Leading industry experts look at the key challenges and talking points likely to dominate the label and package printing industry in 2024.

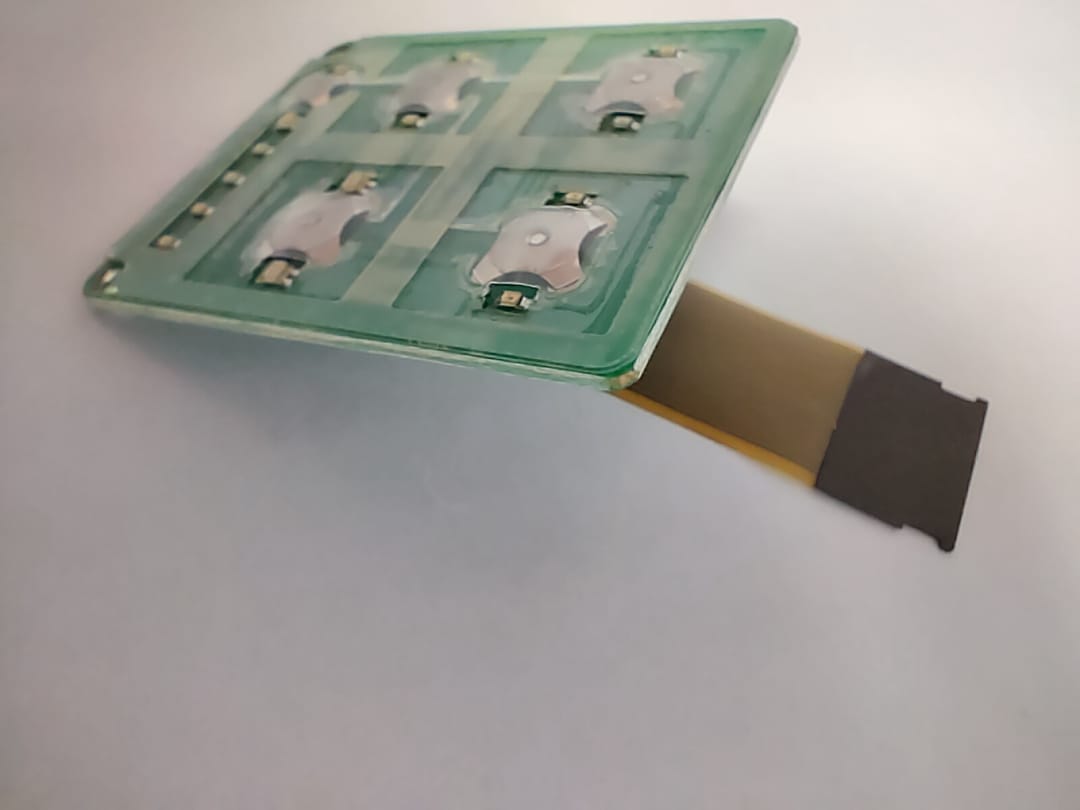

Actega | Actega Metal Print | Afford Industrial | | Aldus Graphics | All4Labels Global Packaging Group | AM Labels Limited | Avery Dennison | Blumer Maschinenbau | Bobst | Cartes | Continental Printing Technology | Comexi | Coveris | Cosmo First Limited | DG Press | Dilli | Domino Printing Sciences | Eco Flexibles | Esko | FAG Graphic Systems | Fedrigoni Self Adhesives | Flexcon | Flint Group | Focus Label Machinery | GEW | The Grey Elephant | GSE | Herma | Hamamatsu Photonics | Henkel Adhesive Technologies | HiFlow Solutions | Hoya Corporation Optics Section | HP | Hybrid Software Group | Infigo | Kocher+Beck | Konica Minolta | Konica Minolta Business Solutions India | Konica Minolta Business Solutions (UK) | Label Traxx | Lemorau | LaserClean | Loftware | Lombardi Converting Machinery | Lundberg Tech | Mark Andy | Martin Automatic | Meech International | Monotech Systems | MPS Systems | Nekkorb | Nilpeter | Omet | OneVision Software | RK Print Coat Instruments | Re | Rotocontrol EMT | Rotometal | Sandon Global | Schoberttechnologies | Screen Europe | Sen Labels Machinery | Sistrade | SMI Coated Products | SQ Label Labeling Software | Steinbeis Papier | Sun Chemical | Tecnocut | Teknek | Troika Systems | Valloy | Voyantic | Wausau Coated Products | Weldon Celloplast | Xaar Membrane Keyboard Switch

With our business remaining firmly focused on innovation that supports improved sustainability in the print and packaging industries, we have continued to achieve many important milestones this year. In fact, the start of the new year marks just 12 months to go as we progress our goal of becoming a carbon-neutral business by 2025 and therefore, we are certain the year ahead will demonstrate further progress towards this objective.

Of course, Actega is also known for its product innovations and as such, 2023 saw new inks, lacquers, coatings, and technology added to our portfolio. With the investments in our production and R&D capabilities this year, we are sure that 2024 will bring even more exciting new products that enable our customers to meet industry regulations, improve the sustainability of their products, as well as offer brands high-quality, stand-out print and packaging.

The latest advances confirmed at Labelexpo gave the market some important updates about the technology, but I think the most crucial messages shared during the show came from our customers. Representatives from these innovative companies provided insight into how Ecoleaf was already benefiting their businesses and generating much excitement among their own customers.

Looking ahead to 2024, we expect adoption of this ground-breaking technology to accelerate. With the higher speeds achievable, even more companies and brands are keen to harness the opportunity to differentiate their products with high quality, more sustainable metallization processes.

All4Labels Global Packaging Group

Paola Iannone, vice president of marketing and communications

If we had to identify three key packaging features for 2024, they would be sustainability, connectivity and personalization with digital printing.

The new year will see many new sustainable labels and packaging solutions, exploiting the latest technologies. Trends will include reused, recycled and recyclable materials, with improved access to recycling streams and also operations focused on renewable energy, for lower CO2 emissions and less production waste.

Meeting end-users’ sustainability needs also demands constant re-thinking under a more inclusive spotlight, opening the path to new levels of diversity and social responsibility, with packaging fully aligned with customers’ values.

Connectivity using QR or RFID tags adds features and functionalities that enhance product compliance. It also provides access to online information and manuals. Brands can leverage interaction opportunities, even with voice messages and augmented reality experiences, for increased consumer engagement and brand loyalty. Intelligent solutions also provide brand protection, confirming authenticity, supporting tracking, and protecting against counterfeiting.

Personalization via artificial intelligence and digital tools will open up new horizons. Variable data management and effective use of AI will enable unique tailor-made solutions, with optimized packaging using appropriate sizes, layouts, and forms - cutting material use, transport needs, and even costs.

As consumer demand for sustainable products continues to grow, businesses are increasingly looking for solutions that meet requirements for packaging that does not harm the environment. To meet this demand, at AM Labels, we have added two new materials to our portfolio; sugar cane paper labels and grass paper labels. The sugar cane paper labels are composed of 95 percent sugar cane fibers, offering an environmentally-friendly alternative to traditional wood-pulp papers. Alternatively, the grass paper labels are composed of 30 percent sun-dried grass fiber (hay) and 70 percent sustainably sourced pulp. The labels are suitable for use across a variety of industries and offer good print quality.

Furthermore, to support businesses in making their operations more sustainable, we offer a range of printers that will print labels without the backing paper. The liner, or backing paper, is a material that is difficult to recycle and therefore often ends up in landfill. Linerless label printers, such as the Epson TM-L100 and the Toshiba BV420D-GL do not require a label liner. Consequently, zero backing paper is sent to landfill, helping businesses to improve their carbon footprint and environmental credibility. Linerless label printing is ideal for businesses of all sizes and where labels are printed at the point they are applied.

