Sign-in to our platforms to access our extensive research, our latest insight, data and analytics and to connect to our industry experts.

Accelerate the move to clean energy with low-carbon intelligence connecting assets, markets, and companies. Inverter Duty Transformer

Access reliable research and analysis within and across the metals and mining industry to make strategic, operational and investment decisions.

Access world-class insight from exploration to end product, with data by assets, country and region.

In-depth insights, supported by robust data offerings, thorough research, and comprehensive consulting services.

Access real-time data and analytics in all major commodities with innovative data points and comprehensive insights to guide strategic and trading decisions.

Understand strategic opportunities and challenges in the rapidly changing upstream industry.

Access unparalleled detail and depth into the Maritime landscape through the most accurate, integrated view of terrestrial, satellite and dynamic AIS networks.

Understand the connections from feedstocks to end products and how each fits.

Explore the themes shaping the energy transition with our monthly thought leadership.

Views from across our team of global experts on the natural resources industry's biggest stories and what that means for your business.

Ed Crook's weekly column examines the interactions of politics, finance and technology impacting the world of energy.

Weekly discussions on the latest news and trends in energy, cleantech and renewables.

Our weekly round up of the lasted opinions, new, industry analysis from our global analysts.

In depth analysis of the energy transition and the path to a low carbon future.

Explore the future growth potential for carbon capture, utilisation and storage.

The latest views from our global experts on the rise of the hydrogen economy.

Explore the growth trajectory for EVs and spot any possible bumps in the road.

As the world maps out a low carbon future, COP29 will dive deeper on financing the energy transition.

Explore trends around sustainability, recycling and the circular economy and their impact on materials markets.

Our global events bring together influential decision-makers from the energy sector.

Browse Wood Mackenzie events by Industry

Explore our wide range of market outlook reports spanning the natural resources and energy industries.

Pinpoint opportunities on a map. In-depth industry and market-data wallmaps.

An integrated view of global renewable and conventional power data and insights across projects, technologies and markets.

Maximise investment opportunities across the hydrogen, ammonia and methanol value chain.

Industry renowned data and analysis, enabling resilient, sustainable portfolios.

Identify advantaged barrels and support critical investment decisions with an integrated view of commercial and technical data.

Analysis of CCUS and offset opportunities to shape decarbonisation strategies.

The single source for exploring industry data alongside leading expertise, analyses, and modelling insights.

Unlock robust data and new unique perspectives across key mined commodities needed to assess the mining landscape.

Seamlessly integrate Wood Mackenzie data into your own proprietary systems with Lens Direct API services.

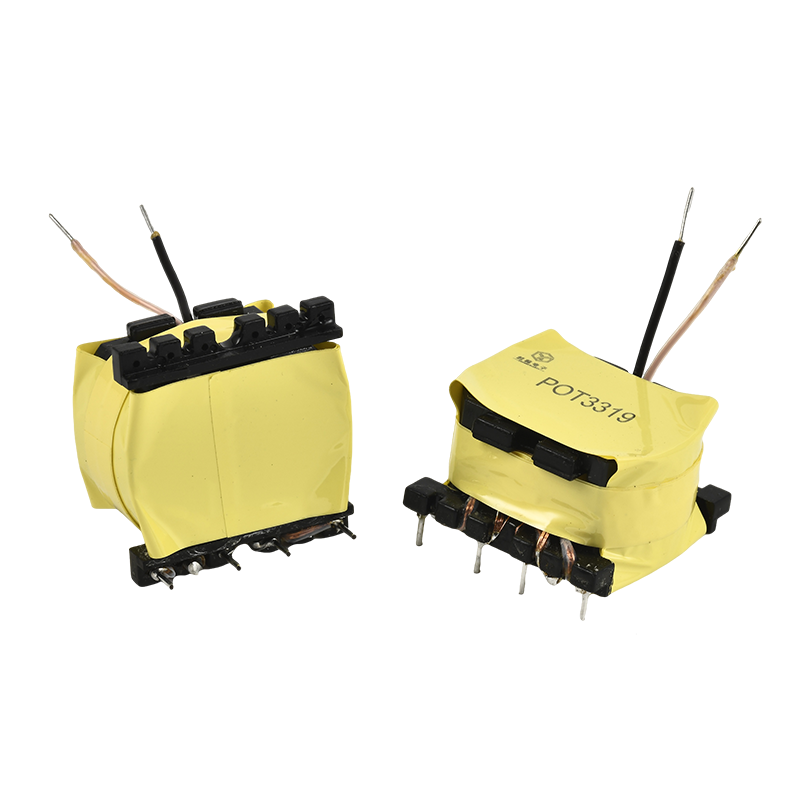

Transformers are a key component in large-scale renewables projects. However, high lead times and rising manufacturing costs are at risk of causing expensive project delays and preventing power plants from being brought online

Kevin is a supply chain professional and electrical engineer with extensive experience in the energy sector.

