Eminence, MO. – Last week, a man from Eminence escaped from the Shannon County Jail and was apprehended once again after a search.

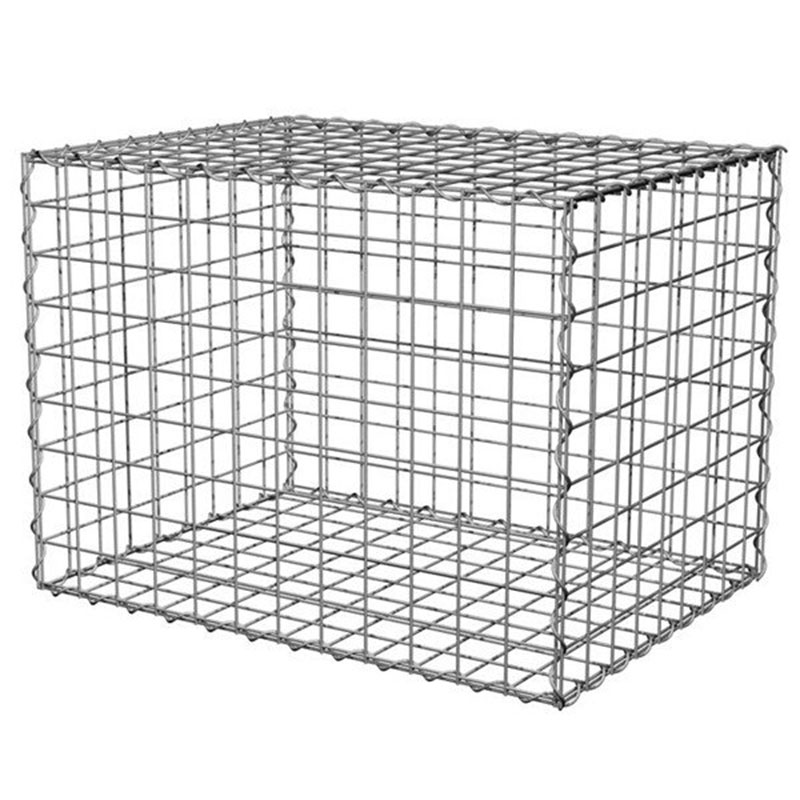

This event started when a convict, identified as Kenny Carpenter, broke through an opening in an old chain link fence. The fence was in the recreational area of the Shannon County Jail. The escape happened on Thursday, July 26th. Steel Bar Grating

Filer wire mesh series The U.S. Marshals, the Missouri State Highway Patrol, and other agencies in the area helped in the subsequent search of the escaped Carpenter. The inmate has a history of drug charges and while not a violent offender, was able to evade recapture until Saturday, July 28th.