Ken Sky, general manager of Tronics Australia and NZ

In the dynamic landscape of manufacturing, the adage that millionaires are made in recessions holds true for those who invest wisely. This proposition is illustrated by the recent surge in manufacturing plants upgrading their technology amidst economic uncertainty. Over the past year, these forward-thinking plants have transformed their operational systems, making them smarter, faster, and more profitable.

The cornerstone of this revolution lies in Industry 4.0, underpinned by interconnected devices, artificial intelligence, big data analytics, and advanced robotics. These four pillars synergize to usher in a new era of efficiency, quality control, data robustness, waste reduction, and overall operational excellence.

Tronics, a respected player in the global manufacturing market since the 1980s, stands out as a prime example. Specializing in standard and custom-designed label applicators and coding machine solutions, Tronics has not only weathered the test of time but has also evolved to meet the demands of the modern era. In 2023, they embraced Industry 4.0 by incorporating each of its four pillars, enabling small and medium-sized manufacturing factories to harness the power of AI, automation, IoT, and advanced robotics through Tronics' comprehensive one-stop-shop offering.

Tronics has partnered with AutoCoding Systems, empowering Australian and New Zealand facilities with end-to-end visibility on their production lines. AutoCoding's device-agnostic solution integrates seamlessly with packaging line devices, allowing communication with any supplier and interfacing with critical systems such as ERP, MES, and WMS. Already deployed on over seven hundred and fifty lines, this partnership enables Tronics to provide customers with complete automatic setup and control of their packaging lines.

In a strategic move in 2023, Tronics announced its distributorship with Morrison Container Handling Solutions. This partnership not only expands Tronics' capabilities but also brings a team adept at assessing production line efficiency. Armed with the latest technologies, Tronics' team can digitally capture, assess, and redesign production lines for optimal efficiency, minimizing downtime and capital expenditure. Tronics' IB team implemented the DG Vending Solution, utilizing machine learning for labelling ink fluid customers. With weight sensors beneath each fluid cartridge, the system provides real-time data on consumption and stock levels, automating replenishment and reducing the risk of ink write-offs. This innovative solution is a testament to Tronics' commitment to proactive, low-admin solutions for its customers. Recognizing the growing importance of sustainability, Tronics partnered with Close the Loop in 2023. This collaboration offers customers a zero-waste solution for recycling ink bladders and cartridges. By embracing sustainability, Tronics is not only reducing its environmental impact but also providing customers with a hassle-free, environmentally friendly program that aligns with evolving consumer values.

As the manufacturing sector embraces the fourth industrial revolution, Tronics’ adoption of these cutting-edge solutions is transforming the landscape for their customers, and their competition. Offering comprehensive solutions that not only enhance operational efficiency but also contribute to a sustainable and ethical approach is where we will see the leaders at the forefront of the industry continue to dominate in 2024.

2023 for Afford Industrial continued a theme in respect of demand and expectation from our narrow web label business sector, which we serve with narrow web UV flexo and digital ink products.

The theme and the ongoing trend have been and are continued augmentation of traditional analog print techniques with digital combined with a drive towards sustainability to support the EU aim for packaging to be fully recyclable by 2030. The focus in the packaging market has been and continues to be a reduction in the use of virgin plastic in production and a reduction in packaging waste.

Workforce shortages, changes in run length and a move towards JIT print have accelerated automation and digitization of print in both traditional flexography and in digital print.

From an ink formulation perspective, our focus has been away from solvent-borne inks and coatings towards energy-curable solutions and specifically UV and LED UV, with LED UV bringing energy savings at the point of print.

Despite the ongoing macroeconomic headwind challenges, declining prices, and supply chain corrections across the globe, the labeling industry still has tremendous market potential. Long-term growth possibilities are anticipated as market penetration of supermarkets and convenience stores will ensure sustained demand and possible increased revenue potential.

Making sustainability a priority to reduce carbon footprint for minimal environmental impact, along with the continued adoption of digital technologies, automation, customization, the growth in ecommerce/business and an increase in overall packaging will continue to be critical turning points for the labeling industry.

Jeroen Diderich, senior vice president and general manager for materials group, North America

As we enter 2024, the economic landscape remains dynamic, showing signs of recovery in the back half of the year. While technology and innovation offer avenues for growth, challenges such as inflation, geopolitical tensions, and shifting labor market dynamics demand careful navigation. We remain optimistic for a stronger 2024 and are using the coming year to focus on three main priorities- improving the customer experience, advancing sustainability practices and helping implement RFID technology.

We expect 2024 to witness a continued shift towards sustainability as businesses increasingly prioritize environmental, social, and governance (ESG) practices. In the US, we continue to see more regulations being introduced along with retailers and brands looking to measure and improve their carbon footprint. It will be increasingly important for the industry to utilize tools to measure carbon footprinting and work together to develop a path to net zero.

As brands look at improving inventory accuracy, RFID technology adoption will offer exciting possibilities at every step of the value chain across industries. Avery Dennison is also embracing digital tools to deliver account management and support that provide an unmatched customer experience and deploying digitization and AI to enhance our industry-leading supply chain and operations.

2023 was a challenging year for the label market. Wars, growing inflation, the consequences of the pandemic and the resulting economic challenges will continue to shape global markets, our macroeconomic environment, supply chains and material procurement in the coming year. The ongoing shortage of skilled labor also continues to concern us and our customers.

Our focus in the new year will therefore remain on automation, improving profitability for our customers and the associated further development of our machines.

We are delighted to be able to present three new developments at drupa in Düsseldorf in May 2024 that will significantly improve the quality of labels and profitability for our customers.

With the AG-4220, we have a brand-new solution for large-format paper and IML labels.

Our Atlas-1110 is now available as a double stack solution for an even higher production output. This gives us the fastest and most productive punching machine on the global market.

We have also further developed our Atlas-40 and added a module for bar banding.

Industry 4.0 with the topics of data acquisition and data exchange will keep us busy in the new year, as will offline programming, for which we have developed a standard solution.

Automatic packaging with robots will become inevitable in order to counteract the problems of labor shortages.

The future of the labelling market remains exciting.

Patrick Graber, marketing director for narrow and mid web solutions

Global forecasts predict that growth in labels and packaging will taper off to some extent in 2024. Elevated interest rates and government funding cuts, coupled with persistent political and economic turbulence, are the main drivers of this slow-down. Nevertheless, specific sectors like security and brand protection will grow, driven by emerging legislation and brand owner demands.

Skilled workforce shortages are moving companies to implement more automated equipment and workflow solutions, intensifying competitive pressure. This will severely affect smaller label printing companies, as they grapple with the resulting cost challenges and difficulty in finding and retaining experienced staff. Consequently, we expect that the strong consolidation in the sector will continue in 2024.

To maintain competitiveness, printers must optimize their production floor and use resources effectively. Strategic future-proof investments in all-in-one production lines and flexo presses with higher levels of digitalization and automation, like the Bobst Digital Master platform and Master M6 press line, are key to improving efficiencies, delivering high quality, and meeting ever shorter deadlines. Proven waste reduction initiatives within production processes and eco-friendly labels will be more important than ever to support brand owners’ sustainability goals and comply with legislation.

In-line flexo with oneECG technology for extended color gamut printing is emerging as favorite choice for short-run flexible packaging, clearly dominating over digital alternatives in terms of cost-effectiveness and productivity. Meanwhile, UV inkjet, known for its high quality and exceptional speed, will continue its upward trajectory as adoption grows and new applications are addressed. Finally, printers embracing fully connected workflows will reap the benefits of end-to-end process control, a critical trend in label and packaging production.

