Database of selected U.S. and international exploration wells

Information on assets, buyers and sellers, deal values, and more. Chemical Bucket Elevator

A searchable database of oil and gas debt and equity offerings.

A list of A&D professionals anywhere.

Prices for top E&P stocks and commodities.

Rextag database of energy infrastructure assets

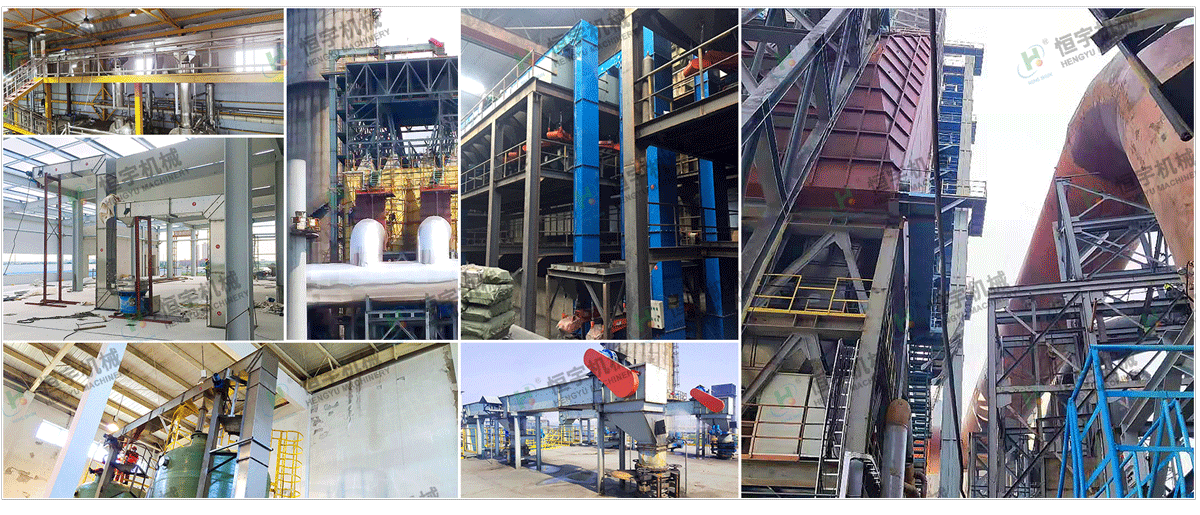

Solaris’ new electrical blender has higher up time than its traditional counterparts, while a mobile bucket elevator speeds up the sand delivery process

Solaris’ new electrical blender has higher up time than its traditional counterparts, while a mobile bucket elevator speeds up the sand delivery process (Source: Solaris)

Cutting the time to complete wells has driven innovation throughout the process, and Solaris Oilfield Infrastructure has turned its inventive engineering focus toward moving, storing and blending sand.

“What we’re trying to do is help our customers be more efficient,” said Scott Lambert, vice president of engineering at Solaris.

But a host of factors can contribute to nonproductive time (NPT), including blender repair and inefficiencies in transferring sand from trucks into storage silos.

Solaris wanted to find more ways to reduce NPT from equipment and a lack of sand, Lambert said.

So, Solaris developed the “AutoBlend,” which is an integrated electric blender with a solid uptime record and the “Top Fill” bucket elevator for transferring sand into each company’s vertical silos.

“There’s been a push in the industry for electric blenders.” —Scott Lambert, Solaris

“There’s been a push in the industry for electric blenders,” Lambert said.

That is because conventional blenders powered by diesel engines are prone to issues that cause NPT, he said. Problems include engine, motor and hydraulic failures.

Lambert said the AutoBlend’s electrical design means the mechanical parts are simpler because drive lines, gear boxes and other components are not required.

“It really simplifies things on the blender itself,” he said.

The blender can be powered by a diesel generator, natural gas or field gas.

The AutoBlend design places an electronics room outside the blender that houses the controls, the high-power switchgear and drives for the motor.

“We stripped down the blender to what a blender does. Blend water and sand,” Lambert said.

And because the AutoBlend was designed to operate in conjunction with Solaris’ vertical sand silos, the blender does not require sand screws or a hopper. The blender has three tubs, which is supported by the company’s six-pack silo design.

