The global hydraulic fittings market is forecast to grow 5.4% through 2029 according to market research firm Valuates Reports. Its “Global Hydraulic Fittings Market Research Report 2023” expects the market to reach a value of U.S. $2110.1 million by 2029.

In 2022, the hydraulic fittings market achieved a value of U.S. $1,453.9 million. Reinforced Tubing

Growth for hydraulic fittings between the forecast years of 2023 to 2029 will be driven by strong demand for hydraulic systems in a range of applications, including automotive, construction machinery and manufacturing.

Valuates Reports says China accounts for 30% of market share while America is 27%. Growth in both markets is anticipated as investments in manufacturing facilities and infrastructure continue to rise and drive the need for hydraulic systems and thus the fittings they utilize.

Hydraulic fittings are a vital part of hydraulic systems, enabling a sealed connection between various components. As fittings can typically be removed, they make it easier to service systems when necessary.

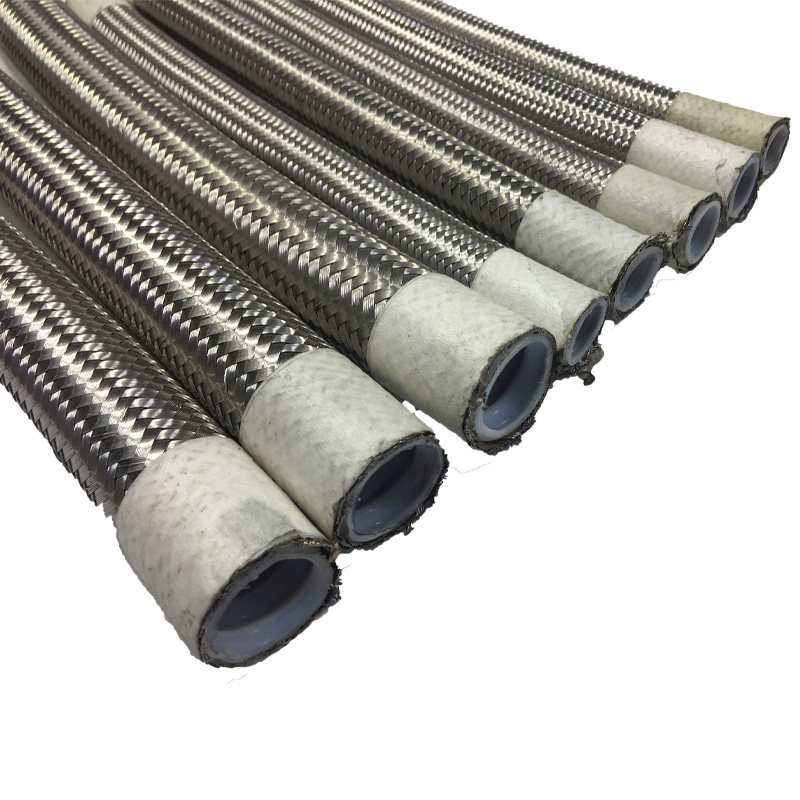

Fittings are available in a range of materials and types to best suit the needs of various applications. The Valuates Reports research looks at the projected market performance for steel, brass, aluminum and plastic hydraulic fittings as well as their varied applications, including those which extend or terminate pipe lengths, add or change direction as well as fittings designed to connect pipes of smaller sizes and those providing special connections or functions.

READ MORE: Hydraulic Fittings and Flanges

The power density and dependability of hydraulics remains unmatched in many applications, especially heavier duty ones, necessitating their continued use in industries such as construction, agriculture, aerospace, automotive and manufacturing.

Projected growth in the coming years for these industries will lead to strong demand for hydraulic systems and their various components such as hydraulic fittings.

A range of market factors are anticipated to help drive growth for hydraulic systems, and therefore their various components such as hydraulic fittings, over the next several years.

According to Valuation Reports, creation of new, more environmentally friendly fitting designs will be among these which will be driven by developments in new technologies and materials, regulations promoting improved energy efficiency and efforts to make hydraulic systems and the applications into which they are integrated more sustainable.

Brad Rico, Vice President of Sales & Marketing at Brennan Industries, said diversification will be a strength for the company in the coming years, including its ability to supply alternative fitting solutions in brass, composite materials, malleable iron, steel, stainless steel, and exotic materials.

“Our ability to provide multiple solutions to the aerospace, automotive, marine, mining, power generation, pharmaceutical, agriculture, food and beverage industries will also aid our success,” he said. Serving customers in multiple countries around the world will benefit the company as well, with Europe, Canada and Mexico representing tremendous growth opportunities according to Rico.

In the aerospace and defense industries in particular, Valuation Reports states advanced fitting designs will be required for years to come due to the safety and rugged environments associated with these sectors. Fittings and other hydraulic components must be dependable and long-lasting, necessitating continued development of improved designs which will benefit growth in the hydraulic fittings market.

READ MORE: The Vital Role of Hydraulic Systems in Aircraft

The research firm says worldwide efforts to industrialize and automate various processes are driving growth for the hydraulics, and thus the hydraulic fittings, market. For instance, many parts of the world are increasing their use of mechanized agricultural equipment – one of the top customer markets for hydraulics – to help make planting and harvesting of crops more productive and efficient. Even as these machines and their various systems become more automated to further increase productivity and overcome labor challenges, hydraulics will remain necessary as they drive many of the work functions of agricultural and other heavy equipment.