Virgilio Micale, global sales manager

The graphic arts market has been changing steadily over last few years, but at the same time these changes have been revealed on a wide spectrum in which following all trends is practically utopic for any company. Machines manufacturing companies, offering solutions to these trends, cannot be excluded from this reality and that is why the specialization, which some manufacturing companies have adopted for a particular sector, has become a great ally to guarantee that the machinery offered is decisive in efficiently achieving goals.

All markets have suffered various imbalances and unfortunately situations continue to arise at a global level that do not provide the feeling of stability necessary for confidence and so investments motivation. Additionally, the labor market has been affected by a substantial lack of human resources, which today represents the main problem for a company.

For Cartes, business foresight is crucial and although we know it does not guarantee success, it prepares us to face the needs of our clients. We are obliged to believe in the future and continue concentrating energies on ensuring that automation increasingly becomes an integral part of all processes, so users can immediately optimize profit margins that have weakened in recent years.

Björn Heise, head of product units flexoprinting flat products and metalback for Continental Printing Blankets

One highlight of 2024 for Continental as one of the leading suppliers of ink transfer solutions for the entire printing industry will be the drupa. Continental will show its impressive range of printing blankets, Axcyl plate mounting sleeves, the extensive range of Laserline flexo-elastomer plates and sleeves, rollers, and embossing materials as well as products for specialty applications.

In the new year the quality and efficiency are driving forces for label industry. Axcyl offers future-proof technology with a rigid structure and a compressive layer able to absorb machine vibrations. The special combination of honeycomb felt with epoxy resin ensures dimensional stability over time and minimizes the impact of the printing speed. This ensures a perfect printing result and highest productivity to label customers. The Axcyl plant in France keeps improving the top performance of plate-mounting sleeves and provides fast lead times to the customers.

One of the mega-trends carried forward into 2024 will be sustainability. Continental has identified the demand for environmental-friendly flexo plates early and offers the appropriate answer with the Laserline range. Elastomer can be imaged without the use of solvents and causes no harmful waste to the environment. Thus, elastomer will be increasingly an alternative to photopolymer.

The packaging sector is confronted with growing demands for sustainability, driven by the escalating challenges of climate change. All stakeholders in the industry, including consumers, brand owners, converters, suppliers, and governments, are under increasing pressure to embrace eco-friendly solutions and designs for packaging that is both recycled and recyclable. Moreover, there is a critical need for adopting more sustainable processes that curtail the use of solvents, reduce CO2 emissions, and minimize energy consumption. In this evolving landscape, the necessity to adjust and provide innovative, effective solutions is paramount. While these solutions are not currently obligatory, a gradual shift towards a future where they are mandatory is evident, as observed in countries such as Spain, Italy, and the United Kingdom.

Simultaneously, the packaging industry has witnessed a diminishing appeal to the workforce over the years. The integration of automation holds the potential to alleviate challenges within this sector. Automation, coupled with user-friendly interfaces and comprehensive training programs, could simplify the learning curve. Furthermore, contemplating the convergence of sustainability and automation leads to the question: What if a packaging facility could function without the use of solvents? Such a plant would not only be environmentally friendly but also provide a healthier and more appealing work environment for employees. Could this be a solution to the shortage of skilled labor? Consequently, promoting this dual trend serves another compelling reason.

To sum up, sustainability and automation emerge as pivotal trends in the packaging industry, necessitating careful consideration to meet evolving market demands. As the adage goes, it is prudent to be proactive rather than reactive. Timely innovation and improvement are imperative to avoid obsolescence in this dynamic industry.

Focusing on innovation in manufacturing is crucial, not only for creating new products and enhancing design but also for global competitiveness. Sustainability is emerging as another pivotal factor, providing a competitive advantage for those prioritizing eco-friendly practices. Anticipate tough market dynamics, with sustained pressure on the entire supply chain — from manufacturer to printer to brand.

In the Indian market, characterized by its substantial youth population food packaging sector is poised for growth. With India's robust manufacturing infrastructure, there's potential for increased exports and the production of niche, value-added products within the country.

Our focus has been on specialty products and would be driving our focus to further increase it. We have a wide range of our label product lines, which includes wrap around labels, pressure sensitive label stock materials and in-mold labels.

Our extensive product range is a result of our robust R&D team's continuous efforts. They tirelessly work to provide tailored and resilient solutions for the label industry, driving our commitment to diversity and innovation.

Jo Ormrod, paper business unit president

2023 has proven to be a challenging year for the whole industry given the ongoing impact of supply-chain issues, double-digit inflation in fresh food and the impact of the cost-of-living crisis on retail sales. 2024 however, provides more optimism and we anticipate that the supply-chain will return to normal through volume stabilization, shopper confidence and the impact of increased promotional activity. As a result of this change, we also expect to see the acceleration of sustainability demands and innovation within the labels sector.

Sustainability will continue to dominate and demands on businesses to offer more circular manufacturing solutions, particularly in light of limited UK recycling infrastructure, will continue to grow. Linear solutions will no longer suffice and demands for full lifecycle analysis for both product and packaging will become critical, this includes the requirement for more sustainable operations to drive down our environmental impact. As part of our industry leading No Waste strategy, Coveris is uniquely positioned to offer fully circular manufacturing through its pioneering recycling business, ReCover, which we have major plans to grow in 2024.

With regards to label innovation, RFID technology continues to be an exciting area for Coveris given our composite sourcetag products offering end-to-end supply-chain security. Driven by increased sustainable demands for zero stock holding, utilizing digital print as a just-in-time, rapid-response supply-chain solution also offers exciting prospects for 2024. Continued innovation in raw material development to support sustainability will also continue to be a key theme.

Adelbert Schoonman, senior engineer for innovation and development

For 2024 and beyond Dutch printing press manufacturer DG press observes several trends that will have an impact on the label, packaging, and security printing industry. Particularly aspects like process sustainability, reduction of carbon footprint, and recyclability of printed products demand changes in materials and production equipment.

In the flexible packaging market, the demand for enhanced recyclability of single use packaging requires combinations of mono-material films with newly developed functional barrier coatings, enabling the production of recyclable packaging with functional and performing barrier properties. De-inking will become more important, as completely clean recyclates have higher value and facilitate true circular recycling.

Printed products will become more complicated in the sense that they cannot be produced with only one or two printing technologies. Functional coatings, security features, and advanced esthetics ask for versatile printing platforms with the ability to produce different products on a variety of materials.

With its modularly designed DG-AUXO hybrid web-offset press series DG press offers the freedom to freely configure its press lines to the exact needs of its customers. This approach provides printers and converters with a versatile printing platform for various combinations of printing technologies, able to produce state-of-art packaging and labels of the future in one pass, through the seamless integration of flexo, rotogravure, digital, and other printing technologies.

Energy curing of inks, like EB, UV, and LED-UV, will take a larger market share, due to energy efficiency and lower carbon footprint in comparison to solvent and water-based inks. The hybrid web-offset press series of DG-press are standard equipped with energy curing systems, but printing technologies based on hot-air drying can be easily integrated.

Solvent-based and water-based ink systems are facing growing resistance in the market because of sustainability defects and carbon footprint. Nitrocellulose (NC) binder-based systems are facing being banned for single-use packaging due to poor compatibility with the recycling processes in place.

Another trend is that security features will become more important in flexible packaging and labels. Although the main reasons in the past, preventing falsification and counterfeiting, are still valid, recognition of packaging in scanning processes and recycling streams has become as important. Due to its long-time presence in and experience in the security print market, DG press can fully support these new trends.

Peter van Riel, European commercial director for digital printing

Despite supply chain disruptions, digital label print has been growing steadily over the past five years. In 2024, we expect to see further growth, though at a slower rate, as converters facing labor, sustainability, and regulatory challenges are looking for innovative solutions to increase production capacity and efficiency.