“You don’t have to keep the hopper full. Our 2.5 million-pound storage system, that is our hopper,” Lambert said.

And without the presence of sand screws, there is no worry about bearings going bad, he said.

In fact, sand screws are one of the leading causes of NPT for blenders, he said.

And because of how common blender problems are, it is not uncommon for operators to have multiple blenders on standby while one blender is pumping.

These blenders are working harder than ever, he said, because the total volumes previously pumped in a year may now be pumped in just a month with wells drilled horizontally rather than vertically, he said.

“It’s much harder on frac equipment now than it was in the ’90s or even the early 2000s,” Lambert said.

AutoBlend has been available now for about 18 months, and down time related to the AutoBlend has been in single-digit hours per month, Lambert said.

“We’ve faced some headwinds in adoption, much like we did when the sand storage happened,” he said.

The pushback comes from the fact that pressure pumping customers already own blenders. And, if a customer has three to four blenders supporting every frac fleet, “a lot of capital is invested in those blenders,” Lambert said.

He said Solaris understands the pushback, but also sees the value of the AutoBlend. It is available on a lease basis.

“For every four blenders working, we want one spare in the field but that’s on us. The customer is not having to pay for that,” he said.

The six-pack silo system can now be filled using Solaris’ Top Fill mobile bucket elevator, and the method saves time and money, Lambert said.

The challenge is how to get sand from bottom-drop trailers up to the top of a 50-foot silo without using long conveyor belts.

“If the silo is 50 feet tall, you’ve got a 100-foot-long conveyor belt feeding it from the ground. It takes up a lot of space,” Lambert said.

Bottom-drop trailers can offload 55,000-pound payloads using the Top Fill elevator in just over four minutes.

“If you have the trucks lined up, we can deliver sand into the sand silo faster than the sand is being delivered to the blender,” Lambert said. “It’s a real space-saving piece of equipment. It’s really compact.”

Solaris’ first Top Fill unit came out in January 2022. More than 20 have been manufactured, working in South Texas, the Permian Basin, Wyoming and the Rockies, and Solaris has more Top Fill units planned in its 2023 build program.

Development of the Top Fill started when Solaris considered the possibility of top-loading wet sand as the last mile of sand delivery became increasingly critical.

Top Fill is moving normal dry frac sand every day, “but we’re performing tests with wet sand now,” Lambert said.

Get the latest updates every Tuesday on exploration, drilling, production and offshore.

Jennifer Pallanich is Hart Energy's senior editor for technology. She has reported on the technology that fuels oil patch exploration, development and production for more than two decades.

2024-04-11 - Continental Resources is adding leases in Midland and Ector counties, Texas, as the private E&P hunts for drilling locations to explore. Continental is also testing deeper Barnett and Woodford intervals across its Permian footprint, CEO Doug Lawler said in an exclusive interview.

2024-02-22 - SM Energy joined Birch Operations, EOG Resources and Callon Petroleum in applying the newest D&C intel to areas north of Midland and Martin counties.

2024-03-12 - U.S. crude oil production will rise by 260,000 bbl/d to 13.19 MMbbl/d this year, the EIA said in its Short-Term Energy Outlook.

2024-04-29 - Marathon Oil, Occidental, Continental Resources and others are reaching under the Permian’s popular benches for new drilling locations. Analysts think there are areas of the basin where the Permian’s deeper zones can compete for capital.

2024-04-15 - Exxon Mobil, which took a final investment decision on its Whiptail development on April 12, now estimates its six offshore Guyana projects will average gross production of 1.3 MMbbl/d by 2027.

Energy news, analysis, interviews, and exclusive coverage you need to keep your industry edge.

Already a subscriber? Sign in

Join Hart Energy and gather insights into three of America’s most prolific shale plays this coming May. Attendees will listen and participate in…

The New Energies Summit will take place August 27-28, 2024.

The Next Generation of oil and gas professionals are forging relationships and moving the industry forward. Presented by our sponsor, Preng &…

With oil and gas back in favor as higher commodity prices equate to stronger returns among oil and gas producers and the exponential growth seen…

Subscribe for free to our newsletters for the latest energy news

Rubber Granular Bucket Elevator © 2024 Hart Energy. All rights reserved. Reproduction in whole or in part, in any form or medium without express written permission is prohibited.