The flooring categories of the past were distinct, offering differentiated benefits that made them more or less suitable for particular applications. As the industry has evolved, new innovations have emerged in an effort to improve performance. In many cases, one category’s success spurs another to innovate accordingly, and that has yielded products that are essentially hybrids. CATEGORY DEFINITIONS In recent years, as laminate and rigid LVT producers have competed for marketshare, innovations have, in some instances, driven the categories toward each other. LVT producers have started experimenting with alternative core materials and wearlayers in an effort to offer a product that can match up to laminate’s ability to withstand dents and scratches. Laminate manufacturers, meanwhile, have begun working on waterproof solutions that offer the peace of mind touted by vinyl products. “As manufacturers, we innovate in part by looking across other categories to see what works and whether the same or a similar concept will work with our product to improve performance,” explains Barbara Ellenberg June, president of the North American Laminate Association (NALFA) and general counsel and public relations representative for laminate producer Swiss Krono. With suppliers seeking flooring solutions “that offer the best of both worlds in terms of aesthetics and functionality,” says CFL president and CEO Thomas Baert, “the distinction between hard surface categories has been blurring in recent years, and we have seen an increasing trend toward hybridization between different types of flooring options.” The hard surface industry has approached this by categorizing products based on their top layer: wood veneer for engineered hardwood, an AC-rated melamine wear surface for laminate, and a vinyl wearlayer for resilient flooring. “As an industry, it’s important to properly classify products to ensure standardization of testing and performance claims, so the consumer can make informed decisions when comparing flooring options and choosing the best product to meet their needs,” says Natalie Cady, director of product, samples and promotions for Shaw’s Coretec brand, which pioneered the rigid core category. This evolution is likely to continue as technologies are developed. For example, the advent of direct digital print promises a new wave of innovation and, likely, hybridization through the ability to turn virtually any substrate into the flooring material of choice. Both Germany-based Hymmen and China-based Benchwick have been developing direct digital equipment that will eliminate the need for decorative foils and could revolutionize the process for applying the visuals to the coreboard. Hymmen has successfully sold three lines-to HMTX, CFL and Engineered Floors (EF). “As technology and manufacturing capabilities continue to advance, the natural progression of hard surface flooring is hybridization to ensure we’re building the best construction(s) with the attributes consumers want most,” Cady says. Dennis Bradway, secretary and former technical committee chair for NALFA, notes, “Improvements that work are a win for consumers. The harm to a category comes if these new hybrids overpromise and underdeliver on warranted expectations. There is a fairly straightforward path for building credibility for new product chemistry and product constructions. Two of the biggest sticking points are that you cannot develop a standard for a product that does not yet exist, and you can’t write a standard around a single-source proprietary product. No ANSI authoritative consensus body developing standards would endorse or support that. In other words, as new products hit the market, there needs to be some critical mass in terms of product volume, number of suppliers, etcetera, before development of a product standard is justified.” Agreeing that it is imperative that the industry establish standards for emerging hybrids, Baert suggests perhaps reclassifying products based on their core material and construction. “For example, our Tenacity eco-composite flooring, while it has some characteristics of laminate and LVT flooring, can be classified as an engineered mineral floor due to its unique combination of natural minerals,” he explains. “By establishing clear categories and standards for these types of products, we can ensure that they are evaluated fairly and accurately.”