Consumer interest in accessing traceability and sustainability information via connected packaging is also growing, and over the next year we expect to see more brands adding unique QR codes to their labels as a way of gaining consumer insights and fostering brand loyalty. The capability to add variable QR codes, as provided by digital printing technology, will be key for converters.

Retrofittable hybrid digital solutions will play their part in responding to this trend. Adding digital modules to existing flexographic processes will allow converters to help brands meet traceability requirements through variable data while delivering cost and waste savings compared to investing in a new hybrid press.

On the supplier side, equipment manufacturers and consumable suppliers will shift their focus to building strong long-term partnerships with converters, supporting continuous process improvement and optimization with innovative technologies and advanced services. As inflation and interest rates remain high, agile finance packages will play a role in supporting label converters in meeting higher demand.

Donghee Choi, director of sales and marketing

In 2024, Dilli will show its digital inkjet label press Neo Picasso Plus in both Drupa 2024 and Labelexpo Americas 2024 to meet customers in global market. During 2023, Dilli has developed and upgraded Neo Picasso Plus continuously and now we want to say that it will be your strong asset to boost your business robustly especially who want to have perfect white opacity, perfect registration with long lasting durability.

Under the era of uncertainty, it is now about the need of flexible production scale and diverse printing in cost effective way. Our aim is to fulfill people’s needs in the labelling market based on trust stably and successfully.

Labeling and packaging industry is going to be eco friendly and will combine logistic technology such as RFID. It keeps going to next level and Dilli will never stop making its customers winners in this field.

For 2024, we expect to see a continued drive towards monopolymer recyclable products, particularly while circularity remains a key focus for consumers and businesses alike. Where recyclability was previously a competitive edge, it’s now essential. We are seeing this play out in real time through discussions with our customers, and a wider range of packaging applications being switched.

We see with evolving legislation, such as the UK Government’s Green Claims Code, that the challenge of greenwashing is being tackled on a major scale. Heightened consumer awareness of sustainability is highlighting recyclability as clear area of focus in packaging and label design.

The unpredictability of the global supply chain will also present further challenges, especially while geopolitical unrest dominates the headlines. We expect to see label and packaging converters respond by prioritizing agility through the supply chain, with stability at the forefront.

In terms of print technologies for 2024, we believe that this will be the biggest year yet for digital printing developments. With sustainability staying high on the packaging and labelling agenda, and with more complex short runs becoming more common, we are expecting to see more businesses exploring what today’s digital printing technologies can offer.

Jan De Roeck, director of marketing, industry relations and strategy

As we look forward to 2024, we find ourselves grappling with the aftereffects of a disrupted supply chain, evolving consumer preferences, and growing demands for sustainability.

The packaging and labels industry is constantly evolving, driven by advancements in technology, changing consumer preferences, and sustainability demands. Businesses must not only adjust to this transformed landscape but also position themselves to excel within it. It is imperative for packaging and labels experts to recognize the potential for enhancing sustainability, fully harnessing the latest technological advancements, optimizing supply chain processes, and achieving greater operational efficiency.

With continuing margin compressions and supply chain factors through to environmental sustainability targets, skills shortages and managing the ongoing energy crisis, the industry must undoubtedly transition towards more efficient, resilient, and sustainable practices to successfully navigate the likely challenges it faces throughout 2024.

By leveraging technological advancements, optimizing supply chain processes, and enhancing operational efficiency, packaging experts can position themselves to excel in the coming year and beyond.

Here at Esko, we recently worked with more than 500 packaging professionals to address the biggest challenges facing businesses in the coming year in our new 2024 Packaging Trends study, which can be downloaded now at https://brands.esko.com/2024-packaging-trends.

In order to ensure that new products in the fields of luxury, pharma, etc. are not counterfeit, the integration of security features is becoming more and more a necessity. It is the reason we developed the new FAG Fluosp Spectro which is a diffraction grating based Spectrophotometer designed to control the fluorescent, invisible inks in fluorescence anti-counterfeiting applications. The high spectral resolution and the wide range of parameters automatically obtained make the design of anti-counterfeiting elements easy and the production stable and secure.

Customers need to manage better quality, for example in the flexographic industry; new screening technologies and new flexo plates arriving on the market have obliged us to develop the new flexo Analyzer called FAG Flex4 Pro. This measuring instrument combined with the new FAG Relix4 are the perfect equipment for controlling the flexo plate production. The function of the focus levels and the function of the light scattering provide information on the cleaning quality in the intermediate depths. The new operating software simplifies the operation of the device. The FAG Relix4 can be integrated into the FAG Flex4 Pro to save space and enables quick measurement of dot sizes and relief depths.

Melissa Harton, marketing director for North America

After a period of significant volatility within the overall supply chain, we expect to see the industry begin to recover and see markets stabilize across verticals, continuing a trend we began to see in late 2023.

Efficient inventory management will be one key factor in this recovery. Fedrigoni remains committed to supporting converters and will continue to evaluate our stocked offerings to align with the converters' desire for more Just-in-Time inventory, ensuring smooth operations and reduced overheads.

Driven partly by the pandemic's impact, we continue to see a shift toward SKU consolidation with converters. We anticipate this trend to continue across the industry. Not only does SKU reduction accommodate evolving consumer needs, but it also allows converters to optimize inventory levels, reducing excess stock and operational costs. Further emphasizing Fedrigoni’s focus on stocked offerings to allow for Just-in-Time delivery.

Fedrigoni predicts a sustained focus on unique shelf differentiation, with an emphasis on high-quality, premium products to capture consumer attention and loyalty.

Sustainability will remain a top priority industry-wide. End users will require converters to find eco-friendly alternatives, including thinner gauge materials, recycled content materials, and explore various environmentally conscious options like APR, FSC, and compostable materials. Corporate Environmental, Social, and Governance (ESG) goals will play a significant role in shaping suppliers' strategies, aligning with customer and end-user expectations for greener manufacturing methods and materials that promote recycling, reusability, and minimize environmental impact. The transition from plastic to paper, whenever feasible, stands as a key sustainability goal for Fedrigoni.

Being mindful of shifts in the broader economy remains crucial. Adaptability to address the ever-changing market demands remains the key to success for our entire industry.

Dan Riendeau, strategic business unit manager for packaging, Flexcon North America

Sander de Jong, vice president of product and technology development, Flexcon Europe

Sustainability is not going away, so it will continue to be a focus. Down-gauged films are gaining popularity with printers asking for thinner versions of BOPP and PE films. These are easy transitions to make and can have an immediate impact. We have been seeing a slight lift in film demand across the packaging market for applications that were historically paper due to paper supply chain challenges. However, the misperception that paper labels are more sustainable continues when, in fact, they are detrimental to the recyclability of PET and HDPE containers because they contaminate the recycling stream.

In addition, the (possibly mandatory) use of recycled content in films and/or liners is expected to become mainstream, and the industry must focus on a stable supply stream for these solutions. The use of bio-based polymers will gain more attention for both films and adhesives, although it is too early to understand when this will scale up in our industry. Finally, life-cycle analysis will become more common because end-users want to fully understand and assess the impact of each component used in a packaging solution.

Anna Niewiadomska, marketing manager for narrow web

The foremost priorities expected within the label sector in 2024 are maintaining costs and print quality while focusing on sustainability and simplification, as witnessed across the print industry.

The escalating demand to reduce the ecological footprint of businesses and products will impact all facets of the industry. However, label converters can’t do it alone, and it has never been more vital for supplier partners to play their part. Flint Group is committed to playing a pivotal role by driving innovation in several areas to support this critical need.

