DULUTH — The Sofidel Group, an Italian multinational papermaker, expects to complete its acquisition of the Duluth mill, now operated by ST Paper, in a matter of days.

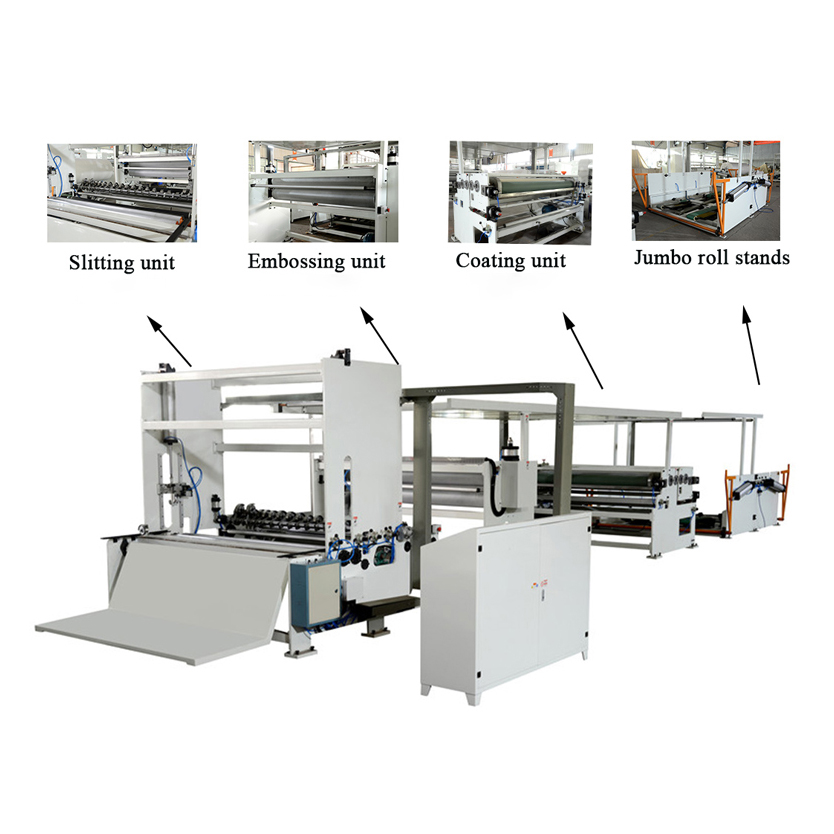

The deal is slated to close at midnight Jan. 31, and Sofidel CEO Luigi Lazzareschi already is laying plans to expand local operations. Facial Tissue Making Machine

“Today there is a paper machine there just producing jumbo reels. But there is no converting operation. So, what we want to do is the entire process — the paper production and then convert those big jumbo paper reels into toilet paper, kitchen towels, facial tissues and napkins,” Lazzareschi said, noting the products will flow both into the retail and away-from-home commercial markets.

He said it will likely take about three years to complete the transformation, which will require a physical expansion of the plant to provide room for converting operations, as well as warehouse space for finished products.

The local workforce also will grow. While ST Paper currently employs about 80 people, Lazzareschi anticipates Sofidel will need around 240 when his vision for the mill is fully realized.

He expects Sofidel will invest between $140 million and $200 million to achieve its objectives in Duluth.

After the Duluth acquisition, Sofidel will have seven U.S. mills.

In Europe, Sofidel ranks as the second-largest producer of tissue paper products, and in 2012 it leaped into the U.S. market, where it continues to aggressively grow operations.

Sofidel produces for private labels in the U.S. instead of selling products under its branded name, Regina, as it does throughout Europe.

Lazzareschi said Sofidel’s paper production has fallen behind its converting capacity in the U.S., causing the company to purchase semifinished jumbo reels from third-party suppliers in recent years, often importing products to feed its operations.

So, the new paper machine in Duluth drew Sofidel’s interest. Lazzareschi said the company usually prefers not to invest in older equipment, but standing up new production presents its own challenges.

He explained that the first year of production can be “a little painful” as operations are dialed in and fine-tuned.

ST Paper began operating its newly purchased paper machine in Duluth at the beginning of 2023 , and Lazzareschi said it offers Sofidel an opportunity to skip the headaches often involved with a startup. Instead, the company will step into a mill with a workforce already on the top of its game.

Addressing the Duluth City Council on Jan. 22, Ron Thiry, chief operating officer of ST Paper, said: "I want to sincerely thank the City Council and the entire community of Duluth that nearly three years ago supported ST Paper's efforts to revitalize and restart the former Verso paper mill on the west side of Duluth."

With that local support and backing of St. Paper's ownership, he said: "We have been able to start a new chapter for the mill, transitioning from graphic paper production into paper and towel production."

Lazzareschi said the Duluth mill should be able to produce 60,000 to 65,000 tons of paper annually.

Worldwide, Sofidel manufactures more than 1.4 million tons of paper products per year, making it the seventh-largest producer on the planet.

The U.S. market is attractive for tissue producers such as Sofidel for several reasons, Lazzareschi explained.

“Americans use much more toilet paper than Europeans,” he said, although Lazzareschi noted U.S. residents’ consumption of other paper products is largely on a par with their peers abroad.

“In Europe, we are folders,” Lazzareschi said, explaining that people typically fold three squares of toilet paper over one another for each wipe, whereas many Americans wad it into a ball.

As a result, Lazzareschi said Europeans use around 12 squares of toilet paper during a typical trip to the bathroom, as opposed to Americans who use an average of about 46 squares.

He said U.S. consumers also tend to prefer a thicker, more absorbent premium tissue material than what Europeans demand.

Another benefit is that newcomers to the U.S. tissue market have many opportunities to produce for private labels versus under their own branded name, according to Lazzareschi. While private labels currently account for about 34% of the U.S. market, those sales continue to grow at about 7% to 8% annually, compared with an overall growth of 1% to 1.5% year over year in the product sector.

Lazzareschi has several loyal private-label customers who continue to provide a steadily growing market for its products.

Finally, Lazzareschi noted that Sofidel enjoys a competitive advantage due to the modern technology and efficiencies it brings to its operations.

Duluth’s paper mill has had some ups and downs with numerous owners through the years until Verso Corp. shut it down in the summer of 2020 , putting more than 220 people out of work.

At the time, the mill produced graphic papers, but ST paper bought the plant and installed a new machine to produce tissue stock, with the help of city, county and state incentives that are expected to transfer to Sofidel , so long as the successor continues to employ at least 80 people in Duluth.

That shift has put the mill on a much firmer footing, according to Lazzareschi, who noted that tissue paper consumption has remained relatively steady through the years and doesn’t fluctuate much with the economy or people’s reading habits.

He said Sofidel also tends to invest for the long haul.

Kitchen Towel Rewinding Machine “I think the people of Duluth are going to see Sofidel’s name on the wall of that mill for many, many years,” Lazzareschi said.