Posted by Jennifer Read | Feb 13, 2024 | Analysis, EMSNOW Mexico, Mexico Analysis

Is Mexico becoming the next big destination for electronics manufacturing? The consensus among industry experts suggests a resounding ‘yes’. Odm Manufacturers

Over recent years, Mexico’s concerted efforts in logistics infrastructure, trade agreements, and manufacturing development are paying dividends, particularly in its ballooning role within U.S. supply chains.

Figures published by the US International Trade Commission reveal that electronics, automobiles, medical devices, and other sectors have witnessed significant growth in Mexico. This surge in manufacturing is not just a domestic shift but part of a global nearshoring trend, with logistics companies ramping up their investments in response.

So, what makes Mexico so alluring to shippers and manufacturers? Eric Porras, Director of MBA programs at Tecnologico de Monterrey’s EGADE Business School, highlights Mexico’s economic development, industrial maturity, and a broad base of existing suppliers. Chip Barth, Managing Director of TBM Consulting’s Global Supply Chain Practice, adds that Mexico’s strong industrial presence aids in reshoring or nearshoring efforts.

Mexico’s global integration through trade deals, including the United States-Mexico-Canada agreement, further enhances its attractiveness. The COVID-19 pandemic underscored Mexico’s advantages, offering a convenient alternative to Asian imports with shorter lead times and cost savings.

However, with expanding sanctions there may be a block on future electronics flows, as the Mexico to U.S. supply chain is significantly bolstered by Chinese imports. Descartes analysed the top 10 HS-2 commodity groups to see how Mexico imports from China compared to U.S. imports from Mexico. It’s apparent that China now represents a significant percentage of the value of U.S. imports from Mexico.

U.S. trade data from 2022 reveals that 14% of all U.S. imports by value originated from Mexico. Foreign direct investment from U.S. firms plays a pivotal role, accounting for 42% of total foreign investment in Mexico since 2006. However, this investment has traditionally been concentrated in a few sectors, with the automotive industry being particularly dominant.

In the first three quarters of 2023, motor vehicle manufacturing attracted $5.4 billion in foreign investments, surpassing any full previous year. This includes significant investments from major players like BMW and Tesla, who are preparing for the future of electric vehicles.

Besides the automotive sector, products like beverages, household appliances, electrical equipment, and medical supplies are also experiencing increased demand in the U.S. market.

The push for speed and agility in today’s on-demand market is evident in the latest wave of logistics investments. Policymakers in Mexico are even proposing a rail corridor to rival the Panama Canal, demonstrating the country’s commitment to becoming a key player in the global electronics industry.

Thousands of senior engineers and procurement professionals subscribe to our LinkedIn Market Intel newsletter – get yours here

For more help with looking at supply chain options, contact Astute Electronics

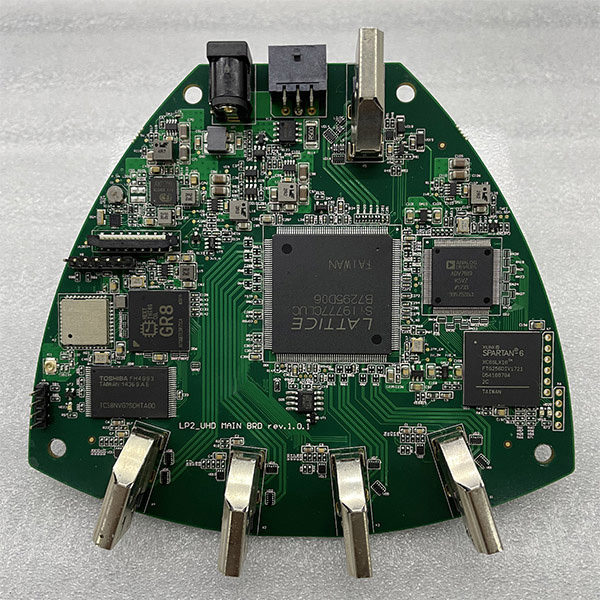

Printed Circuit Board Assembly © 2024 EMSNow.com, Global Source for the Electronics Manufacturing Services Industry |