First, the development of high-performance UV LED dual cure ink technology, designed to cure under both traditional UV mercury or UV LED lamp technology. UV LED curing systems deliver faster, consistent curing performance at a fraction of the energy of mercury-based UV curing systems, adding value to label printers on a number of important fronts. The development of our EkoCure line of dual cure inks delivers optimum flexibility to narrow web converters, enabling them to transition to UV LED unit by unit or press by press. Furthermore, avoiding unnecessary ink inventories and waste is undoubtedly a vital sustainability benefit for narrow web printers.

With an industry focusing increasingly on recycling, our teams have developed varnishes and primers for the shrink sleeve market to support the circular economy by enabling cleaner PCR (post-consumer recyclate). When used, ink and coating technologies do not interfere with the recycling process. Our Evolution products, aptly named because they enable packaging to be reused in ever-evolving forms, are designed to increase the yield of material reclaimed from the recycling process by allowing label material to be recycled at the same time as a PET bottle without risk of contamination.

Materials that align with the broader industry trend toward sustainability will be a prominent growth area in the upcoming year. The emphasis will be on creating thinner and lighter label substrates without compromising quality, along with an increased utilization of recycled materials to diminish dependence on virgin resources. Additionally, there will be a focus on developing materials with recyclability and compostability in mind to address environmental considerations.

An example of how we’re rising to this challenge is our ZenCode range of inks and coatings for solvent-based flexographic and rotogravure printing. Dedicated products from the ZenCode product range have received Cradle to Cradle Material Health Certification. The same applies to products approved for composting by OK Compost in Europe. In the North American market, Flint Group offers APR certified biodegradable products within the ZenCode range.

2024 will see further pressure on brands and printers as legislation continues to become more stringent worldwide. Potential legislation changes mean that partners like Flint Group must offer new ink innovations, especially for higher demand for Food Contact Material (FCM) applications. As automation and digitization become more commonplace, the need for high-quality and consistent inks will also increase.

Increased complexity of printing will also put more pressure on label converters, further driving the adoption of new ink technologies. Partners like Flint Group must consistently provide knowledgeable and responsive technical support. This support will become even more crucial as the skilled workforce shortage continues to impact operations throughout the label industry, particularly in Europe and North America. Automation and connectivity will stay atop the priority list. Flint Group addresses this with value-adding services such as FlintLink and VIVO Colour Solutions. FlintLink is our fully integrated digital customer portal. Our customers can access vital account information from one touchpoint - a bespoke centralized support and resource hub, including an integrated web shop. VIVO Colour Solutions is Flint Group’s unique digital color management platform providing an entire new level of convenience and delivering continuous improvement and waste reduction.

David Lee, technical sales director

In an uncertain world, global economic and political pressures will continue to affect business investment plans through 2024. The chancellors 2023 Autumn statement has provided some business tax incentives for UK business to encourage capital investment in 2024 despite these outside pressures.

One driver is clearly customer demand, as research continues to show that consumers increasingly prefer companies with a solid commitment to reducing their environmental footprint. As the green economy grows, we're learning that green solutions often lead to bottom-line growth. This will lead to companies of all sizes offering customized solutions to build stronger relationships with customers.

On the back of this the digital revolution is gathering pace with high end toner and inkjet solutions improving production speeds and making them a more attractive proposition. The trend is moving to more automation and hybrid solutions integrating flexo and digital converting technologies for a single pass solution. Energy will continue to focus attention on costs of running inefficient drying systems on old equipment, with LED drying reducing energy cost and increasing uptime it would seem a win-win for any business looking at new equipment or upgrading existing machinery.

Robert Rae, managing director of sales

Sales of new machinery have been hard hit in 2023, as high interest rates, consolidation, weakening economies and global conflicts have combined to negative effect. We hope and expect that interest rates will reduce next year, encouraging more machine investment in Europe and the USA, which has been weak for the past two years.

Our retrofits have been strong, especially in Europe and in UV LED, driven by the productivity improvements and energy savings that LED brings. We expect this to continue growing in 2024, despite reductions in global energy prices, because these remain well above pre-pandemic levels and the technology continues to improve with products such as GEW’s AeroLED. More and more label printers are switching their production sites fully to UV LED, accelerated by the preparedness for LED that GEW’s Rhino technology introduced in 2015… we are now seeing many companies make the most of their LED-ready investment from all those years ago.

There has been a marked increase in the prevalence of hybrid inkjet and flexo machines in the last couple of years, which seems destined to increase further as huge investments are made in improving these technology platforms.

Print shops must deploy standardized workflow automation best practices in two key areas. Pre-press departments are becoming stressful, profit-eroding bottlenecks. Pre-press staff, especially in labels and packaging print, will not be able to handle the growing number of designs and ultra-fast turnaround times. Detailed variations of existing artwork will continue to skyrocket in 2024, and throughput will become unmanageable using current methods. I see it already happening. With one hour of press downtime running as high as 500 EUR, one error could cost thousands, and over time could cripple a printing operation.

Another error-prone area that will be critical to success in 2024 is the plate room. Today, plate room staffers are overwhelmed. They are expected to know every single detail of what is in their archive of printing tools. But that number can climb to tens of thousands of flexo/offset plates, screens, gravure cylinders, and so on! The meticulous tracking, tracing, and fast, accurate retrieval of these tools, only possible through automation, will be crucial. A recent Grey Elephant whitepaper examined this looming dilemma in detail.

There is no doubt: establishing standardized workflow automation best practices will be essential for ongoing profitability in 2024 and beyond.

Maarten Hummelen, marketing director and co-founder

In 2024, ‘how to assure repeatable quality with the most efficient use of resources’ will be the deal-breaking challenge for label and package converters – not only to control costs, but in order to reduce carbon footprint. This will lead to increasing process automation of analog processes such as flexo and gravure.

Concerns around sustainability, rising raw material prices and pressure for yet shorter production runs will make waste reduction and process optimization the top priorities for label and package printers in 2024.

Converters will face increasing pressure from brands to reduce carbon footprint – and to quantify their environmental impact. This will lead to more digitalization of analogue processes like flexo and gravure. We expect to see greater interest in software and technologies that automate processes, at all stages of the workflow, so first-time-right quality can be assured with the most efficient use of resources and time.

When it comes to managing inks and processing color, converters should consider end-to-end solutions, beyond ink dispensing alone, and look at software for managing procurement, inventories, ingredient traceability, and providing ink consumption and cost date for every job.

Converters are also recognizing the need for software packages that connect easily with other areas of the print workflow, to drive automation and efficiency across the entire production process. To manage ink for example, data such as ink recipes and logistic events can be exchanged with cloud applications or ERP systems instantly. This is an effective way of speeding up processes while cutting administration and the risk of human error.

Milos Kojic, marketing manager B2B

Sustainability will continue to strongly impact our industry in 2024. Supporting label printers and users in achieving their sustainability goals is currently one of our core tasks. This mostly involves achieving goals in line with the zero waste hierarchy: In other words, taking into account the aspects of reduce, reuse, recycle and recover. We can now offer adhesive material solutions for all objectives.

We observe strong regulatory requirements worldwide. This includes the aspect of sustainability, but also product safety and traceability, for example for pharmaceuticals and food. Brand owners are very sensitive and are now seeking close contact not only with label printers, but also with the manufacturers of the self-adhesive material.

In terms of sustainability, there are certainly differences between individual countries. In Scandinavia, the requirements for wash-off solutions with labels are particularly strict. In contrast, Italy and France are European pioneers when it comes to the compostability of packaging and labels. However, the global 'gold standard' in this category is an Australian standard, which we are probably the first to fulfil with an adhesive material. Such specifications often quickly develop into unofficial standards in other markets, especially within the EU. This happens because it is not efficient for packaging manufacturers to have different solutions for different markets.