The Freedonia Group is projecting global demand for agricultural equipment to increase 6.5% each year through 2026 due in part to farmers replacing older machinery and regions such as China investing in further mechanization. Recent data from the Association of Equipment Manufacturers (AEM) shows larger tractor sales remain positive in the U.S. as farmers continue investing in new equipment and technology to help them reduce their production costs while increasing crop yields.

“The appeal of the newer equipment centers on improved fuel efficiency, better GPS technology, and improved automation features, which is why farmers are continuing to make these investments,” said Curt Blades, senior vice president, industry sectors and product leadership at AEM, in the association’s press release announcing its August 2023 farm tractor data.

Investments in infrastructure projects around the world are benefiting the hydraulic fittings market as well. Use of construction equipment and other heavy machinery which rely heavily on hydraulic systems are building the roads, bridges and other structures for which funds are being provided – through government policies such as the Infrastructure Bill in the U.S. As such, demand for this equipment and the components within them is expected to remain positive as these investments continue over the next several years to improve older infrastructure as well as add it in regions where it may not have existed previously.

Related to this are the investments being made in new manufacturing facilities as part of near- and re-shoring efforts. Hydraulics play an important role not only in the equipment building these facilities but also in the manufacturing operations themselves as they are utilized in various production machinery as well.

READ MORE: How the CHIPS and Science Act Will Benefit Fluid Power and Motion Control Manufacturers

Valuates Reports also points to the automotive industry being an important growth driver for the hydraulic fittings market. Hydraulics continue to play a role in the steering and braking systems of many on-road vehicles, and this industry has picked up steam again as consumer interest has renewed after many postponed purchases when the global pandemic hit in 2020. In addition, the semiconductor chip shortages which previously plagued it has begun to subside, better enabling car manufacturers to meet demand.

Another area of growth Valuates Reports sees is renewable energy. The research firm notes hydraulic systems are important components within wind turbines and solar tracking systems. With global efforts increasing to utilize these and other alternative power systems to reduce carbon emissions, long-term growth is anticipated for hydraulic systems, and thus fittings, used in this sector.

Brennan’s Rico said electrification and continued replacement of fossil fuels presents a threat to the marketplace. However, the ability to develop alternative solutions and serve multiple markets and industries will provide opportunities for growth in the coming years.

Valuates Reports sees renewable energy as an area of growth for the hydraulic fittings market. The research firm notes hydraulic systems are important components within wind turbines and solar tracking systems. With global efforts increasing to utilize these and other alternative power systems to reduce carbon emissions, long-term growth is anticipated for hydraulic systems, and thus fittings, used in this sector.

Joe Carr, Product Manager – Specialty Fittings at Brennan Industries, said many customers see DIN fittings as a good option for applications in emerging markets such as hydrogen and wind. In general, the company is seeing increased demand in the U.S. for fittings with international thread types such as BSP, JIS and metric because more international machinery is manufactured and maintained in the region.

When it comes to metric types, Carr said DIN 2353 compression fittings are of particular interest to customers for hardline applications, and are especially popular for railcar production, steel mills and marine repair operations.

Mark Mazzone, Director of Business Development at Brennan Industries, said one of the strongest opportunities for growth is in instrumentation fittings. “As the natural gas market evolves, the need for tube fittings and instrumentation fittings to move the fuel or gas will increase,” he said. “Hydrogen fuel cells, liquefied natural gas (LNG), and other related markets will continue to grow as the world transitions to renewable energy.”

The need to maintain hydraulic systems will benefit the hydraulic fittings market as well. Many of the machines and vehicles in which hydraulic fittings are used are in service for years, sometimes a decade or more, which requires their hydraulic systems and components to perform as desired during that time.

Properly maintaining the equipment and systems helps to ensure longevity. But occasionally it will be necessary to replace components such as fittings, offering manufacturers of these parts growth opportunities in the aftermarket.

READ MORE: How to Safely Maintain Hydraulic Systems

Today many machine and vehicle OEMs are working to extend the lifespan of their products to help customers reduce costs and improve sustainability – the longer products are in the market, the less material that winds up in landfills as well as inputs and energy used to manufacture them. Being able to easily replace some parts, like hydraulic fittings, will aid these efforts and provide long-term growth potential for the hydraulics sector.

In general, the global hydraulic fittings market will be an area of growth as demand for hydraulic systems and the applications in which they are utilized experience positive conditions over the next several years.

Sara Jensen is executive editor of Power & Motion, directing expanded coverage into the modern fluid power space, as well as mechatronic and smart technologies. She has over 15 years of publishing experience. Prior to Power & Motion she spent 11 years with a trade publication for engineers of heavy-duty equipment, the last 3 of which were as the editor and brand lead. Over the course of her time in the B2B industry, Sara has gained an extensive knowledge of various heavy-duty equipment industries — including construction, agriculture, mining and on-road trucks —along with the systems and market trends which impact them such as fluid power and electronic motion control technologies.

You can follow Sara and Power & Motion via the following social media handles:

X (formerly Twitter): @TechnlgyEditor and @PowerMotionTech

Transparent Pvc Pipe LinkedIn: @SaraJensen and @Power&Motion