Sagar focuses on PV system pricing for US and LATAM regions.

Global Head, Onshore Wind Energy Research

Global Head, Onshore Wind Energy Research

Ben is focused on supply chain research within the utility and renewables space.

Our recent report, ‘Supply shortage and high lead times: market dynamics and supply chain update’ , explores transformer market dynamics and the factors driving supply shortages. Drawing on proprietary data, insights from research analysts, and deep industry links, we look to understand the transformer sector in greater detail, revealing the reasons behind the increase in lead times, and the rise in component costs.

Fill out the form on the top right to download an extract from the full report, or read on for an introduction to the challenges and opportunities across the sector.

Transformer lead times have been increasing for the last 2 years - from around 50 weeks in 2021, to 120 weeks on average in 2024.

Large transformers, both substation power, and generator step-up (GSU) transformers, have lead times ranging from 80 to 210 weeks, and some manufacturers have already announced plans to expand capacity to meet growing demand.

As the global installed base of power transformers continues to age, active replacements are underway at most utilities. In the US, a multi-decade replacement programme is underway as installed transformers surpass their 35 to 40-year design life.

In addition to the supply chain imbalance brought about by the pandemic, transformer lead times have also increased because components require custom specifications that can only be provided by specialist manufacturers.

Given that it can take decades for transformer manufacturers to break even, many are reluctant to make the investments required to expand production. The same manufacturers that acquired the technology and financial capital in the 1980s, are enjoying full production slots and higher margins because of increased global demand. In turn, this limits their motivation to expand and risk financial instability.

Likewise, major original equipment manufacturers (OEMs) continue to cite material, equipment, and skilled labor constraints as driving factors for supply constraints and consequent increased lead times.

In the US, only around 20% of transformer demand can be met by domestic supply. Despite President Biden signing executive orders In June 2022 to help domestic manufacturers increase their production, funding has yet to be specified in any subsequent bills.

Transformer prices have risen 60% to 80% on average since January 2020. Commodity prices for raw materials such as Grain Oriented Electrical Steel (GOES) have doubled since January 2020, while copper prices have increased approximately 50% over the same time frame.

During the pandemic, manufacturers expected a drop in demand for transformers, and production for these commodities slowed down. As a result, manufacturers are now struggling to ramp up production levels to meet global demand.

GOES prices have surged by almost 100% since January 2020, driven by a significant market deficit and key manufacturers curtailing production. Prices have eased slightly since peaking in Q4 2023, but the market is expected to remain volatile moving forward amid capacity constraints and growing demand. This has resulted in GSU transformers seeing a 4% to 15% increase in exposure to GOES over the same period.

Despite the raw material costs easing over the past 12 months, transformer costs have continued to increase as suppliers elevate margins to maintain higher costs due to the strong demand and long lead times.

As utility companies and project developers face transformer shortages, manufacturing players like Virginia Transformer Corporation and WEG have opened new manufacturing plants to increase their production capacity. Likewise, Sunbelt Solomon has made an investment to establish facilities that support the repair and recycling of transformers.

However, based on conversations with developers and suppliers, we predict that as much as 25% of global renewable projects could be at risk of project delays due to high transformer lead times.

The global demand for standalone photovoltaic (PV), wind and grid scale storage are all expected to grow, which will continue to put pressure on lead times. Unless adequate project planning is put in place to account for supply shortages, many projects could end up being delayed.

To learn more a bout the challenges and opportunities in the power transformer market, fill out the form at the top right of the page to download your complimentary extract from the report.

Our detailed coverage of the transformer market can help guide your investment decisions and corporate strategy, while helping you identify the primary drivers that are influencing trade and price dynamics.

RM Series You can also find out more about our Supply Chain Intelligence offering here .