However, sustainable solutions are still subject to high-cost pressure. Yet today it is increasingly possible to reconcile both aspects without having to compromise. For example, we have developed a PE film that consists of half post-consumer recycled material but is almost the same price as a conventional standard PE film. We have also introduced the first certified wash-off adhesive, which is almost as expensive as a standard permanent adhesive. The often-cited cost argument against switching to a more sustainable solution is therefore becoming less and less valid.

Naveen Balla, technical marketing engineer, Europe

Hamamatsu Photonics provides mercury-free UV LED and excimer lamp solutions for the printing industry. Notably, market data shows that the use of UV LEDs in the printing industry has grown by over 10 percent annually during the pandemic years, and 2023 has seen a further rise in the adoption of UV LEDs by this market. Digital print is leading the way in replacing mercury arc lamps with UV LEDs, but in 2023, even the narrow-web flexographic printing market has seen a rise in the sales of UV LEDs by roughly half the mercury arc lamps, which is a big step in our view.

These trends are an indication of the printing industry's commitment to sustainability, energy efficiency, and flexibility, which is being driven by end-users. We expect this trend to continue, and we have aligned ourselves accordingly. We also anticipate a need for higher printing speeds, and our UV LED solutions are designed to meet this demand. We have focused on air-cooled UV LEDs that do not compromise on power and have designed accessories for N2 purging to ensure tack-free prints even at high speeds. Our UV curing solutions are easy to integrate, and we believe that they will provide significant benefits to our customers.

Our optimism as a manufacturer and active stakeholder in the printing market stems from the alignment of current trends with our preparedness. It's a reassuring indicator that we are moving in the right direction.

Oliver Juentgen, marketing and communications manager

The packaging industry is evolving rapidly. Shifting consumer and regulatory expectations for safety and sustainability are the key driving force for that change. Companies at every step in the value chain need to work together to develop innovations that protect products, people and the planet. And adhesives will make a big positive impact on this transformation in 2024 and beyond.

Consumers and legislators are placing a sharp focus on the potential risks of mineral-oil hydrocarbons in food contact applications linked to the recycling process of packaging. Businesses in the packaging industry can proactively address these risks and anticipate future laws. The key trend is providing innovative adhesive solutions with high bio content and mineral oil free for food contact self-adhesive labels used for broad set of applications, not only under room temperature but more often applied under semi freezer and deep freezer conditions.

The transition to a circular economy is another key trend. Packaging that is made from recycled material and compatible with recycling processes will continue to gain popularity. Special wash-off adhesives make it easier for recyclers to remove labels from bottles and achieve high-quality recycling output. Henkel’s RE grades offer adhesives for compatibility of recycling for paper labels used on cardboard.

Everyone wants to know what success could look like this year for label converters.

CEOs and other stake holders are wondering which 2024 technology enhancements and innovations will increase their future business success.

We predict that the trends in technology, connectivity and automation enhancements are poised to continue solving problems and presenting opportunities in 2024. The megatrend of Industry 4.0 continues to evolve and with it multiple ways to achieve efficiency and business growth for label converters.

In its 2024 Manufacturing Industry Outlook, Deloitte describes how a large number of manufacturers will be considering adding smart factory and Industry 4.0 tools in 2024. In fact, according to a 2023 Deloitte study, 83 percent of manufacturers believe that smart factory solutions will transform the way products are made in five years.

The one sure prediction we have is that technology will assist manufacturing with success in 2024 and moving forward. And by adopting tech-forward strategies now, label converters set themselves apart from their competitors, and this agility will translate to future business success.

As mergers and acquisitions continue into 2024, we will see more forward sighted owners and stake holders looking to upgrade to smart factory advanced technologies such as automation, AI, smart algorithms, Internet of Things (IoT), digital twins, data analytics, MES and cloud computing for their plants and business environments.

Success will mean making investments, not just in machine and equipment innovations, but also in robust MIS/ERP management systems with smart factory and Industry 4.0 features.

2024 will certainly present challenges, but it can also be a pivot point. We predict that investigating new technology and digital transformations will be forefront for many label and packaging manufacturers. As a technology driven software company, HiFlow Solutions can help you with the goals of understanding what emerging technologies will help your operations this year and beyond.

Takayuki Nagakura, project leader flexo application

The year 2024 will need the major technological innovations for the LED-UV market. Until now, the irradiation time and intensity of the LED-UV irradiator in the drying process have been set out in not clearly detail to prevent inadequate drying, but it is now necessary to take a more detailed approach and analyze the dynamics of each print job to reduce the environmental impact.

This requires a detailed observation of all outputs and settings in the irradiation system, and new software and hardware for this purpose would be important tools in the market. Therefore, the approach of selling LED-UV system that only emphasizes peak intensity or specific technologies is already outdated.

Data analysis for customers will become part of a simplified service, as printers are eager to collect information on what is happening within their own company and are looking for places where they can make savings, such as detailed control of electricity costs per print job to achieve further efficiency gains and to see differences in settings for different operators.

With electricity bills not expected to be significantly lower next year than in 2023, or even slightly higher, demand for LED-UV conversion is expected to increase further, but investment in LED-UV conversion of existing presses rather than new units is heavily influenced by the economic trends of each printing company.

Thus, it would be short-sighted to assume that increased demand for LEDs will lead to an immediate increase in orders. We expect LED-UV demand growth to be greater in the flexo sector than in offset and inkjet and will continue to focus on this sector.

Haim Levit, senior vice president and general manager for HP Industrial Print

Labels and packaging, while being a resilient and stable industry, has been navigating a period of turbulence these past few years, and while persisting global pressures continue to pose challenges from disrupted supply chains and energy supply to the dwindling availability of talent, 2024 could be the tipping point for a new era to come. The rapid growth during 2021 and the first half of 2022 turned into softness in some markets and sharp decline in others. This decline is attributed to multiple factors including inventory destocking, food and beverage consumption moving back to normal, and consumers fears from recession. Major label and packaging media suppliers reported a sharp 15-20 percent decline in sales for the first half of 2023.

Digital print of labels and packaging did not escape this softness; however, the impact was moderate. The 10-15 percent annual print volume growth rate turned into a modest single digit growth.

The uncertainties of growing geopolitical tensions have thrown the question of secure and stable supply chains once again into the spotlight. As good supply has become less trustworthy and freight costs have continually spiraled, much of production has shifted back to the US and Europe, enabling converters to take a more local approach to business, while slashing expensive and unsustainable transportation. The issue of good demand however is another concern, while today we can see evidence of recovery in some areas, the reality is the impact is still there.

After decades of growth in a stable and predictable environment, the labels and packaging industry is at a major tipping point. Market development has been, for years and decades, driven by technological developments, and we have now reached a point where the entire supply chain is at the core of future developments. Digital is moving from various niches to mainstream, changing the nature of the conversations.

At HP, we are committed to not only adding value into the printing processes, but across the entire value chain. A full digitalization journey is necessary to embrace the challenges ahead, and drupa 2024 will be a turnkey moment where automation will be a major element to watch. With partners, across inkjet and LEP printing technologies, adding intelligence to machines and processes, we will help converters to produce more effectively and sustainably.

Click here to read the full Haim Levit market overview.

In 2024, we see three converging trends driving the growth of the label industry. With brands and consumers alike concerned about climate change, sustainability considerations including faster lead times and shorter production runs will continue to drive the migration of labels and packaging to digital printing devices. Modern inkjet and electrophotographic digital presses can match the print quality of flexo, offset, and gravure printing, and solutions for digital embellishment and variable data are available for high value labels.

As run lengths become shorter, it’s logical that the total number of print jobs will increase. A recent study by Smithers predicts an increase of 15 million packaging jobs per year by 2027 in Europe and North America alone, and perhaps 50 million more jobs worldwide. Managing such a high order volume will require powerful workflow automation tools like HYBRID Software’s CLOUDFLOW for design preparation and layout, color management tools to match brand colors with digital colorants and facilitate the movement of jobs between digital and conventional presses, as well as integration with ERP and scheduling systems.

