The imposition of a 30% anti-dumping duty (ADD) on bare printed-circuit boards (PCBs) is impacting companies benefiting from India’s production-linked incentive (PLI) scheme for IT hardware. This ADD, applied in response to complaints from six local PCB manufacturers about cheap imports from China and Hong Kong, is increasing production costs and reducing global competitiveness for domestically manufactured products.

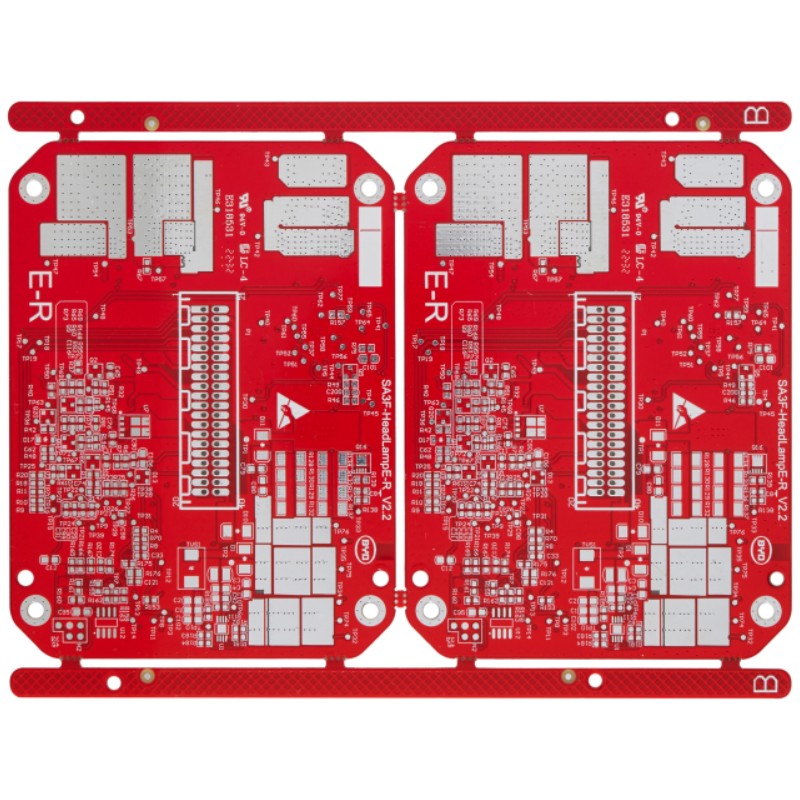

Industry executives report that the ADD raises production costs by 3-4% for lighting products, 1% for IT hardware, and 2-3% for telecom products. This cost increase is particularly burdensome for firms engaged in domestic PCB assembly, a requirement under the revised IT hardware PLI scheme, which necessitates local component sourcing and PCB assembly (PCBA) within the first year of operation. Pcb Led Light

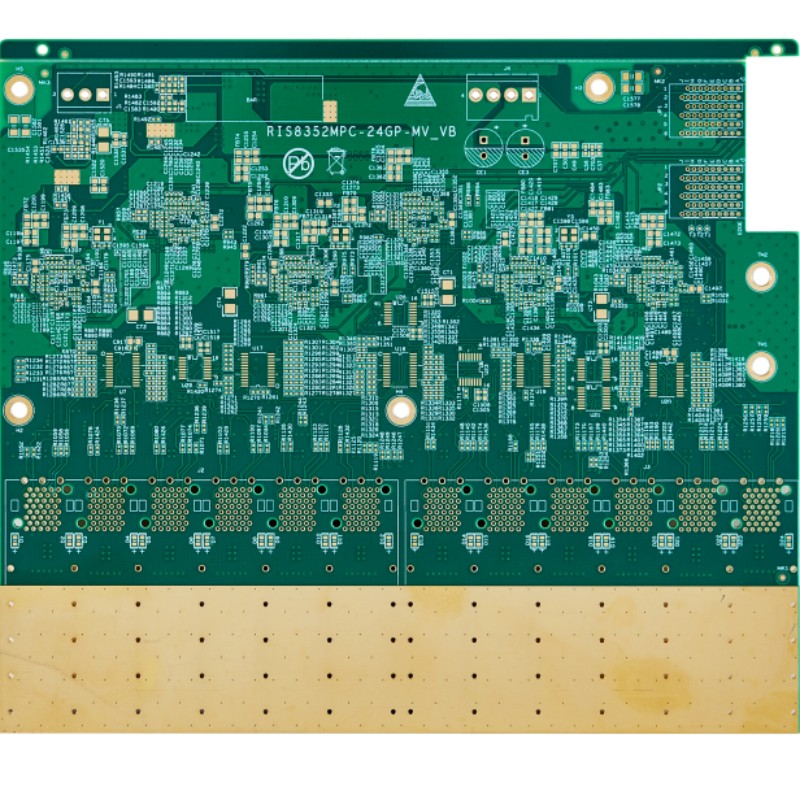

Some 27 companies, including major players like Dell, HP, Dixon Technologies, Lava, Foxconn, Lenovo, and Optiemus, have committed to manufacturing IT hardware under the PLI scheme, which has a Rs 17,000-crore outlay. Despite incentives for local PCBA, the ADD on bare PCBs poses a significant challenge.

However, the duty exempts mobile phone manufacturers, PCBs with more than six layers, flex PCBs, and other complex designs. This selective application of the ADD highlights disparities in how the policy affects different sectors within the electronics industry.

Printing Circuit Board The ADD aims to protect domestic PCB manufacturers, but it also creates hurdles for companies trying to meet the PLI scheme’s localisation requirements while maintaining global competitiveness. Balancing these objectives remains a complex challenge for policymakers and industry stakeholders.