By continuing, I accept the T&C and agree to receive communication on Whatsapp

The Building material sector reported weak set of earnings for Q3FY24, with an exception of top PVC piping companies which continue to witness demand tailwinds. Bathware segment too faced a challenging demand environment this quarter. The demand revival in Ceramics and Woodpanel segment which was expected in H2FY24 has not panned out so far, in fact have witnessed volume guidance being trimmed. The implementation of BIS standards in the Woodpanel segment is expected to incrementally benefit the domestic MDF/Particleboard manufacturers. Analysts of IIFL Securities expect the near term outlook to remain tepid, and expect a pick-up in real estate completions to drive demand for building material products H2FY25/FY26 onwards. Re-iterate CPBI and KJC as analysts of IIFL Securities top picks. Pre Laminated Plywood

Ceramics – Muted performance continues:

The performance for Ceramic companies was muted with KJC & SOMC reporting 6% and -3% YoY volume growth respectively. KJC mgmt has been scaling down its volume growth guidance downwards from 13-15% to 9-10% in Q2 and now at 6-7%. Between April-October’23, ceramic exports were robust at ~Rs123bn (up 49% YoY). However, November onwards monthly exports run-rate has declined to Rs15bn due to sharp spike in sea freight. Gross margins and Ebitda margins were broadly stable on a sequential basis. Bathware too saw demand pressures during the quarter with CRS recording a 4% YoY revenue decline largely led by weakness in Sanitaryware segment.

Pipes Business – Volatile quarter; Q4 to be healthy:

PVC pipe companies reported a mixed bag when it came to volume growth, except SI and ASTRA, other companies reported muted volumes largely due to volatility in PVC and CPVC prices leading to de-stocking by dealers. PVC/CPVC prices declined by 7%/ 5%, and are expected to stabilise in Q4FY24. Agriculture segment witnessed weak demand due to seasonality and drop in PVC prices, although demand from Housing (Plumbing) and Infrastructure segment remained good. SI clocked in the strongest volume growth (17%) partly driven by higher offtake from govt orders for Nal se Jal scheme. Ebitda/kg for PVC pipe companies was lower QoQ partly due to inventory losses during Q3, though was higher YoY. Q4FY24 demand outlook however remains strong with January offtake looking quite encouraging.

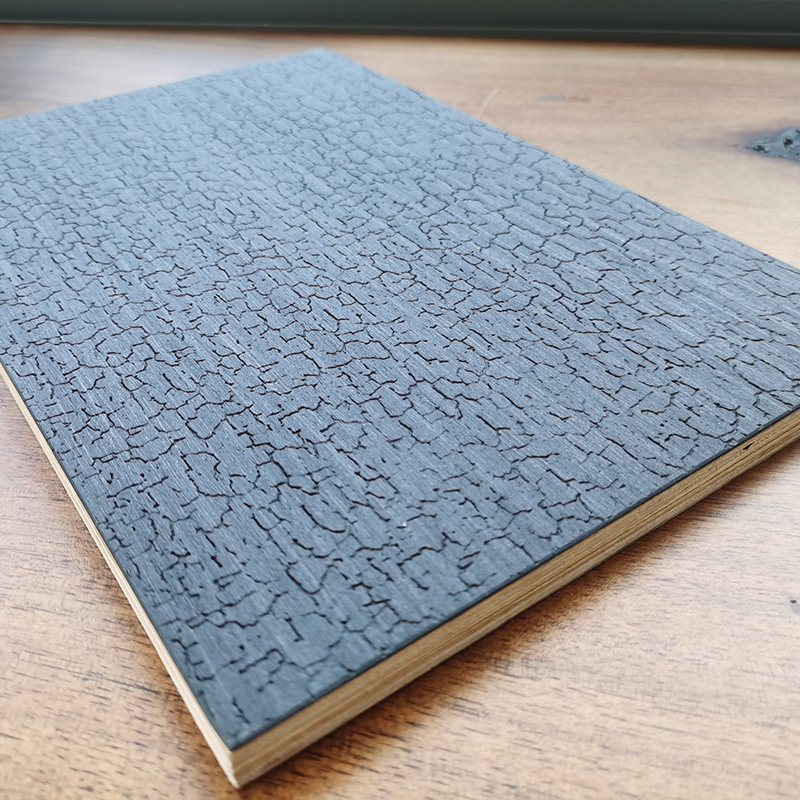

Woodpanel – A lot riding on BIS implementation:

Plywood volume growth for CPBI & MTLM was 3% and 11% respectively in Q3. Laminates volume growth was a mixed bag – with domestic demand doing fine while exports were impacted due to the ongoing Red Sea issue (SYIL/GRLM faced Rs180-200mn impact each). In the MDF segment, imports which were 25-30k cbm/month in Q1FY24, went up by 60% in Q2 and was back to 32kcbm/month in Q3. Implementation of BIS regulations (in force since February) hold the key as panel players expect imports to slow down further. Domestic realization was under pressure, down 7/11% YoY for GREENP & RDL respectively. Export realization however was up 2%/4% YoY. MDF margins remained under pressure with GREENP and CPBI reporting 20% and 19% margins respectively in Q3. MDF margins are expected to come under further pressure in Q4.

Demand recovery expected in H2FY25:

Companies now expect demand to improve in H2FY25/FY26, with expectations of buoyancy in real estate launches to drive demand as completions draw near. Within analysts of IIFL Securities coverage, their see CPBI and KJC as top picks.

IIFL Customer Care Number (Gold/NCD/NBFC/Insurance/NPS) 1860-267-3000 / 7039-050-000

IIFL Securities Support WhatsApp Number +91 9892691696

2024, IIFL Securities Ltd. All Rights Reserved

www.indiainfoline.com is part of the IIFL Group, a leading financial services player and a diversified NBFC. The site provides comprehensive and real time information on Indian corporates, sectors, financial markets and economy. On the site we feature industry and political leaders, entrepreneurs, and trend setters. The research, personal finance and market tutorial sections are widely followed by students, academia, corporates and investors among others.

Stock Broker SEBI Regn. No: INZ000164132, PMS SEBI Regn. No: INP000002213,IA SEBI Regn. No: INA000000623, SEBI RA Regn. No: INH000000248

This Certificate Demonstrates That IIFL As An Organization Has Defined And Put In Place Best-Practice Information Security Processes.

Plywood Drawer Construction By continuing, I accept the T&C and agree to receive communication on Whatsapp