The third trend is the acceptance of software-as-a-service and cloud computing. The printing industry has been relatively slow to accept these technologies, stemming from a reluctance to entrust customer files and proprietary business data to shared computing environments. But the shortage of skilled IT employees and the ever-increasing threat of malware and ransomware from bad actors worldwide have made hosted SaaS solutions quite desirable to brands and label printers. Cloud-based solutions also support scaling and load balancing, which is vital as package printers continue to consolidate via mergers and acquisitions.

With drupa just months away after an eight-year hiatus, 2024 is sure to be a busy and productive year for software and hardware suppliers to the label industry.

Douglas Gibson, CEO and founder

2024 will see continued demand for personalization and automation in the labelling industry. Customers demand ‘the Amazon experience’. They expect a quick, smooth online user experience, with minimal to no human interaction, regardless of whether they’re ordering ten personalized stickers for a bachelor party or 10,000,000 a quarter (with seasonal and geographical variations) for their employer.

They expect to be presented with products that are most relevant to them, based on previous orders, so they can reorder with as little fuss as possible.

Paul Bromley, head of global sales

Those most likely to succeed in the B2B space would be those who could get the online sales pipeline up and running, quickly and efficiently.

A demand we have seen is to provide printer service providers with the collective tools or packs to allow quick setup of a storefront - all within the comfort of the office and without the requirement of a developer.

B2B portals that can be quickly set up, populated with products and skinned, in the end clients branding, will see the most repeat business.

2024 will be about choosing the right solution – one that drives ‘reorders’ by keeping existing customers logged in and ‘sticky’.

Nicolas Kirste, head of sales

The labeling industry is developing at a rapid pace. At Kocher+Beck, we presented our predictions for the emerging trends that will shape the landscape in 2024 at Labelexpo. One significant and ongoing trend revolves around sustainability. The demand for environmentally friendly and recyclable materials will increase, prompting label manufacturers to look for alternative solutions to minimize environmental impacts while maintaining product quality. This includes continuing to optimize tooling production from an environmental perspective.

Digitalization will also become even more important. The integration of advanced technologies such as printed electronics and RFID/NFC into labels will increase consumer engagement and provide interactive experiences. Turning labels beyond their traditional role into valuable communication tools will also increase the complexity of the die-cutting process.

Kocher+Beck also predicts an increase in individualization and personalization in the label industry. Brands and local small businesses are increasingly seeking unique and customized label designs to stand out in a crowded market, increasing the need for flexible and efficient production methods.

Overall, these forecasts point to an industry focused on innovation and customization, where sustainability, technology integration, and individualization will be the key growth drivers. Kocher+Beck's findings point to a dynamic future for the label industry and emphasize the importance of remaining agile and responsive to these evolving trends.

Sacha-Vittorio Paolucci, head of industrial print business development

In a world of uncertainty where a perceived global downturn in overall print production is part of the equation, it is heartening to see that digital labels, packaging and embellishment are shining brightly.

A need for greater automation and for innovative end-to-end ecosystems will continue to be high on the agenda and an essential driver forward for industry stakeholders such as converters, brands, and suppliers. An increased focus on complete production workflows in packaging and label sectors is also helping converters to rethink possibilities in a world of new opportunities.

With labelling and packaging requirements becoming ever more complex as data demands grow, compliance and regulatory environments tighten, the supply chain increasingly relies on labelling as a vital source of traceability.

All these factors point to a narrative that Europe’s digital label and packaging markets – and indeed those across the world – are poised for yet more substantial growth. Despite the buoyancy in digital label-making, overall growth predictions for the sector are said to have a ‘soft outlook’. This will continue at least through the first half of 2024, according to recent Finat market analysis.

One of the negative trends remarkably is a ‘continuous deceleration’ in e-commerce sales, which has been a significant driver in recent years. ‘The slowdown is here to stay, as post pandemic tailwinds fade and as high inflation and rising interest rates significantly curb demand,’ says the report.

Notwithstanding that we have made huge strides in label markets, we also acknowledge the significant challenges that will be faced in the year ahead for our customers. Our gut feeling, however, that is that issues they face such as the supply of raw materials will begin ease. This is despite a Gartner report that pointed to a survey in 2021 revealing 68 percent of supply chain leaders constantly commented on high-impact disruptions and that 79 percent of organizations with 500-plus employees want to be better prepared for risk over the next few years.

Whatever lies ahead, our commitment remains to deliver the best possible service to all our employees, clients and partners.

See the full comment on our website.

Konica Minolta Business Solutions India

While we have already integrated the technology of variable data printing, we continue to see rampant innovation in that category of printers, and as always, Konica Minolta is heavily invested in innovation. Additionally, we will continue to see a rising awareness in sustainability practices, and a growing synergy between print and augmented reality. The integration of Artificial Intelligence and automation is optimizing processes, while the exploration of 3D printing applications opens new dimensions in prototyping. Additionally, digital textile printing gains prominence for its flexibility and customization capabilities. These trends collectively define a landscape where technological advancements continue to reshape and redefine the possibilities within the digital printing segment.

Konica Minolta Business Solutions (UK)

Jon Pritchard, label, packaging and inkjet consultant

We expect to see an increasing trend toward consolidation in the labels and packaging industry in 2024, as print providers grapple with diminishing print volumes and challenging economic conditions including rising costs for material and labor, along with inflation etc.

Generally, there will be a heightened challenge for print providers to foster healthy business growth. Unfortunately, just providing high-quality CMYK jobs at a low cost with excellent service alone is no longer sufficient for sustainable business expansion. Print providers are actively seeking new avenues to boost profit margins and revenue streams. This is why the focus on embellishment is expected to grow, providing an innovative distinguishing factor for print providers, allowing them to deliver added value to printed communications and packaging. Tactile effects using varnish and foils are also gaining increased significance, especially in the drinks industry, as they prove effective in attracting buyers.

Additionally, there will likely be a growing demand for increased automation, with a continued focus on innovative end-to-end ecosystems. Workflow, software, and process automation, coupled with cloud solutions, will remain crucial factors in driving improved automation and efficiencies. The packaging and label sectors will witness a heightened emphasis on complete production workflows, enabling converters to rethink possibilities in a world of new opportunities.

In 2024, the printing market is expected to undergo a significant transformation, with a major shift towards sustainability. Laserclean, at the forefront of this evolution, anticipates that eco-conscious practices will become a core necessity for printing companies, driven by escalating environmental concerns and compliance. This trend will also influence the cleaning methods used in printing processes.

Traditional cleaning techniques, which often rely on chemical solvents and consume substantial amounts of water, are likely to be replaced by more eco-friendly alternatives. Laser cleaning solutions are set to play a pivotal role in this transition. These solutions offer a non-abrasive, chemical-free, and highly efficient method for maintaining printing equipment, significantly reducing the ecological footprint while enhancing machinery longevity and performance.

This shift towards sustainability is not just about adopting greener practices; it's also about aligning with the evolving preferences of customers and clients. Printing companies are expected to increasingly seek green certifications and eco-labels, demonstrating their commitment to sustainable operations. This is not merely a 'nice-to-have' but a vital aspect of business strategy, catering to eco-conscious clients and opening new market opportunities.

In 2024, we see the label-converting industry further accelerating the adoption of automation in all stages of the production process, from prepress to invoicing. Labor challenges and digitization have encouraged companies to invest more in automation to maintain productivity and quality. Ultimately, the goal is for a more flexible, predictable, and accurate production process.

