NX Filtration N.V.'s (AMS:NXFIL) stock price has dropped 11% in the previous week, but insiders who sold €2.4m in stock over the past year have had less luck. The average selling price of €10.92 is still lower than the current share price, or in other words, insiders would have been better off holding on to their shares.

While we would never suggest that investors should base their decisions solely on what the directors of a company have been doing, logic dictates you should pay some attention to whether insiders are buying or selling shares. Pipet Tip

View our latest analysis for NX Filtration

In the last twelve months, the biggest single sale by an insider was when the Founder, H.D.W. Roesink, sold €1.5m worth of shares at a price of €10.92 per share. While we don't usually like to see insider selling, it's more concerning if the sales take place at a lower price. It's of some comfort that this sale was conducted at a price well above the current share price, which is €2.69. So it may not tell us anything about how insiders feel about the current share price.

In the last year NX Filtration insiders didn't buy any company stock. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

I will like NX Filtration better if I see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Many investors like to check how much of a company is owned by insiders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Our data indicates that NX Filtration insiders own about €7.1m worth of shares (which is 5.3% of the company). We do note, however, it is possible insiders have an indirect interest through a private company or other corporate structure. Overall, this level of ownership isn't that impressive, but it's certainly better than nothing!

There haven't been any insider transactions in the last three months -- that doesn't mean much. We don't take much encouragement from the transactions by NX Filtration insiders. And we're not picking up on high enough insider ownership to give us any comfort. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. For instance, we've identified 3 warning signs for NX Filtration (1 makes us a bit uncomfortable) you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

Find out whether NX Filtration is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com. This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

NX Filtration N.V. develops, manufactures, and sells hollow fiber membrane modules in Netherlands, Europe, North America, Asia, and internationally.

Excellent balance sheet and fair value.

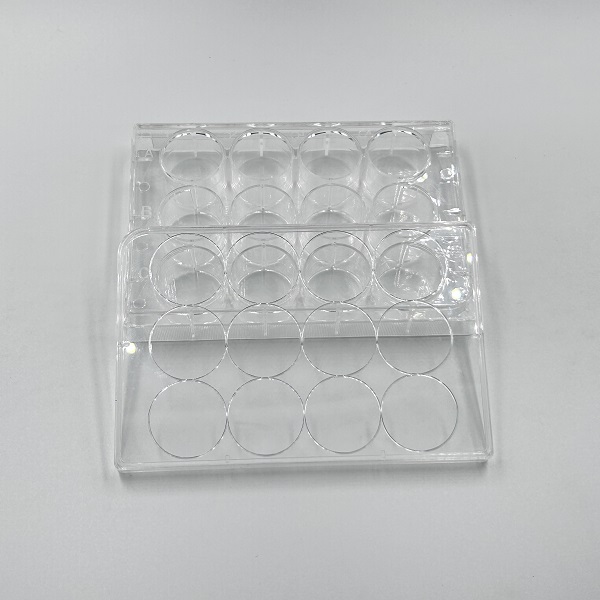

35mm Cell Culture Dish Simply Wall Street Pty Ltd (ACN 600 056 611), is a Corporate Authorised Representative (Authorised Representative Number: 467183) of Sanlam Private Wealth Pty Ltd (AFSL No. 337927). Any advice contained in this website is general advice only and has been prepared without considering your objectives, financial situation or needs. You should not rely on any advice and/or information contained in this website and before making any investment decision we recommend that you consider whether it is appropriate for your situation and seek appropriate financial, taxation and legal advice. Please read our Financial Services Guide before deciding whether to obtain financial services from us.