THE FLOATING MARKET Pioneered by laminate and expanded by LVT, locking systems have become ubiquitous, offering ease of installation that has turned average homeowners into DIYers and lowered the cost of installation by professionals. “That one category-easy to install floating floors-touches on a lot of categories,” says Inhaus CEO Derek Welbourn. “Click was one of the very first innovations to come out of laminate. It was followed fairly quickly by click-together engineered wood. Then came click-together [flex] vinyl, then vinyl morphed into WPC that was click-together and, ultimately, turned into SPC that was click-together.” As that market has gotten increasingly crowded, it has blurred the lines between categories, especially as suppliers seek to capitalize on the aspirational value of wood through marketing and product names. “If you go back to the 1980s, you had sheet vinyl, and you had solid wood,” says David Moore, Mohawk’s senior product director for wood. “Today I think it’s hard for consumers to understand-and I don’t think it’s really that important to them to understand-exactly how a product is made. They want a great-looking floor that is going to last, based on their lifestyle.” With wood-look aesthetics predominantly comprising the click-together market, it’s safe to say that wood is the visual of choice for most Americans, though they have the option of buying the real product or a product that looks like real wood. While wood offers authenticity and increases home values, the plastic-based substitutes are winning in the waterproof positioning game. Since LVT is made of polyvinylchloride, it is inherently waterproof but more susceptible to scratching. Laminate offers superior scratch resistance and a more realistic visual, but it is not waterproof. This has led both to work to address their own challenges, though in many cases, they are grouped together in showrooms. CCA Global, which is overhauling its merchandising to help simplify the shopping experience, is separating the wider category into wood and waterproof wood, with the latter denoting laminate and LVT with wood looks. Mohawk’s new BelleLuxe laminate offering carries the same waterproof wood designation to differentiate it from the existing natural wood options. “Research shows that, when shopping for hard surface flooring, consumers prioritize features like durability, scratch resistance, value compared to cost, and cleanability over category designations and environmentally friendly attributes,” says Cady. THE “HYPE” OF WATERPROOF PERFORMANCE Jamann Stepp, vice president of hard surface for The Dixie Group, jokes that “most consumers are not living in an aquarium,” but with LVT’s inherent waterproofness being hyped in the marketplace, such performance has become a key selling point across categories. “Because everything is now moving toward waterproof, it’s almost become like the ante into the game; consumers expect it to be waterproof,” says Kyle Brown, Swiss Krono’s executive vice president of product development, sales and marketing. With its wood core, laminate has had to innovate in order to compete. Manufacturers first incorporated ultra-tight locking systems and then applied hydrophobic sealants to the joints to help prevent water from seeping down to the core. But in order to claim true waterproofness, producers are now experimenting with different core constructions and technologies, altering the traditional composition of wood pulp and resin in unique ways in order to prevent or limit the core from swelling. “There really isn’t one standard type of waterproof core,” explains John Hammel, director of wood and laminate for Mannington, which introduced its SpillShield technology paired with a moisture warranty in 2017. “There are different types of resins used, and each formulation is proprietary. The amounts used also differ.” At this year’s Surfaces, Inhaus debuted Uberwood, a melamine-infused HDF core with a thermally fused melamine top layer, and Swiss Krono introduced Corepel, pairing a proprietary-polymer wrapped HDF core with a melamine wearlayer. This summer, Dixie will launch TruCor Refined, taking the category in a different direction by combining a mineral composite core with a melamine top layer. “Right, wrong or indifferent, I don’t think the waterproof play is going away,” says Stepp, who expects other mineral-fiber-core products to hit the market later this year based on conversations he’s had with Asian suppliers. Dixie is sourcing its line from China and is already set to expand it, should it prove popular. While Stepp believes its properties will stand up in the market, he expects it will take some education of RSAs in order to get them comfortable with promoting the product. “That is going to be key to our success: explaining the difference between hybrid and real laminate and doing the pros and cons comparison in the rigid core world as well,” he says. Stepp is calling TruCor Refined a hybrid laminate, in keeping with industry standards due to its melamine top layer. The designation also conveys the product’s superior scratch performance, one of laminate’s inherent and well-known advantages, while distancing it from resilient products, which are coming under greater scrutiny for their PVC components. He is also positioning the product apart from those with magnesium oxide cores, a familiar mineral composite offering on LVT that Stepp says has shown to be brittle, hard to cut and dimensionally unstable. TruCor Refined features a core that includes fiberglass, epoxy resin and copper powder, making it 100% waterproof, and carries an AC4 rating for scratch- and abrasion-resistance. (AC ratings range from AC1 to AC6, with 6 being the highest.) Originating in Europe, Inhaus’ Uberwood and Swiss Krono’s Corepel are being marketed as eco-resilient, since they combine a wood core with the properties of resilient flooring. Corepel is comprised of at least 50% wood yet offers a MSR-AI wear resistance rating and can be used in commercial applications. Testing has shown the locking system to be stronger than that of LVT and products with a traditional HDF core, according to the company. While Brown says offering a PVC-free waterproof option was the impetus, the brand’s sales are being driven by its performance benefits. Uberwood has an AC-5 rating against scratches and is also rated for commercial applications. THE MOVE TOWARD PVC-FREE Just as laminate has evolved to offer an answer to LVT’s waterproof story, LVT has begun altering its core composition to offer greater durability as well as a more eco-friendly option. Shaw’s Coretec “led the pack on bringing mineral core constructions to market due to the unique features and benefits these products offer, particularly when it comes to scratch resistance,” Cady says. Inhaus has been offering PVC-free rigid core products for several years, opting for food-grade polypropylene, 25% of which is post-consumer recycled material. In turn, the flooring material can be recycled at the end of its useful life, getting ground back up and used in other polypropylene items like lawn chairs. In addition to such benefits, Welbourn says “it is a super category in terms of dimensional stability; it’s easier to install; and with our process where it’s 100% digital and the textures are digital, we have some opportunities to do some interesting designs over other categories.” He also notes its competitive price point, since most customers are still not willing to pay a high premium for sustainability. “If you’re talking about the mid and upper end of the category, polypropylene doesn’t have to be more expensive,” he says, adding, “I think that’s why it really has a future.” Industry leaders do cite a growing interest in sustainable flooring options, especially on the commercial side, and with the government’s increased focus on climate resilience at even the micro level, it stands to become more widespread. News reports and scientific research increasingly cite the threats of non-sustainable offerings across industries, and in February, the nation was gripped with the news of a Norfolk Southern train derailment and the dangers associated with the spilled vinyl chloride it was carrying. “Overall, the movement toward PVC-free flooring is an important step toward a more sustainable and eco-friendly future, and we believe that this trend will only continue to grow as more consumers become aware of the benefits of PVC-free options,” says Baert. CFL made a push at this year’s Surfaces for its Tenacity “eco-composite,” made from a mixture of stone minerals and wood fiber, and OEM producer MJ International said it has begun filling orders for its rice husk-based SPC, or RSPC, made from rice husks and stone powder. Last year, MSI introduced its own version of a hybrid rigid core, featuring a polymer-encapsulated HDF core with a resilient top layer protected by MSI’s CrystalLux wearlayer for its Smithcliffs line. “End users are getting tired of choosing between waterproof and extreme scratch resistance,” says MSI product buyer John Mcelroy, noting that the line is seeing success. Lvt Black