One of our focuses in 2023 was to incorporate prepress automation into Label Traxx with Siteline, which can automatically pull a job and any customer-supplied files straight into your prepress automation software. We’ve found that this reduces up to 90 percent of the time required to process large, multi-version orders by eliminating mundane, repetitive tasks.

Enabling these seamless integrations — and trusting this process — is key to creating a system of ‘lights out production’. This mindset will guide how Label Traxx continues developing its product ecosystem in 2024.

Natália Lopes, marketing director

Reflecting on 2023 with considerable growth, we believe in 2024, the label and packaging industry will be facing ongoing political and economic turbulence, particularly the high interest rates, will create challenges for businesses and certain investments.

With that in mind, we think converters will try to invest wisely by making better use of their equipment and producing more items on each machine. Sustainability and brand protection will be more critical in the industry than ever. Regulations will increasingly impact label design, material choices, manufacturing methods, and the need for better recyclability.

Another ongoing issue is the shortage of trained workers. Indeed, there will be a strong demand for user-friendly machines with increased automation features. Converters will likely favor all-in-one solutions over multi-process options.

It's a rapidly evolving industry that requires constant adaptation and innovation. Lemorau is dedicated to supporting label producers by simplifying their processes. Creating exceptionally user-friendly equipment with increased automation features and capable of offering multiple solutions within a single machine.

Josh Roffman, executive vice president of marketing

In the tumultuous landscape of 2023, the supply chain has witnessed a surge in complexity and volatility.

Heading into 2024, corporate leaders need to have their finger on the pulse of global supply chain health, identifying where operations need to be adjusted. Loftware’s annual survey of customers and partners revealed some key areas where business leaders are focusing their attention over the coming year.

The focus on sustainability has become an undeniable force across the modern business landscape, with a surge in regulations poised to reshape the way companies operate.

As we head into 2024, we expect automation - driven by cloud technology - to play an important role in ensuring businesses are compliant with both current and upcoming climate regulations.

In recent years, consumers have demanded greater supply chain efficiency and transparency, partly driven by a desire to understand where and how a product has been sourced and manufactured. With this is mind, it’s no surprise that 79 percent of survey respondents flagged global traceability as a priority for their company – an increase from 70 percent just 12 months ago.

It’s no secret that manual processes represent barriers to growth and scale. For companies still managing siloed and disconnected legacy solutions, continuity is at risk and valuable time and savings can be lost. The focus now should be on prioritizing digital transformation and investment in innovative technologies, such as the Cloud, artificial intelligence (AI), and IoT solutions, to enhance operational efficiency and resilience.

The rise of AI is another trend that we will be monitoring closely over the next 12 months, with advancements in this area promising to deliver numerous benefits including improved accuracy, heightened agility, and accelerated production. Please see our website for the expanded version of the Loftware’s view on the upcoming trends in the market.

As we embark on a new era, the labeling industry sails into uncharted waters, driven by technological advancements led by companies such as Lombardi Converting Machinery, dynamic shifts in consumer behavior, and an increasingly tangible commitment to sustainability.

A paradigm shift towards sustainability takes center stage in 2024, with Lombardi Converting Machinery positioning itself as a pioneer in eco-conscious labeling. A transformative shift towards labels made from recycled and biodegradable materials is observed. Demonstrations during the latest Labelexpo edition showcased Lombardi's Synchroline and Invicta i1 machines printing on Ocean material provided by UPM - The Biofore Company / UPM Raflatac, designed to enhance the sustainability features of flexible packaging and support the circular economy.

Lombardi distinguishes itself by providing advanced technology to print labels and flexible packaging that not only meet the industry's highest standards but also align with the growing consumer demand for responsible packaging solutions. In a world embracing sustainability, Lombardi emerges as a pioneer in eco-conscious printing technology.

Taking center stage in 2024 is a significant push towards hybrid/digital technologies in the label industry. Lombardi's hybrid printing solution, incorporating inkjet and flexographic technologies, emerged as a benchmark during the latest edition of Labelexpo Europe. The Digistar Astra, an extremely flexible configuration, empowers our clients to create dynamic, high-quality labels within optimized production times.

Moreover, the prevalence of 'smart labels' integrating RFID and NFC technologies is on the rise, offering real-time traceability, authentication, and increased consumer engagement.

In the era of mass customization, Lombardi recognizes the increasing demand for personalized labels that tell a brand's distinctive story. Brands relying on Lombardi Converting Machinery's technological vision can anticipate a growing demand for visually appealing labels that establish a deep emotional connection with consumers. Leveraging our range of modular printing solutions (covering everything from narrow web to finishing to mid web...), brands can customize labels with unique texts, images, or QR codes, fostering a deeper and more authentic brand communication. An example? With the exclusive Toro unit, embossing, hot foiling, and hologram insertion can be achieved to enhance the label being printed.

As 2024 unfolds, Lombardi pushes its technological vision towards greater collaboration and integration. Ongoing research and development in printing processes can lead to new harmonious synergies between our technology and other cutting-edge technologies like digital printing, defect control, drying systems that are more energy-efficient, and increased automation resulting in less burden on the operator. This integrated approach promises a seamless workflow, enhancing the efficiency of the entire production process.

In an era where consumer awareness of product safety is paramount, Lombardi reaffirms its commitment to regulatory compliance. A response to stricter regulations related to food safety, product traceability, and labeling standards can be expected. Lombardi's printing machines enable the real-time provision of batch-specific information, not only ensuring regulatory compliance but also reinforcing consumer trust in the authenticity and safety of labeled products.

The labeling industry in 2024 unveils a canvas painted with innovation, sustainability, and a renewed emphasis on supply chain resilience. Lombardi Converting Machinery emerges not only as a builder of flexographic, hybrid, finishing, and flexible packaging printing machines but positions itself as an expert and prepared partner, dynamically adapting to the changing needs of consumers and the market. Join Lombardi in charting the future of the label printing industry with diligence and foresight.

Karsten Kejlhof, chief commercial officer

Cost reductions, fewer qualified employees and high labor costs have made automation essential to growth in the label and flexible packaging markets. Add demands for reductions in CO2 emissions, stricter environmental legislation and ESG sustainability reporting, and tomorrow’s challenges can seem complex. At Lundberg Tech we believe these challenges will continue to have a great focus in 2024 – and automation as well as handling of waste are going to be high on the agenda.

At Lundberg Tech our focus is to help our customers with easy solutions to the above challenges. In our opinion part of the solution is a well-designed and easy to use waste handling system, as it improves productivity, reduces downtime, cuts waste handling costs and CO2 emissions with compact, easy to transport, recycle-ready material. Our scalable modular systems offer durability and reliability, and our solutions do more than keep your production going – they ensure that you are recycle-ready when mono materials and recyclable label stock become the industry standard.

Tom Cavalco, executive vice president

As SKUs continue to rise and run lengths decline the demand for fast set-up times increases, label converters will need to be agile with their production capability, whether with traditional flexo or digital technology, but most likely with a combination of both – so what better than a hybrid?

With more than 300 hybrid installations worldwide, Mark Andy is in the unique position of having a press suitable for all sectors of the label market from the Digital Pro PLUS to the sophistication of the Digital Series HD models.

In the 13in (330mm) web width sector that typifies label converting, predictions are that the sales of digital presses will rival those of flexo presses in 2024 and beyond. This is attributable to both a change in market demand and the ongoing development of digital technology.

A consequence of this will be the move of pure flexo lines into wider web widths and more sophisticated lines that will allow the single-pass production of flexible packaging, shrink sleeves and folding cartons.

Growth areas will include the expandable Digital Pro PLUS that allows converters to extend capacity as their business grows, as well as RFID, more automation to address the declining skill levels across the industry, and computer technology like Mark Andy’s sMArt link and ProWORX.

Gavin Rittmeyer, vice president of sales and marketing