Stay up to date. See the latest Top Manufacturer reports.

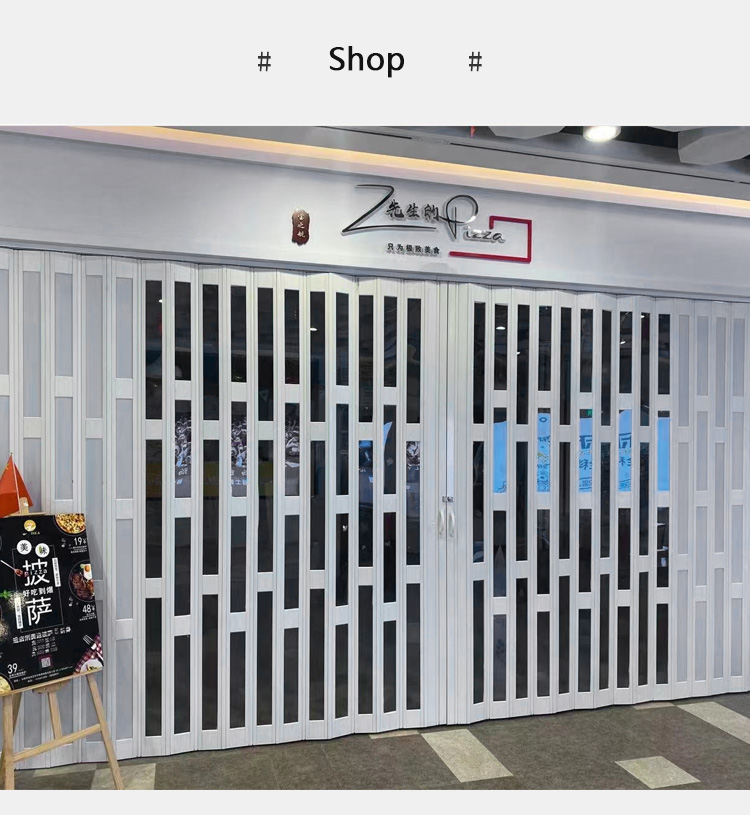

Window & Door’s annual Top 100 Manufacturers list details North America’s 100 largest manufacturers of residential windows, doors, skylights and related products, based on sales volume. Much of the information comes from companies directly, which our research team verifies and fact-checks. Our team also researches and fact-checks information for companies that do not participate in our survey, which are indicated by an asterisk beside their names. This year’s list further solidified what we’ve been seeing for several years now: the industry is healthy and continues to grow.• Folding Doors

What percentage of your total gross sales do residential window and/or door products represent?*

Of those products, about what percentage are new construction versus replacement?*

Left: Has your company experienced measurable, significant growth over the past 5 years?* Right: How did your 2018 gross sales compare to 2017 gross sales?*

*Note: Statistics do not represent every company in the Top 100 Manufacturers List, but of companies willing to provide information, which amounts to more than four-fifths of the list.

This year’s survey queried companies if they had experienced measurable growth in the past five years. Only seven companies said no, although 10 responded “unsure.” Seven companies posted revenues that put them in higher categories than in past years.

Year over year, only one company on this year’s list had lower gross sales in 2018 than in 2017. Nearly every other company reported their revenues were higher. The increased sales volume makes sense in the face of 2018 recognizing a 2.8 percent gain in single-family starts, according to research from the U.S. Department of Housing and Urban Development and the Commerce Department.

Remodeling also continues to be a boon for product manufacturers, with the U.S. home remodeling market expanding more than 50 percent since the end of the Great Recession, according to the Harvard Joint Center for Housing Studies, jchs.harvard.edu.

Strong growth, however, poses its own challenges. Many companies in this year’s list cited “staying ahead of and managing growth” as a top challenge. Growth also requires more people, which aligns with Window & Door’s Industry Pulse survey published earlier this year, which found that 71 percent of survey respondents plan to hire in 2019. Recruiting and retaining those people remains one of the industry’s greatest challenges, as Window & Door continues to explore in its ongoing Workforce Development series.

Costs also continue to climb. Many Top 100 companies attribute this to tariffs and rising transportation costs. (For more information about freight challenges, see In the Trenches.)

In the past year, Harvey Building Products saw the biggest revenue category jump from $100 Million to $200 Million to $300 Million to $500 Million this year. It’s been working toward solid growth for several years, though. Since 2016, the company acquired Soft-Lite, Northeast Building Products, and Thermo-Tech, all of which Harvey credits for its growth.

Starline Windows moved to the $500 Million to $1 Billion category, up from $300 Million to $500 Million, which the company attributes to a new facility in 2016 that allows Starline to book more projects.

Earthwise Group, meanwhile, shares that in the past five years sales have increased by more than 75 percent and the company hired more than 1,000 new employees. It also launched two start-up manufacturing plants and acquired three others.

YKK AP, one of the largest companies on our list at more than $1 Billion, expanded its production capabilities and moved into a new manufacturing facility totaling more than 500,000 square feet.

Numerous other companies on this year’s list also shared how acquisitions and facility expansions have helped their growth in the past five years.

*Sales are estimated based on research; figures not provided by company

Marvin, which manufactures a wide range of fenestration products including aluminum, wood and fiberglass products, has more than 5,600 employees across all of its locations.

Left: MI Windows and Doors whose primary product is vinyl windows, had between $300 million to $500 million in estimated gross sales in 2018, which the company says is higher than the previous year. Right: Steves & Sons manufactures its products, the bulk of which include interior doors and exterior wood steel and fiberglass doors, at its San Antonio plant.

In the past year, Boral has expanded its head count by 18 percent and expanded its geographical footprint from local Texas markets to southern U.S. regions.

Left: Vytex implemented a measure and installation program, which it says has grown significantly as the small skilled labor market makes the program more attractive to dealer-partners. Right: Lux Windows and Glass Ltd.’s primary product line is its hybrid windows, but it also has aluminum metal clad windows, PVC windows and various products in the door market.

Solar Innovations has a three-building campus totaling more than 400,000 square feet of manufacturing and office space for its 170 employees.

National Glass Association 344 Maple Ave West Unit 272 Vienna, VA 22180 703/442-4890

Pvc Interior Folding Door © National Glass Association. All Rights Reserved. Privacy Policy