Related Topics: AHF Products, Engineered Floors, LLC, Shaw Industries Group, Inc., Mohawk Industries, The Dixie Group, HMTX, Mannington Mills

Doug Jackson Showcases Cali's New Products at Surfaces 2024

Subscribe to get our weekly newsletter delivered directly to your inbox

Floor Focus is the oldest and most trusted flooring magazine. Our market research, strategic analysis and fashion coverage of the flooring business provides retailers, designers, architects, contractors, building owners, suppliers and other industry professionals the information they need to achieve greater success.

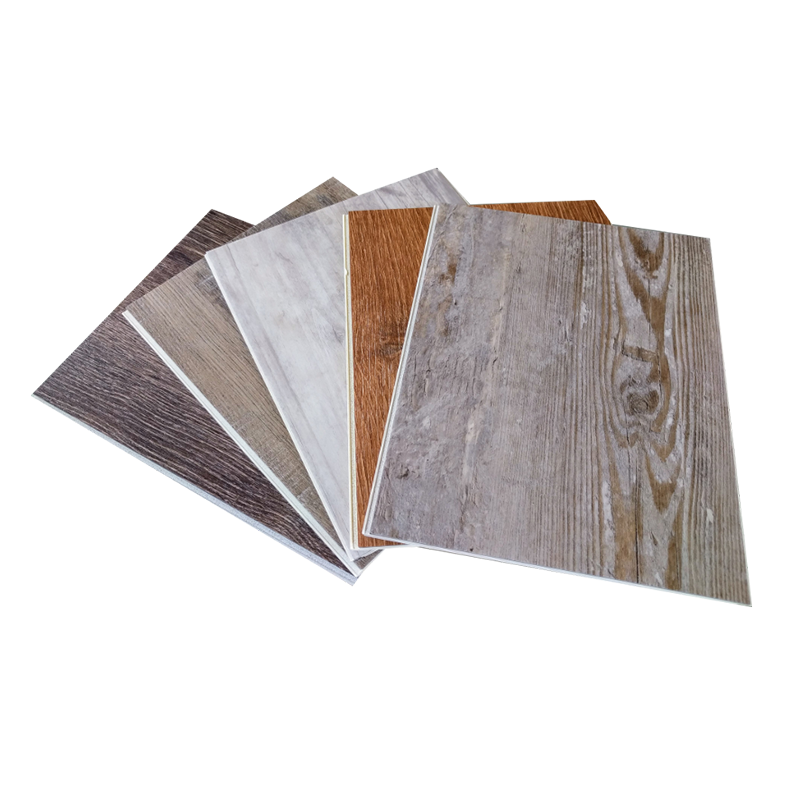

Brown Grey Laminate Flooring This website, Floordaily.net, is the leading resource for accurate, unbiased and up to the minute flooring news, interviews, business articles, event coverage, directory listings and planning calendar. We rank number one for traffic.