Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

In this week’s Market Movers Americas, presented by Jennifer Pedrick: • All eyes on Freeport LNG... Acetic Acid Prices

The Chinese government has kicked off an internal consultation for the compliance emission trading...

This report is part of the S&P Global Commodity Insights' Metals Trade Review series, where we dig...

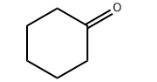

Methyl isobutyl ketone (MIBK) and methyl isobutyl carbinol (MIBC) are flammable, colorless, stable liquids that are largely consumed in solvent applications. MIBK is an excellent solvent for resins used in the production of surface coatings, as well as being widely used in rubber chemicals for the production of tires, as a solvent in the manufacture of pharmaceuticals and adhesives, and for specialized metallurgical extraction. MIBC’s major application is in the manufacture of lube oil additives, followed by its use as the principal flotation frother in treating copper and other ores. Total world MIBK consumption will grow moderately during 2021–26, driven by demand in Asia, especially mainland China and India.

The following pie chart shows world consumption of MIBK:

A majority of global MIBK is consumed in Asia, with mainland China accounting for half of regional consumption. Solvent applications (mostly in surface coatings) consumed the majority of MIBK in most regions (about 48% of total consumption in 2021). Although classified as a VOC, MIBK still benefits from increased demand in high-solids coatings, which can help in achieving a reduction of VOCs. Consumption of MIBK for coatings will continue to increase during 2021–26.

MIBK’s use in rubber antiozonants accounted for 36% of total MIBK consumption in the major consuming countries/regions in 2021. More than 60% of world MIBK consumption in the rubber antiozonants market is concentrated in mainland China, where radial tire demand has increased, driven by the steady development of mainland China’s automobile industry. Growth of 2–2.5% per year is projected for Chinese MIBK consumption in the rubber antiozonants market in 2021–26, while Indian Subcontinent consumption (only 7% of the total in 2021) will contribute rapid growth of 7–7.5% per year. Total world MIBK consumption will grow at an average rate of 2.5% per year from 2021 to 2026.

World MIBC consumption s estimated about 60,000–65,000 metric tons per year in recent years, mainly used in the Americas and Europe. World MIBC statistics are difficult to estimate but overall, MIBC will experience positive growth in lube oil applications and as a flotation frother (especially in actively mined regions).

For more detailed information, see the table of contents, shown below.

S&P Global’s Chemical Economics Handbook – Methyl Isobutyl Ketone (MIBK) and Methyl Isobutyl Carbinol (MIBC) is the comprehensive and trusted guide for anyone seeking information on this industry. This latest report details global and regional information, including

S&P Global’s Chemical Economics Handbook – Methyl Isobutyl Ketone (MIBK) and Methyl Isobutyl Carbinol (MIBC) has been compiled using primary interviews with key suppliers, organizations and leading representatives from the industry in combination with S&P Global’s unparalleled access to upstream and downstream market intelligence, expert insights into industry dynamics, trade and economics.

This report can help you:

Acetaldehyde - Chemical Economics Handbook (CEH)

Acetic Anhydride - Chemical Economics Handbook (CEH)

Acetic Acid - Chemical Economics Handbook (CEH)

Acetone - Chemical Economics Handbook (CEH)

Acetonitrile - Chemical Economics Handbook (CEH)

Acetylene - Chemical Economics Handbook (CEH)

Acrylamide - Chemical Economics Handbook (CEH)

Acrylic Acid, Acrylate Esters and Polymers - Chemical Economics Handbook (CEH)

Acrylic and Modacrylic Fibers - Chemical Economics Handbook (CEH)

Acrylic Surface Coatings - Chemical Economics Handbook (CEH)

Acrylonitrile-Butadiene-Styrene (ABS) Resins -Chemical Economics Handbook-CEHl Economics Handbook (CEH)

Acrylonitrile - Chemical Economics Handbook (CEH)

Adipic Acid - Chemical Economics Handbook (CEH)

Activated Carbon - Chemical Economics Handbook (CEH)

Air Separation Gases - Chemical Economics Handbook (CEH)

Alkyd/Polyester Surface Coatings - Chemical Economics Handbook (CEH)

Alkyl Acetates - Chemical Economics Handbook (CEH)

Cas 111-01-3 Supplier Alkylamines (C1-C6) - Chemical Economics Handbook (CEH)