV larger than a Ford Escape small SUV “better be really functional or a work vehicle.”

A small team within the company is developing the underpinnings of a less costly smaller electric vehicle, which Farley said would be profitable because of U.S. federal tax credits as high as $7,500 per vehicle. He gave no time frame for the small EV to come out, but said Ford's next generation of electric vehicles would come in 2025 through 2027.

His comments about the union raise questions about whether the new small EV would be built in Mexico, which has lower labor costs. Vehicles built in North America are still eligible for the U.S. tax credit.

Farley also said he sees EV battery prices coming down with more competition. The company, he said, may go with a common cylinder-shaped battery cell to leverage purchasing and get better prices. He also said Ford might do that with another automaker.

Ford’s Model e, the electric vehicle unit, lost nearly $5 billion before taxes last year. Farley wouldn't give a date for it to break even, but said any new EV built by the company has to make money within 12 months of its release.

In November, CFO John Lawler noted the agreement with the UAW allows the automaker to be able to rebalance manufacturing lines, its footprint and automation. The company sees opportunities with material, warranty and structural costs, too.

"We need to do that by reducing the number of hours it takes to build a vehicle, simplifying designs and reducing complexity," Lawler said, "as well as driving increased efficiencies through our factories, and that's what we're focused on."

In 2023, the company still posted a net income of $4.3 billion due largely to big profits from its Pro commercial vehicle unit and Ford Blue, the internal combustion division.

Farley said Ford and others will have trouble competing on EVs with Chinese automakers, which are likely to sell 10 million of them this year. It's a big reason that Ford has recruited management talent to focus on lean operations, he said.

Chinese automakers, he said, went from selling no EVs in Europe two years ago to 10% of the market now.

Chinese auto giant BYD 's Seagull small electric vehicle, he said, has about $9,000 in material costs, and it will probably cost the company another $2,000 to meet crash test standards, for a total cost of around $11,000. It has a range of about 150 miles in cold weather, “not a fantastic vehicle, but pretty damn good.”

In a statement, Daniel Ives, managing director of senior equity analyst for Wedbush Securities, said: "The UAW strike was a big wake-up call for Ford, and Farley has to keep all options on the table for building out manufacturing in Mexico and other low-cost locations. The Chinese are flooding the market, and this is creating a big problem for Ford, GM, Tesla and others. 2024 is a big year, and the UAW strike was a big jolt to the strategy for EVs."

In a statement after the conference, Ford added that it's the "No. 1 employer of UAW-represented autoworkers and the only automaker to add thousands of UAW-represented jobs since 2007. We also continue to invest in our UAW-represented plants during one of our biggest-ever new product launch years in the U.S. — with new F-150, Ranger, Explorer, Expedition, Lincoln Navigator and Lincoln Aviator all launching this year. As Jim said, we will continue to build a strong business with the right cost structure and manufacturing footprint.”

Shares of Ford closed up 2.4% to $12.52 in trading Thursday.

Dot Male Connector Detroit News Staff Writer Kalea Hall and Associated Press Reporter Darlene Superville contributed.