China Steel Corp (中鋼) yesterday announced that it would keep domestic steel prices unchanged for deliveries next month to comply with changes in international markets and customer needs.

The decision to stay put following four consecutive months of price hikes came as the firm took customers’ inventory write-down expenses into account, the nation’s largest steelmaker said in a statement. 2b Finish Stainless Steel

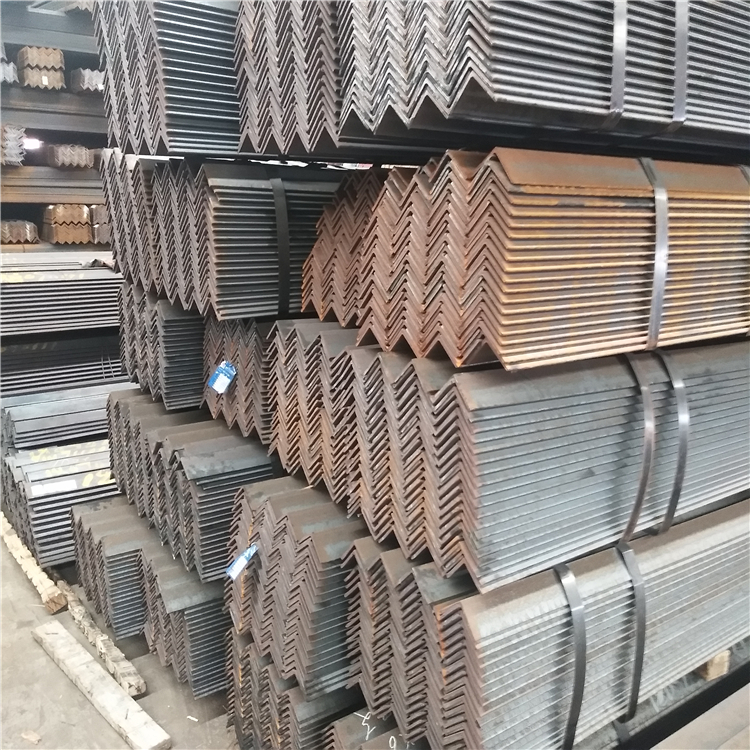

China Steel said that in the second quarter, it would only raise prices of steel plates used in vessels, and A36 and SS400 steel plates used in structural applications by NT$300 (US$9.5) per tonne, leaving the rest unchanged.

The firm reached the decision after considering several factors, including domestic downstream customers’ actual demand and order-taking schedule, and the steel market’s tepid recovery and confidence toward the economic outlook, it said.

China Steel expects steel demand to pick up after May and believes that potential US interest rate cuts starting from June would be a shot in the arm for the industry, it said.

“Cutting interest rates will promote investment, drive consumption and refresh the economy. It will be helpful for the real-estate market, and machinery equipment and vehicle sales, and it will also drive the demand for steel,” China Steel said.

The firm said the overall steel market remains stable in terms of supply-demand dynamics and is expected to show sequential improvement in the coming quarters.

On the other hand, global steel prices are expected to rise in the second quarter following consolidation in the first quarter, China Steel said.

Prices have shown signs of a turnaround, the firm said, citing announcements by US steelmakers Cleveland-Cliffs Inc and Nucor Corp on Thursday last week to raise hot-rolled steel prices by US$28 to US$44 per tonne, along with the 10th consecutive price increase next month for high-carbon hot-rolled steel coils by China’s Baowu Steel Group Ltd (寶武鋼鐵).

China Steel on Monday reported that consolidated revenue in the first two months of this year increased 5.91 percent year-on-year to NT$60.89 billion.

Shipments reached 1.93 million tonnes in the first two months, the company said, adding that it expects 2.7 million to 2.8 million tonnes of shipments in the first quarter and an even higher amount in the second quarter as the industry enters a peak season.

DISAGREEMENT: German Chancellor Olaf Scholz has spoken out against the tariffs, as it would affect his country’s auto industry, which benefits from business in China Volvo Car AB has started to shift manufacturing of Chinese-made electric vehicles (EVs) to Belgium as the EU prepares to impose tariffs on China-made EVs, the Times reported. On top of transferring production of Volvo’s EX30 and EX90 models to Belgium, the automaker might also move assembly of some Volvo models bound for the UK, the report said, citing unidentified people. Volvo, which is owned by Zhejiang Geely Holding Group Co (吉利控股集團), is seen as the most exposed among western automakers to the potential tariffs, the Times said. Trade frictions between the EU and China have led to a barrage of anti-dumping probes

European Semiconductor Manufacturing Co (ESMC), a subsidiary of contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), will hire almost 2,000, from Germany and other European countries, ESMC president Christian Koitzsch said on Monday. At the Taiwan-Europe semiconductor cooperation forum in Berlin, Koitzsch said ESMC would utilize TSMC’s advanced technologies, talent in Europe and good work ethic in Germany to build a world-class talent pool for the semiconductor industry. In August last year, TSMC announced it would team up with Robert Bosch GmbH, Infineon Technologies AG and NXP Semiconductors NV to set up ESMC, in which the Taiwanese partner would hold a

The US is opening antitrust investigations into two of the world’s most valuable companies, Microsoft Corp and Nvidia Corp, over their dominance of the rapidly emerging field of artificial intelligence (AI), people familiar with the matter said. Microsoft has poured more than US$13 billion into its partnership with OpenAI, tapping the startup’s generative AI technology for the Bing search service, Edge internet browser and Windows. Nvidia, the world’s most valuable chipmaker, has acknowledged allocating its chips to customers it deems most likely to use them quickly, prompting concerns that it has too much power over the market for cutting-edge AI semiconductors. The

Products NXP Semiconductors NV said it is seeking to diversify its manufacturing capacity geographically to further enhance chip supply resilience together with its Taiwanese foundry partners amid the uncertainty of geopolitical tensions and natural disasters. NXP made the remarks after it announced a new joint venture with Vanguard International Semiconductor Corp (VIS, 世界先進) on Wednesday. The companies plan to invest US$7.8 billion to build a 12-inch fab in Singapore, and the joint venture, VisionPower Semiconductor Manufacturing Co, would begin construction of the fab in the second half of this year at the earliest. “Chip storage is one of the key topics we need to